High Inputs Likely Beat Down Profits

Rabobank: Sticky Input Costs Likely Keep Farm Profits Under Pressure Through 2027

OMAHA (DTN) -- Outside of a weather-related supply shock, an outlook for global crop production and supplies by analysts at Rabobank suggests there isn't much potential for commodity farmers to break even until the 2027-28 crop year.

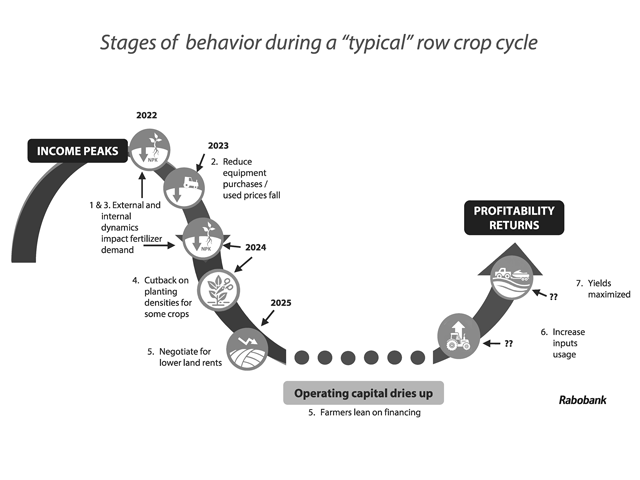

Analysts at Rabobank on Tuesday highlighted their outlook for crops, inputs and profitability by diving into trends affecting global stocks and production. Unfortunately, U.S. farmers remain stuck at the bottom of an economic downturn that began in 2023 and shows little sign of a quick rebound.

"We don't see much potential for breakeven until we get to the 2027-28 crop year at this moment," said Stephen Nicholson, global sector strategist for grains and oilseeds at Rabobank. "We continue to move that year ahead because it doesn't seem like we can quite get over the hump. Input costs have come down, but it's been very, very sticky, and, I think, stickier than usual in the convergence of basically input costs and corn."

Nicholson added there is little in the baseline models to suggest a price rally or decline in input prices that would lead to a more break-even scenario. "We just don't see that convergence happening anytime soon and that's where the concern is."

Producers have reduced capital expenses such as machinery and stretched their dollars on inputs such as fertilizer. Still, some input costs are showing little flexibility for coming down.

"We're trying to negotiate lower land rents, and that's been very, very difficult," Nicholson said.

From a bank perspective, Nicholson said farmers are tapping higher percentages of their operating lines as well.

Looking at crop production -- even without updated USDA data -- markets still show an abundance of grain and oilseed supplies globally.

"We have monster supplies -- record supplies," Nicholson said, though he also noted the rate of growth in global production is slowing down.

Longer-term trends also suggest it will likely take some form of extreme weather event hitting a major production region to break the current price cycle.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

"It's more than likely going to be a supply-led shock, primarily because of drought or some other supply shortfall," Nicholson said.

STOCKS TO USE

While there are large supplies of grain globally, Nicholson said stocks-to-use ratios are "at comfortable levels," but still declining for crops such as corn, wheat and rice. "I want to mention that because production is not keeping up with the supply, even though we're having record demand," Nicholson said.

Outside of soybeans, one of the major problems with global stocks is that top exporting countries are holding a smaller share of total available grain, Nicholson said. Global exporters are holding 33% of the corn stocks while China controls as much as 68% of the stocks. For wheat, China holds 49% of available stocks, and with rice, major exporters only hold about 29% of the available grain.

"So that does give you some concern if you are a buyer," Nicholson said. "There's not many free stocks in the world available."

Wheat and corn also are showing multi-year declines in their global stocks-to-use ratios. That adds to the prospect of market swings for those crops if production dips.

"You have much more potential for price volatility because you have declining stocks-to-use ratios and any shift in production or shortfall can move that market very quickly," Nicholson said.

Corn could see greater price volatility if stocks begin to decline back to levels of the mid-2000s, Nicholson added. "You can have a very big pick up really quickly in prices if something goes wrong," he said.

Soybeans are the exception because the major exporters -- the U.S. and Brazil -- both have ample soybean stocks.

"That's why you don't get too worried about the supply of soybeans because they are being held by the two biggest exporters," he said.

INPUTS VERSUS CROP PRICES

As a U.S. Senate hearing on Wednesday was looking at fertilizer prices, Rabo analysts were also highlighting the "dislocation" between input costs and crop prices. Fertilizer prices continue to rise while commodity returns decline.

As DTN's Retail Fertilizer Trends highlighted this week, anhydrous saw an 8% increase this past month to $842 a ton. Looking deeper, anhydrous is nearly 20% higher than it was a year ago. Nearly every fertilizer tracked by DTN shows a similar increase.

Whether it is fertilizer or land costs, input prices remain too high for current margins.

"The competitive advantage of U.S. growers at present, with the cost of land, with the tariffs around inputs, is not sustainable," said Sam Taylor, a senior analyst for farm inputs at Rabo.

Rabo analysts alluded to the fact that there are a lot of factors surrounding input costs that all seem to be hitting producers at the same time.

"It's not just fertilizer this time. It's fertilizer, it's chemicals because of issues with production or it's about tariffs on steel and aluminum," which affects machinery prices while farmers are not spending capital on equipment, Nicholson said. "It's all of these things at once and that's probably more of a concern."

One of the problems for producers looking at other options is that current farm programs and crop insurance also don't necessarily encourage diversification. The safety net has become a barrier for producers looking at alternative crops or practices, analysts said.

See, "Senators Probe Market Power Behind Rising Seed and Fertilizer Costs," https://www.dtnpf.com/…

Also see, "Anhydrous 8% Price Spike in One Month Leads Five Fertilizer Prices Higher," https://www.dtnpf.com/…

Chris Clayton can be reached at Chris.Clayton@dtn.com

Follow him on social platform X @ChrisClaytonDTN

(c) Copyright 2025 DTN, LLC. All rights reserved.