Technically Speaking

US Energy Prices Turn Higher as Temperatures Plummet

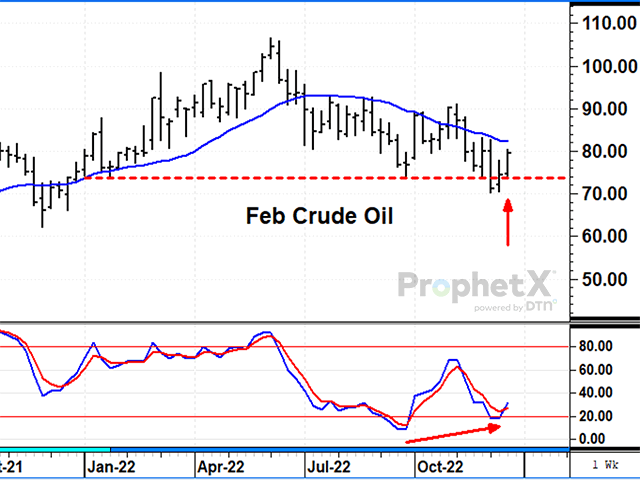

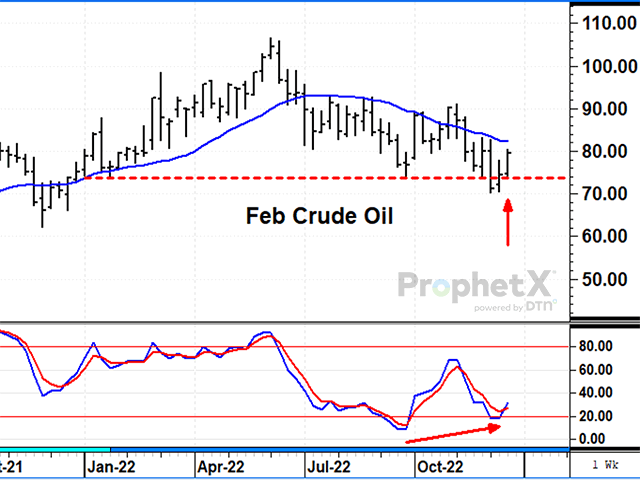

CRUDE OIL:

February crude oil closed up $5.10 in the week ended Dec. 23, at $79.56. Friday's close was a dramatic turnaround from the Dec. 9 close of $71.21, the lowest February close in 2022 and the bottom of a sell-off inspired by trader concerns about recession worries and rising COVID cases in China. Apparently, traders lost sight of U.S. crude oil inventories at their lowest level in eight years and the possibility of cold temperatures in December. Technically speaking, the bullish change in momentum turned the weekly stochastic up, completing a pattern known as bullish divergence. Crude oil's higher close also confirmed that the new lows in early December were fakeouts, not breakouts. A close above $83.30, if it happened, would confirm a bullish change in trend with the December low of $70.31 unlikely to be taken out anytime soon.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

February ultra-low sulfur diesel, a fuel made for both heating oil and diesel uses, closed up 14.02 cents a gallon last week, ending Friday, Dec. 23 at $3.2148 a gallon. Like crude oil, but not quite as bearish, ultra-low sulfur diesel prices fell to a new eight-month low in early December, pressured by the same factors as crude oil and also reflecting a rush at refineries to increase distillate supplies ahead of winter. With ultra-low sulfur distillate supplies near their lowest in four years, the technical outlook turned more bullish this week. Similar to crude oil, the weekly stochastic shows a bullish divergence and has turned higher, an indication of downward momentum being broken. A close above $3.344 a gallon, if it happened, would confirm a bullish change in trend.

GASOLINE:Gasoline prices have been the most bearish of the three fuels on this page with supplies in the week ended Dec. 16 up 1% from a year ago, the result of sagging demand and more active refinery effort since early November. Like crude oil, February reformulated gasoline prices tanked to a new 2022 low in early December, closing at $2.0612 a gallon on Dec. 8. In the week ended Dec. 23, February gasoline closed up 24.56 cents at $2.3915, close to the one-month high of $2.4151 a gallon. Along with crude oil and distillate prices, February gasoline's higher weekly close turned the weekly stochastic up and left behind a bullish weekly divergence, a promising pivot from its previous downward momentum. A close above $2.4151, if it happens, will confirm a bullish change in trend.

**

Comments above are for educational purposes and are not meant to be specific trade recommendations. The buying and selling of grain and soybean futures involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on Twitter @ToddHultman1

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .