DTN Retail Fertilizer Trends

Fertilizer Prices Continue to Move Lower

OMAHA (DTN) -- Retail fertilizer prices tracked by DTN for the last week of February 2023 continue to move lower. This trend has been in place for a couple months.

All eight of the major fertilizer prices are again lower compared to last month. Five of the eight fertilizers had a sizeable price decline. DTN designates a significant move as anything 5% or more.

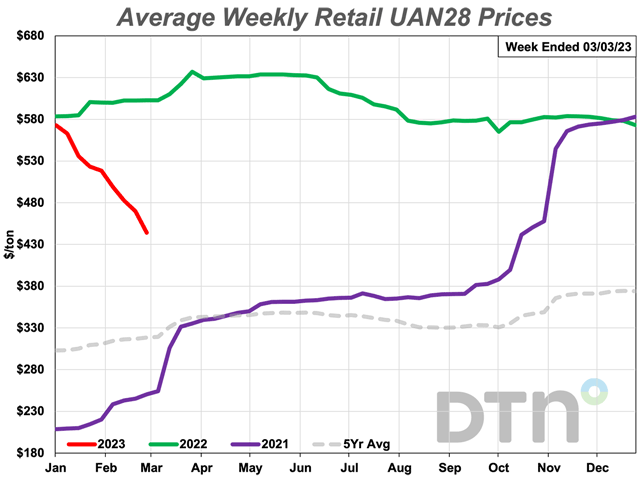

Leading the way lower again was UAN28. The nitrogen fertilizer was 14% lower compared to last month and had an average price of $444/ton.

Anhydrous was 12% less expensive than a month prior and had an average price of $1,077/ton. UAN32 was 10% lower compared to last month and had an average price was $525/ton.

Urea was 7% less expensive compared to the previous month with an average price of $648/ton. Potash was 5% lower compared to last month with an average price of $666/ton.

The remaining three fertilizers were all just slightly lower compared to the prior month. DAP had an average price of $827/ton, MAP $827/ton and 10-34-0 $741/ton.

On a price per pound of nitrogen basis, the average urea price was at $0.70/lb.N, anhydrous $0.66/lb.N, UAN28 $0.79/lb.N and UAN32 $0.82/lb.N.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

As long as commodity prices stay strong, fertilizer prices will too, according to a fertilizer company economist. In a DTN Ag Summit series presentation last week, Andy Jung, chief economist for Mosaic, said he sees a positive outlook for agriculture as farmers across the world have incentives to grow more crops and thus apply fertilizer.

"We are bullish on ag in the medium term, which includes this year and even into the next one," Jung said. "Fertilizer prices have some support for sure."

The good news for farmers is nutrient prices have declined considerably compared to prices just a year ago.

Jung blamed higher prices on several big drivers which reduced the global fertilizer supply. This included the beginning of the Ukraine-Russia war, a loss of an import port for potash (Belarus) and phosphorus supply constraints from China.

While these supply issues are still in play, these factors have softened some, he said. This is especially true on the nitrogen side, with European natural gas prices retreating from last year's high price levels.

"Supply constraints in phosphorus and potash are still present and will persist for some time to come yet," he said.

Jung said one item farmers should watch closely is the continuing war between Ukraine and Russia.

Ukrainian production of crops could be scaled back some because of the war. Global fertilizer production, however, should provide plenty of supply and availability of nutrients and should not be an issue, he said.

All fertilizers are now lower compared to one year ago. DAP is 6% less expensive, MAP and 10-34-0 are both 12% lower, potash is 18% less expensive, UAN32 is 25% lower, UAN28 is 26% less expensive, urea is 27% lower and anhydrous is 28% less expensive compared to a year prior.

DTN gathers fertilizer price bids from agriculture retailers each week to compile the DTN Fertilizer Index. DTN first began reporting data in November 2008.

In addition to national averages, MyDTN subscribers can access the full DTN Fertilizer Index, which includes state averages, here: https://www.mydtn.com/….

The Fertilizer Institute (TFI) President and CEO Corey Rosenbusch testified before the House Committee on Agriculture last week. You can read it here: https://www.dtnpf.com/….

| Dry | ||||

| Date Range | DAP | MAP | POTASH | UREA |

| Feb 28-Mar 4 2022 | 879 | 937 | 815 | 887 |

| Mar 28-Apr 1 2022 | 1033 | 1045 | 868 | 1022 |

| Apr 25-29 2022 | 1049 | 1082 | 881 | 1004 |

| May 23-27 2022 | 1056 | 1082 | 879 | 989 |

| Jun 20-Jun 24 2022 | 1040 | 1058 | 885 | 902 |

| Jul 18-22 2022 | 1007 | 1043 | 887 | 836 |

| Aug 15-19 2022 | 978 | 1026 | 881 | 807 |

| Sep 12-16 2022 | 952 | 1009 | 877 | 808 |

| Oct 10-14 2022 | 925 | 986 | 863 | 824 |

| Nov 7-11 2022 | 931 | 980 | 853 | 812 |

| Dec 5-Dec 9 2022 | 920 | 950 | 819 | 784 |

| Jan 2-Jan 6 2023 | 876 | 879 | 752 | 739 |

| Jan 30-Feb 3 2023 | 847 | 862 | 704 | 698 |

| Feb 27-Mar 3 2023 | 827 | 827 | 666 | 648 |

| Liquid | ||||

| Date Range | 10-34-0 | ANHYD | UAN28 | UAN32 |

| Feb 28-Mar 4 2022 | 837 | 1487 | 603 | 703 |

| Mar 28-Apr 1 2022 | 896 | 1526 | 637 | 711 |

| Apr 25-29 2022 | 906 | 1534 | 631 | 730 |

| May 23-27 2022 | 906 | 1531 | 634 | 731 |

| Jun 20-Jun 24 2022 | 905 | 1497 | 616 | 716 |

| Jul 18-22 2022 | 894 | 1431 | 598 | 696 |

| Aug 15-19 2022 | 878 | 1336 | 576 | 676 |

| Sep 12-16 2022 | 861 | 1369 | 578 | 665 |

| Oct 10-14 2022 | 759 | 1417 | 576 | 670 |

| Nov 7-11 2022 | 758 | 1434 | 582 | 680 |

| Dec 5-Dec 9 2022 | 751 | 1415 | 581 | 681 |

| Jan 2-Jan 6 2023 | 754 | 1302 | 573 | 673 |

| Jan 30-Feb 3 2023 | 754 | 1223 | 518 | 583 |

| Feb 27-Mar 3 2023 | 741 | 1077 | 444 | 525 |

Russ Quinn can be reached at Russ.Quinn@dtn.com

Follow him on Twitter @RussQuinnDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.