Minding Ag's Business

Farmers Borrow Less as Average Interest Rate on Operating Loans Exceed 7.5%

MT. JULIET, Tenn. (DTN) -- Sharp interest rate increases slammed the brakes on farmer borrowing, according to a quarterly survey of bankers conducted by the Kansas City Federal Reserve.

Non-real estate farm loan volumes dropped 10% from first-quarter levels last year, and that's after an average increase of 15% throughout 2022. "Lending activity was pushed down by fewer new loans and smaller-sized operating loans," wrote economists Nate Kauffman and Ty Kreitman.

The average interest rate charged on all types of farm loans increased for the fifth consecutive quarter, reaching the highest level since 2007. The average interest rate on real estate loans climbed 3.5 percentage points since 2021 and are now just shy of 7%. Interest rates on non-real estate loans are up 4.5% in the same period to near 7.5%.

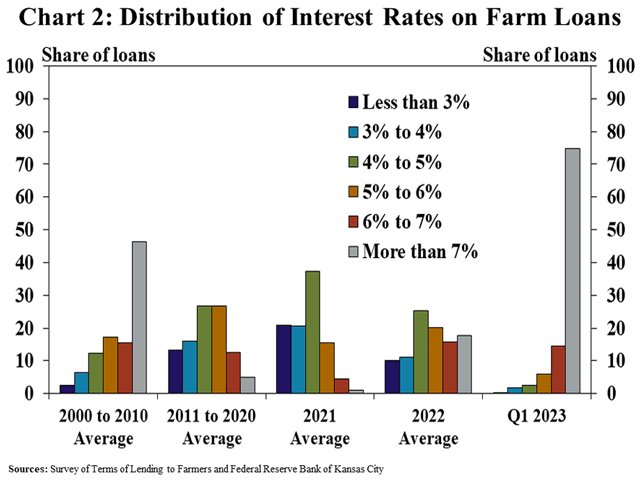

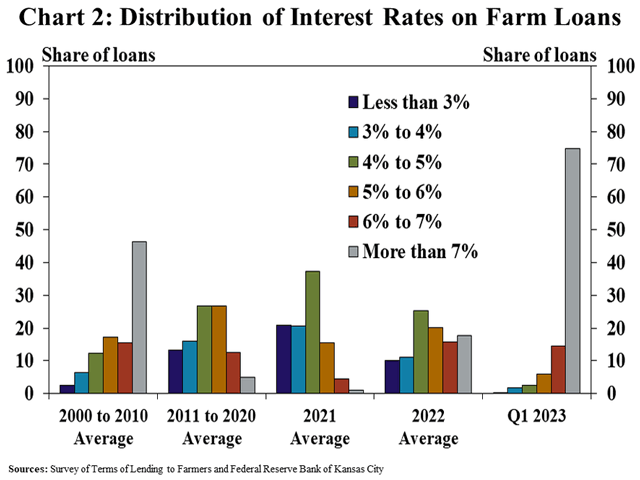

"The range of interest rates available to borrowers has also shifted rapidly," Kauffman and Kreitman wrote. "In contrast to the average over the past two decades, three-fourths of new loans in the first quarter had an interest rate above 7%. In comparison, more than half of farm loans had rates below 5% on average from 2011 through 2020."

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Higher rates led to an overall decline in lending at commercial banks in the first quarter. The report noted that while key input costs like fertilizer and fuel remain elevated, they're notably lower than last year and likely reduced the need for credit for some producers. Fewer and smaller operating notes were the primary driver of the 10% decline in non-real estate farm loan volume.

Kauffman and Kreitman wrote that the overall financial health of farmers is good.

"Remarkably strong farm income during recent years has bolstered liquidity for many producers and supported historically strong farm loan performance. The availability of credit at agricultural banks remained ample, and while higher expenses could increase borrowing needs for some operations, substantially higher interest costs could also put downward pressure on demand for credit." You can read the entire report here: https://www.kansascityfed.org/….

What they don't say is that nontraditional lenders have slowly eroded demand for loans over time. Input suppliers as well as collateral-based lenders have become more prevalent in the market, and because they don't face the same public reporting requirements as commercial banks and the Farm Credit System, it's difficult to quantify how much agricultural debt these organizations hold. Purdue University professor emeritus Mike Boehlje published a blog on the topic, in which he cites a USDA study showing nontraditional lenders hold 19% of the farm-sector debt. According to another data set -- the Kansas Farm Management Association -- nontraditional lenders accounted for 30% of active loans. You can read his blog here: https://agribusiness.purdue.edu/….

Boehlje referenced a study he and several other economists conducted in 2021 on the strategic behavior of nontraditional lenders.

"The results suggest that in contrast to the widely held perception that nontraditional lenders capture market share during prolonged periods of financial stress and because of a lower degree of regulatory oversight, these lenders have in fact increased their market share by successfully identifying gaps in the supply side of the market and developing products/services to meet the needs of that market niche," he wrote.

Liquidity and underwriting standards are also similar to traditional lenders, but nontraditional lenders tend to find a competitive edge in their "convenience, speed in decision making, lower interest rates and innovation in product/service offering. The implication is that these types of firms are expected to be long-run permanent participants in the agricultural credit markets."

Katie Dehlinger can be reached at katie.dehlinger@dtn.com

Follow her on Twitter at @KatieD_DTN

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .