Canada Markets

Commercial and Noncommercial Traders Hold Record Canola Positions

The canola market continues to search for a catalyst needed to signal a market bottom and a move higher. Unfortunately, it is doubtful that this is the week, with China and other Asian nations celebrating the Lunar New Year holiday, which will mute demand signals and could conceivably lead to lighter volume trade.

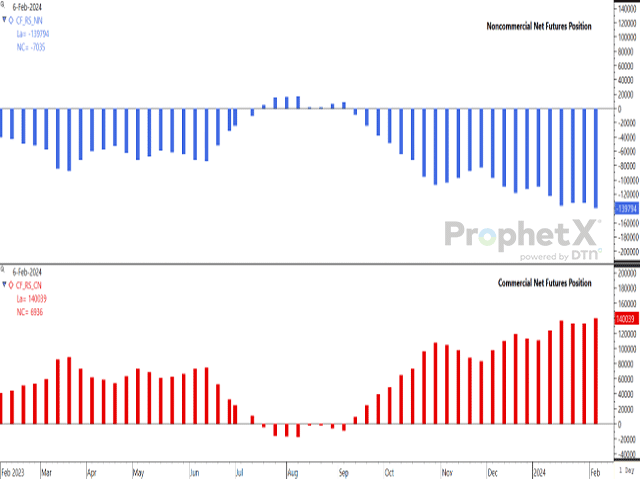

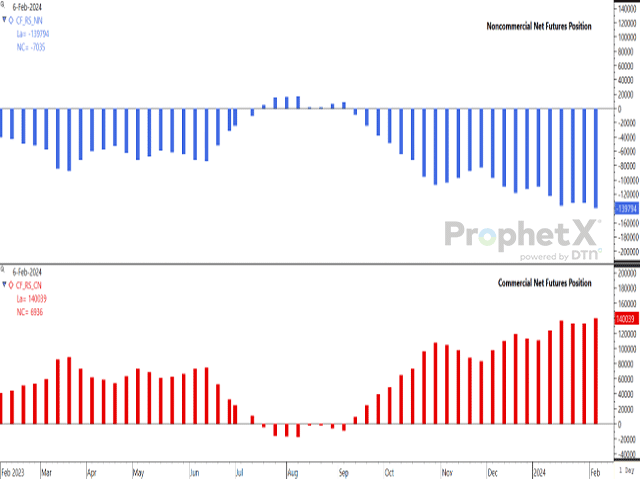

As seen on the attached chart, the CFTC's Commitment of Traders report released on Feb. 9 for the week ending Feb. 6 (blue bars), shows noncommercial traders increasing their bearish net-short position in canola futures for the first time in three weeks to a record-large net-short of 139,794 contracts. This is the seventh time this crop year, or since Aug. 1, that this position has reached a record level, with the previous record from September 2019 at 93,084 contracts.

The speculative crowd remains steadfast in their bearish sentiment. We learned on Feb. 8 that week 27 exports of 246,600 metric tons was the largest weekly volume shipped in 14 weeks and the second-largest weekly volume shipped this crop, while the Feb. 9 trade led to a $7.30/mt drop in the March contract and we have seen lower highs and lower lows in each of the past two sessions. In addition, the March contract realized a weekly loss for a third consecutive week during the week ending Feb. 5.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

While this market continues to search for a bottom, an X (formerly Twitter) conversation reminded me of a theory promoted by a former DTN analyst Tregg Cronin. His Golden Rule says First Basis, then Spreads, then Futures -- indicating the order of events that take place for a move in prices to take places. Basis strength during past weeks may be the first reaction required in this potential chain of events.

As seen by the red bars on the lower histogram of the attached chart, we also see that commercial traders are holding a record net-long position in canola futures of 140,039 contracts. Since August 2018 when the CFTC started reporting canola positions, commercial and noncommercial traders have never been further apart.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @CliffJamieson

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .