Ag Policy Blog

USDA Says Cash Receipts Higher, But Farmers Face Record Expenses and Inflation

OMAHA (DTN) -- The largest year-to-year-increase in production expenses for farmers this year will take a small bite out of overall net farm income, bringing it down $900 million, or 0.6% from 2021, USDA forecast Thursday.

Overall, USDA's Economic Research Service update on farm income reported farmers receiving higher cash receipts for a broad range of commodities, but also paying more for nearly every major production expense.

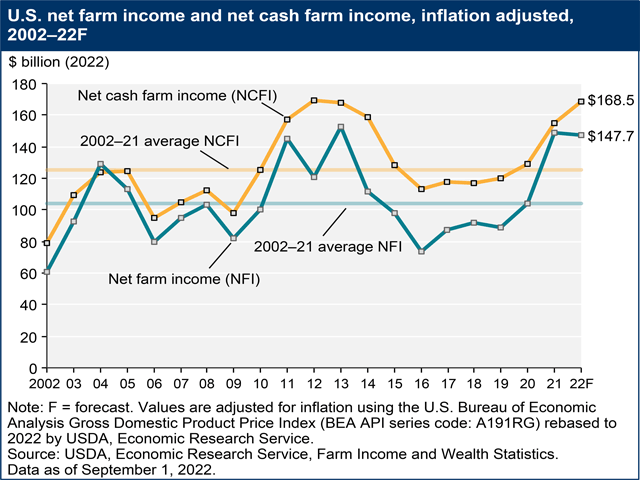

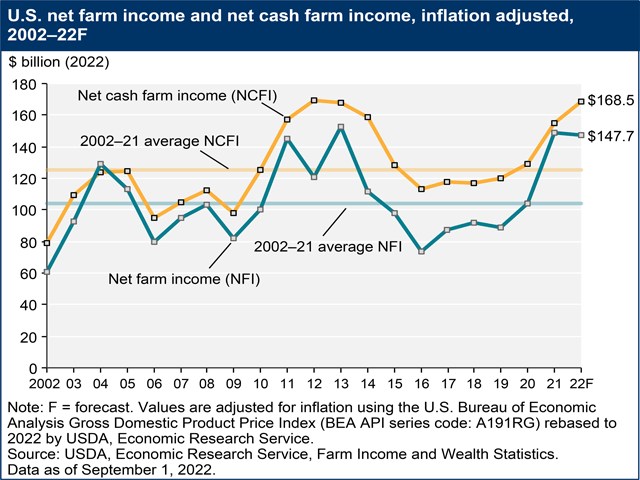

On the surface, USDA noted that net farm income, which USDA describes as a broad measure of profits, will increase $7.3 billion, or about 5.2%, to $147.7 billion. But once the effects of inflation are factored in, USDA reports net farm income gets pulled down about $900 million below 2021's total.

Net farm income has rallied from a 2016 low point of $73.6 billion but remains below the 2013 peak of $152.5 billion.

Net farm income details gross farm receipts minus production expenses including depreciation.

Another USDA indicator, net cash farm income, is forecast to increase $13.5 billion (8.7%) when adjusted for inflation. Net cash farm income looks at farm cash receipts and expenses from crops and livestock. Net cash farm income is expected to come in at $168.5 billion for 2022, the highest level since 2012, according to USDA.

PRODUCTION EXPENSES

USDA forecasts farm production expenses this year will increase $66.2 billion, or 17.8% from last year -- the largest year-to-year dollar increase on record. Nearly every category of expense tracked by USDA is higher in 2022 than last year.

Costs for fertilizer, lime and soil condition increased by $15.4 billion -- up 52% from 2021 costs -- to $45 billion.

Feed expenses, the biggest expense category, rose $9.7 billion, to $75 billion, because of higher commodity prices.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Pesticides increased $3.7 billion in cost to nearly $21.5 billion.

Fuel costs increased $5.9 billion, to $19.8 billion.

Farmers also area paying $7.5 billion more in interest on loans up to $26.5 billion in costs.

CROP RECEIPTS

Cash for crops is projected at $274.2 billion, up $36.4 billion, or 15.3% from last year. Soybeans, corn and wheat are driving higher revenues in 2022.

Soybean sales in 2022 are expected to increase $14.9 billion (30.6%) from 2021 because of both higher prices and more quantity sold.

Corn receipts are forecast to increase by $1.9 billion (16.7%) for the same reasons.

What sales are expected to increase $4 billion (33.7%) on a major bump in prices.

Receipts on hay, vegetables and sugar beets also are higher while sales fell for potatoes, fruit and nuts.

LIVESTOCK INCOME

Total sales for livestock and poultry products are expected to increase $55.3 billion (28.3%), to $251.1 billion. All major sectors are forecast higher.

Broiler sales are spiking, expected to increase $17.8 billion (56.6%) higher than a year ago.

Milk sales are expected to rise $15.2 billion (36.4%) in 2022 due to higher prices.

Cattle and calves receipts are projected to increase $11.7 billion (16.3%) also because of higher prices.

Chicken egg sales are expected to increase $6.6 billion (76.3%) because of higher prices and lower volumes -- likely due to avian influenza.

Hogs also will see a $2.5 billion increase (8.9%) in receipts.

GOVERNMENT PAYMENTS

Direct federal aid to farmers is forecast at $13 billion, down 49.7% from 2021 levels. Much of the decline in lower aid comes from fewer payments being made through supplemental and ad-hoc payments to farmers tied to COVID-19. Separately, higher prices for commodities such as corn, soybeans and wheat will ensure no payments under the Price Loss Coverage (PLC) and few potential payments from the Agricultural Risk Coverage (ARC) program.

The full USDA Economic Research Service farm income report can be viewed at https://www.ers.usda.gov/….

Chris Clayton can be reached at Chris.Clayton@dtn.com

Follow him on Twitter @ChrisClaytonDTN

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .