Ukraine Grain Shipping Struggles Mount

Shipping Totals Show Ukraine Grain Effectively Cut Off Without Black Sea Ports

OMAHA (DTN) -- With port access accounting for nearly three-quarters of Ukraine's grain exports since the Russian invasion, Russia's moves to cut off the Black Sea and attack port infrastructure will effectively stop Ukraine's access to the world.

That's one major take from DTN Lead Analyst Todd Hultman following a webinar on the latest agricultural challenges in Ukraine on Thursday. Without that Black Sea deal, Ukraine's options for moving major volumes of grain are limited.

"Overall, it seems Ukraine will have a tough time maintaining the pace we grew accustomed to when Russia allowed the Black Sea grain corridor," Hultman said.

Pressure continues to mount on Russia to re-establish the Black Sea grain corridor, even as Russia is attacking grain infrastructure at ports and farms. African leaders and China each have pressed Russian President Vladimir Putin to reach a new deal to reopen Ukrainian grain exports.

Antonina Broyaka, an associate professor of agricultural economics at Kansas State University, was a dean at an agricultural university in Ukraine before the war began. Broyaka has since held frequent webinars updating some of the impacts of the war on Ukraine's agricultural sector.

On Thursday, Broyaka highlighted just how much Ukrainian farmers and grain shippers have relied on those Black Sea ports to move commodities since the shipping deal was brokered a year ago.

Russia ended its participation in the Black Sea agreement on July 17 and has since then launched repeated attacks on key ports such as the city of Odesa and ports on the Danube River.

"They will continue to blackmail and try to open and close engagement as they want," Broyaka said.

Russia's navy also has ramped up threats against civilian ships in the Black Sea, warning against any movement toward Ukrainian ports.

Broyaka highlighted several farms and grain-storage facilities have been destroyed in just the past two weeks. That included the destruction of hundreds of thousands of tons of grain that was ready to ship.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

"It looks like they decided if they cannot get over Ukraine, they're going to destroy the most important grain infrastructure," Broyaka said. She added that options for getting Ukrainian grain to global markets "keep dwindling."

PORTS OVER RAIL

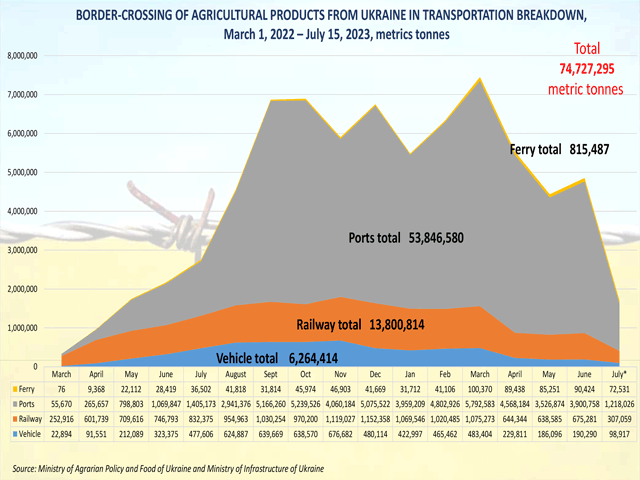

Combined, the Black Sea ports as well as ports along the Danube River have accounted for nearly three-quarters of Ukraine's grain and oilseed shipments since the war began.

Since February 2022 when Russia launched its attacks, Ukraine's total grain and oilseed exports have totaled 75.7 million metric tons (mmt). That included 32.9 mmt of corn and 17.5 mmt of wheat.

The bulk of those exports began in July last year after the Black Sea initiative was reached. Ports overall account for 53.8 mmt of total exports, or 72% of the total volume. Rail shipments to Europe accounted for 13.8 mmt, and trucks take up nearly 6.3 mmt.

"So, the Black Sea ports dominated (in volume)," Broyaka said. "Also, we're not even close to our annual export capacity."

The Black Sea ports overall have accounted for nearly 32.9 mmt of grain shipments involving more than 1,000 vessels. Corn took up more than half of those shipments and wheat accounted for 27% of the volume out of those ports. Sunflower meal and oil were the next largest shipments.

"The Black Sea initiative was effective, but not so much as we expected or needed," Broyaka said.

Rail and truck shipments out of Ukraine declined dramatically in April after five border countries -- Poland, the Czech Republic, Romania, Hungary and Bulgaria -- banned imports of Ukrainian grain over pushback from their own farmers about the market impacts of those shipments. Those bans were set to last until at least Sept. 15.

"We hope it will not be extended longer, especially under the blockade of the Black Sea ports," Broyaka said.

CHINA FACTOR

China, which has been an ally of Russia so far in the war, also had been the biggest beneficiary of the Black Sea agreement, taking in nearly 8 mmt of grain -- largely corn shipments. At least some experts have indicated this could strain China's relationship with Russia.

At least one attack on Ukrainian ports knocked out 60,000 metric tons (mt) of grain that was meant for China.

"China is signaling publicly that it very much wants to see the Black Sea Initiative continue," said Caitlin Welsh, an expert in food and water security at the Center for Strategic and International Studies, a U.S. think tank, told the Wall Street Journal in an article Friday.

HUMANITARIAN AID

On Thursday, Putin also met with leaders from African countries and offered to provide up to 50,000 mt of grain to six countries over the next three to four months as a humanitarian effort.

Still, that volume of Russian charity pales compared to humanitarian grain purchases out of Ukraine's ports in the past year. The United Nations cites Ukraine had shipped 725,000 mt of grain for the World Food Program with Ethiopia, Yemen, Afghanistan, Turkey, Sudan, Kenya and Somalia as the dominant recipients of that grain.

Reuters also reported Friday that African leaders had called on Putin to renew the grain deal and find a way to move ahead with peace talks. Egyptian President Abdel Fattah al-Sisi was among those who pressed Putin to revive the grain deal, Reuters stated. Putin responded by blaming high food prices on Western policies.

The full July 27 KSU webinar can be watched here: https://agmanager.info/…

Chris Clayton can be reached at Chris.Clayton@dtn.com

Follow him on Twitter @ChrisClaytonDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.