Grain Marketing Tips for Spring 2022

Bullish Potential Makes Hedging Corn a Risky Business in 2022

MT. JULIET, Tenn. (DTN) -- Reid Thompson usually sells a portion of his crop before its even planted. This year, he estimates his early marketing has an average cash price of $6.50 per bushel of corn and $15 per bushel of soybeans.

"The do-nothing strategy would have been the right one this year," the McClean County, Illinois, farmer told DTN, adding that some of his early sales, like selling $12.50 soybeans, came with a side of margin-call heartburn.

He doesn't regret the early sales, even though they look low considering current prices.

"You've got to look back and say, I was happy with this number, and we are making good money," he said. "I think the hardest part of this market will be how you manage your greed, how you manage the excitement of $8 corn."

DTN Lead Analyst Todd Hultman said this marketing year is unlike any other, and your marketing plan should reflect it.

"I've never approached a summer in my past 37 years in the business where I've seen such explosive bullish possibility for grain markets as what we're facing this summer," he said, due to the confluence of the Ukraine-Russia war, drought in South America, a slow start to U.S. planting and drought in the western Plains.

"There are strong fundamental reasons for why we have high prices. There's also a big fear premium in the market lifting prices even higher because of the war situation and the uncertainty of what (Russian President Vladimir) Putin will do," Hultman said.

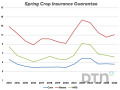

Projected prices for crop insurance -- $5.90 per bushel for corn, $14.33 for soybeans and $9.19 for spring wheat -- are at historically high or record levels, helping to establish a price floor for many farmers. (For more, see: https://www.dtnpf.com/…)

"There definitely is a risk that prices could fall off at some point. But overall, this is not a market where we're going to end up this year with a big surplus of corn or soybeans," Hultman said.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Thompson said his marketing goal this year is to boost levels of working capital to help him weather the razor-thin to nonexistent profit margins he expects in 2023 and 2024 due to high input costs. To do that, he said it's important to make decisions with the information you have, like market fundamentals and your finances.

Thompson said it's important to recognize that while the market has big upside potential, it can also move very quickly the other way, especially with current daily limits. (For more, see: https://www.dtnpf.com/…)

"At some point, you have to accept the fact that the market may or may not go higher. You have to manage the risks that you can see," he said.

MITIGATE MARGIN RISK

Thompson used option spreads for most of the past decade to lock in a relatively inexpensive $4-per-bushel floor, but he has shifted to cash forward contracts, mostly hedge-to-arrives, to minimize the sting of margin calls the past couple of years. Hedge-to-arrive contracts lock in the futures price, leaving the basis component of the cash price to be established later.

Hultman agreed that cash contracts are the way to go in a year like this one.

"I know these high prices are extremely tempting. They're lucrative, and they look good on paper. But I think everybody needs to be very sober about the risks they take on, especially if they're short the futures market," he said. If a farmer does want to make early sales, Hultman recommended pricing no more than 25% of an expected crop using cash contracts with buyers, thus avoiding the risk of margin calls if the markets make big moves.

Mark Nelson, director of commodities at Kansas Farm Bureau, also suggested slowing down pre-harvest marketing, and if growers did make early sales using futures contracts, switching them out for cash contracts.

In a recent webinar, he walked through four scenarios of how that might work financially. In some cases, the farmer may suffer a loss on the position, but depending on basis, it's also possible to have a profitable outcome.

"Elevators that forward contracted, they're in the same boat" on wanting to avoid large margin calls, he said. "There may be very little desire by elevators to have those positions. So, we're probably seeing a much wider basis, partially, because of that." (You can watch a replay of the webinar here: https://www.youtube.com/…)

CONSIDER CALLS

If a farmer does want to be short futures contracts, buying a call option is one way to offset some margin risk, Hultman said. A call option gives the buyer the opportunity to buy the underlying asset (grain futures contracts in this case) at a set price.

"Those call options are not cheap, but they could be better than nothing," Hultman said.

Thompson agreed on call options and argued that they can help farmers manage their fear of missing out if the market does move to atmospheric prices.

"When we start looking at $8 corn, I'm going to get pretty excited, because when have you ever had that opportunity now?" he said. "And if you wonder what could be, buy a $9 or $10 call. You've already made like $4 a bushel, so why not spend a little money and buy the opportunity to get a little more?"

OLD-CROP OPPORTUNITIES

If farmers still have old-crop corn or soybeans in the bin, Hultman suggested making sales in phases between now and the end of June.

"Typically, corn doesn't earn interest. It doesn't pay dividends. It's rare that it goes up, so take advantage of good times and cash a check."

Katie Dehlinger can be reached at katie.dehlinger@dtn.com

Follow her on Twitter at @KatieD_DTN

(c) Copyright 2022 DTN, LLC. All rights reserved.