Canada Markets

Canada's International Trade for November

Statistics Canada's November Canadian International merchandise trade report shows total exports falling by 2.3% and total imports down 2.1%. As a result, the country's trade balance with all countries moved from a $130 million surplus in October to a $41 million deficit in November, the first deficit reported in three months. At $7.3 billion, Canada's trade surplus with the United States fell to the lowest level reported in 11 months, or since December 2021.

Exports reported for the broad Farm, fishing and intermediate food products group were reported at a record $5.9486 billion for the month, up 56.3% from the same month in 2022.

This study looks at trade data for select crops and products, with a focus on crops that are not adequately covered in weekly Canadian Grain Commission data.

Lentil exports in November totaled 277,858 metric tons, up from the previous month and the largest November exports in six years. Measured in dollar value, the top three destinations were Turkey, India and United Arab Emirates, with 62% of the total value shipped to these countries. Cumulative exports at 832,311 mt are up 28.1% from last year and 20.7% higher than the five-year average. This volume has reached 36.2% of AAFC's forecast 2.6 million metric tons of exports, ahead of the steady pace needed to reach this forecast.

Canada's dry pea exports were reported at 193,954 mt in November, down sharply from the previous month and the lowest volume shipped in three months. Measured in dollar value, Bangladesh and China took close to equivalent amounts that account for 54% of the total value exported. During the first four months of the crop year, exports to China total 634,252 mt, up slightly from the same period last crop year although is down 34% from the three-year average as China turns to alternate supplies. Cumulative exports total 1.058 mmt over four months, up 15.2% from the same period in 2021-22 while down 13.6% from the five-year average. This volume has reached 42.3% of AAFC's 2.5 mmt export forecast, well ahead of the steady pace needed to reach this volume.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Chickpea exports totaled 21,239 mt in November, the largest volume shipped in five months and the largest November exports seen in five years. Cumulative exports total 70,860 mt, up 75% from one year ago and 59.5% higher than the five-year average. Cumulative exports have reached 36.3% of the forecast target of 195,000 mt, which was revised 15,000 mt higher in December. Exports are slightly ahead of the steady pace needed to reach this forecast.

Mustard exports in November totaled 13,000 mt in November, down slightly from the previous month but the largest November movement seen in six years. In dollar value, 44% was shipped to the United States while the next largest destination was Belgium at 21.2%. The cumulative volume shipped is up 26.8% from the same period last crop year and 14.8% higher than the five-year average. Total exports have reached 38.1% of AAFC's 110,000 mt forecast, ahead of the steady pace needed to reach this forecast.

Canary seed exports totaled 18,765 mt over the month, the largest volume shipped in three months. Measured in dollar value, the largest amount was shipped to Mexico, accounting for 34.2% of total shipments. Cumulative shipments of 65,671 mt are up 52% from the same period last crop year while are 30.2% higher than the five-year average for this period. Exports have achieved 38.6% of the current AAFC forecast of 170,000 mt, which was revised 5,000 mt higher in December, while are slightly ahead of the steady pace needed to reach this forecast.

Flax exports totaled 14,374 mt in November, the largest volume shipped in seven months. Measured in dollar value, 74% of the month's exports were shipped to the U.S. A minimal 1,450 mt has been shipped to China over this period, down from 17,188 mt over the same period last crop year and the three-year average of 22,788 mt. Cumulative exports at 43,521 mt are down 45.6% from the same period last year and down 60.6% from the five-year average. Exports have reached 11.6% of AAFC's 375,000 mt export forecast, well-behind the steady pace needed to reach this forecast.

Soybean exports are seen at 1.272 mmt in November, up sharply from the previous month and the largest monthly exports reported since November 2018. Measured in dollars, 42.8% of the reported value was realized in shipments to China, with volumes to China rising considerably over the past two months to 556,576 mt in December, also the largest volume shipped since November 2018. Cumulative soybean exports over three months of the 2022-23 crop year are pegged at 1.957 mmt, down 4.2% from the same period last crop year and 2.2% below the five-year average. Over three months of the row crop crop year, 46.4% of AAFC's 4.4 mmt export forecast has been achieved, well ahead of the steady pace needed to reach the current forecast.

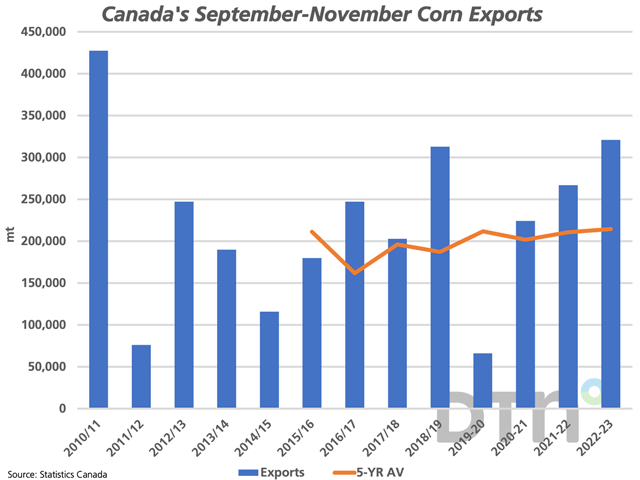

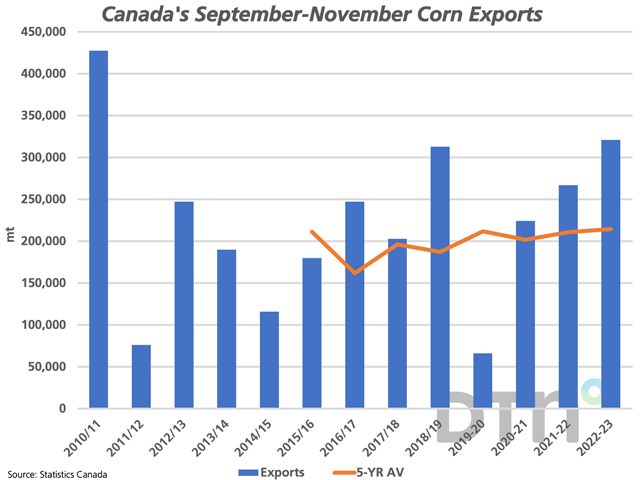

Corn exports totaled 233,549 mt in December, the largest monthly movement in six months, with 71% of the total value of these exports realized from business with Ireland and the United Kingdom. Exports over three months total 320,915 mt, up 20.3% from the same period last crop year and 49.6% higher than the five-year average for this period, and the largest volume shipped in this three-month period in 12 years. Cumulative exports represent 18.3% of AAFC's 1.750 mmt export forecast, behind the steady pace needed to reach this forecast.

Corn imports over the month totaled 131,270 mt, the largest monthly volume imported over the three months of the corn crop year. Cumulative imports of 316,587 mt. This volume is down 68% from the same period last crop year (Sept-Aug) and 43.8% lower than the five-year average. The cumulative volume is behind the steady pace needed to reach the current AAFC import forecast of 2 mmt.

Canola oil exports totaled 217,440 mt in November, down from the previous month. Cumulative exports total 881,312 mt, up 5% from the same period in 2021-22 and down 11% from the three-year average.

Canola meal exports were reported at 550,022 mt in November, the largest monthly volume shipped in 20 months. Cumulative exports total 1.799 mmt, up 21% from the same period last crop year and 13% higher than the three-year average.

Ethanol imports for the month of November are reported at 177 million liters, the largest volume reported in three months. Imports over the first 11 months of 2022 total 1.621 billion liters, 38% higher than reported one year ago while 43% higher than the three-year average.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .