Kub's Den

Forest or Trees: Grain Marketing Opportunities to Lock in Profitability Through 2025

The past few Christmases, in a truly magnificent display of cheapskate frugality, I've been cutting down volunteer cedar trees from the fence lines and using them as scrawny Charlie-Brown-like Christmas trees. Now I've got my eye on the one I'm fattening up for Christmas 2022 in eight more months. It's going to be a great little (free) tree.

However, while I'm focused on just one tree, I'm in danger of missing the surrounding forest of all the other volunteer cedars -- weeds -- that will choke out desirable forage plants and generally make a nuisance of themselves. This happens to me sometimes: I get obsessively focused on just one thing and develop tunnel vision, which blinds me to everything else going on around me.

Grain marketers focused on today's hot prices are also in danger of missing the forest for the trees.

This isn't a column about grassland management, or even about grain market prices for the 2021 crop ($7.88 corn and $16.08 old crop soybeans), or even about prices for the 2022 crop ($7.35 corn and $14.78 new-crop soybean futures). This is about keeping an eye on everything else going on around us and not getting so obsessed with one idea -- "Gotta sell $8 corn; gotta sell $8 corn" -- that we miss an opportunity to lock in profitable prices for several years in advance.

It's about the opportunity to sell 2023 corn at $6.60 and/or 2024 corn at $5.90 and/or 2025 corn at $5.70 (the futures prices presently available for the December 2023, December 2024 and December 2025 corn contracts).

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Those high prices for the next several years might be justified by a long-term outlook about global geopolitics and supply chain problems that could persist past 2022 and into 2023 and beyond, or they could just be spillover bullishness from the market that's hot right now. Do traders really believe there won't be abundant grain refilled into the world's inventories before 2025? Or do they just see high prices for this year's futures contracts and assume the next years' futures contracts ought to be roughly the same price?

It's a phenomenon we've seen before -- a very hot nearby supply and demand situation creates bullishness that spills over into all the subsequent futures contracts trading along the calendar. If those far-off crop years never generate legitimate bullishness of their own, then their prices will ultimately revert back to some neutral level (i.e. below $4 per bushel for corn and below $10 per bushel for soybeans).

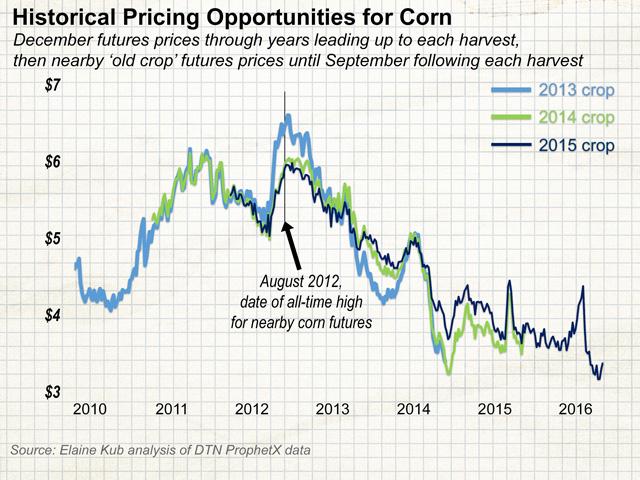

As a case study, let's consider the opportunities that were available 10 years ago, during the 2012 grain rally, which peaked in August 2012, to lock in prices for the next few years' worth of production. The highest price ever offered for 2013 corn had nothing much to do with expected 2013 supply and demand, but instead occurred roughly at the same time as the rally for old-crop 2011 grain and drought-ravaged 2012 grain. The December 2013 corn futures contract hit its all-time high on Sept. 7, 2012, at $6.65, at least five months before crop insurance reference rates were set and before most grain producers would even start thinking about hedging the next year's new-crop prices. Even further out from most people's thinking was the December 2014 corn futures contract's all-time high, $6.14 on Sept. 19, 2012, which then dwindled lower through the next 27 months until its expiration. Same story for the December 2015 contract, which hit its high of $6 on Sept. 19, 2012, and then flailed around and ultimately traded as low as $3.56 before it went off the board three years and three months later.

Of course, the mechanics of locking in prices three years in advance can be tricky. Maybe your local elevator will write you a hedge-to-arrive contract for 2025's grain production already in May 2022, but maybe not. They may choose not to take the risk or carry those contracts and pay those margin calls on your behalf through the next three-and-a-half years.

Alternatively, grain marketers can always participate in the futures and options market directly in their own brokerage accounts, but this may require extra cash flow management to maintain margin calls -- a calculation that is difficult enough to consider for the next five months until the 2022 harvest, let alone through all the years and months until the 2023, 2024 or 2025 harvest. (No futures contracts are trading yet for the 2026 crop or beyond.) See "Bullish Potential Makes Hedging Corn a Risky Business in 2022" by DTN Farm Business Editor Katie Micik Dehlinger for an in-depth analysis of that strategy here: https://www.dtnpf.com/….

If you do decide to do it, if you successfully lock in a price for grain that's not even a seed yet and is nothing more than a glimmer in your eye right now, you create the possibility that in November 2024, you'll be hauling in soybeans worth $13.45 while your neighbors are hauling in soybeans worth $9.45, or in November 2025, you'll be hauling in corn worth $5.65 while your neighbors are hauling in corn worth $3.65. The opportunity exists right now to make your income statements look good and profitable not just for one year's crop (2021), or two years' (2022), but for five years in a row.

Of course, there's a risk that those years could be filled with stress and regret. There are legitimate supply and demand reasons to feel today's high grain prices may persist or even get higher through a multiyear pattern (lingering La Nina, inflation, resilient global demand, whatever is going to happen over in Russia and Ukraine). If the tricky trading mechanics don't stop some people, the fear of missing out on even higher prices will stop others from making this trade. Why sell at $5.65 when the market might go to $7 between now and 2025? This is a reasonable consideration.

It is, in fact, the same consideration and the same risk we always take when we set a price on grain. Unfortunately, nothing about grain marketing is ever so obvious and easy a win as chopping down a volunteer cedar and getting a free Christmas tree.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Elaine Kub, CFA is the author of "Mastering the Grain Markets: How Profits Are Really Made" and can be reached at masteringthegrainmarkets@gmail.com or on Twitter @elainekub.

(c) Copyright 2022 DTN, LLC. All rights reserved.