Market News Counters Fed Rate Hike

Fed Rate Hike Will Tighten Credit, But Other News Rallies Grain Prices

OMAHA (DTN) -- Grain prices rose Wednesday despite the Federal Reserve once again raising interest rates one-quarter of a point, a move that likely will tighten loan volumes for farmers.

The Fed raised rates to 5% to 5.25%, the highest level since before the home mortgage crisis hit in 2007. It's now the tenth straight quarterly rate hike for the central bank.

The news comes as farmers are already borrowing less, but other positive news -- such as lower diesel and fertilizer prices -- may outweigh the impacts of higher borrowing costs.

Federal Reserve Chairman Jerome Powell warned in a news conference that the U.S. economy is likely to face further "headwinds" from tighter credit conditions. The strains on the banking sector have already tightened up credit for businesses and homes, he said.

Powell also said no decision has been made on the next move on rates, though the statement released by the Federal Reserve overall indicated a possible pause. With inflation still at 5%, Powell reiterated multiple times that the central bank's goal is to bring inflation back down to 2% levels.

"We have a goal of getting to 2%. We think it's going to take some time. We don't think it will be a smooth process," Powell said.

Powell noted the country continues to have "very strong" employment at 3.5% and said the country has an "extraordinarily tight labor market." However, he also added, "We do see some evidence of softening conditions."

Asked about the debt limit standoff, Powell said fiscal policy matters are up to Congress and the White House, but he added that allowing the U.S. government to default on debt payments would be unprecedented, adding that it would have significant impacts on the economy.

"No one should assume that the Fed can really protect the economy and the financial system and our reputation globally from the damage that such an event might inflict," Powell said.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

GRAIN PRICES MOVE COUNTER

The Fed announcement Wednesday wasn't enough to overcome other factors in the grain markets. As DTN's Closing Grain Comments highlighted, grain prices saw a needed rally on Wednesday. Corn, soybean and wheat futures contracts all saw upward moves. December corn was up 10 3/4 cents to $5.30 1/2 a bushel. November soybeans were up 5 cents to $12.72 1/4, and July Kansas City wheat was up 44 3/4 cents to $7.85 a bushel.

Prices moved up following reports out of Russia claiming Ukraine launched drones against Russian President Vladmir Putin. The escalation of rhetoric between the two countries again prompts doubts about the stability and long-term prospects of the Black Sea grain agreement.

"Wednesday's news comes as officials were meeting to talk about the future of the Black Sea grain deal. Russia is threatening to pull out of the deal on May 18, but says it will continue talking with the U.N. in Moscow on Friday," DTN Lead Analyst Todd Hultman noted, citing a Reuters report on the talks.

OTHER MARKET IMPACTS

The S&P 500 closed 28.83 points lower (0.7%) for the day with the market indicator falling late in the day after the Fed announcement.

Crude oil prices also continued to fall with West Texas Intermediate (WTI) crude closing at $68.28, its lowest close since March 20. The WTI price has lost $8.50 since last Friday's close.

FARMERS ALREADY BORROWING LESS

The Fed move comes as farmer borrowing has already "slammed the brakes," as DTN Farm Business Editor Katie Dehlinger reported in late April. A report from the Kansas City Federal Reserve showed that non-real estate loan volumes had fallen 10% in the first quarter of 2023 compared to a year earlier.

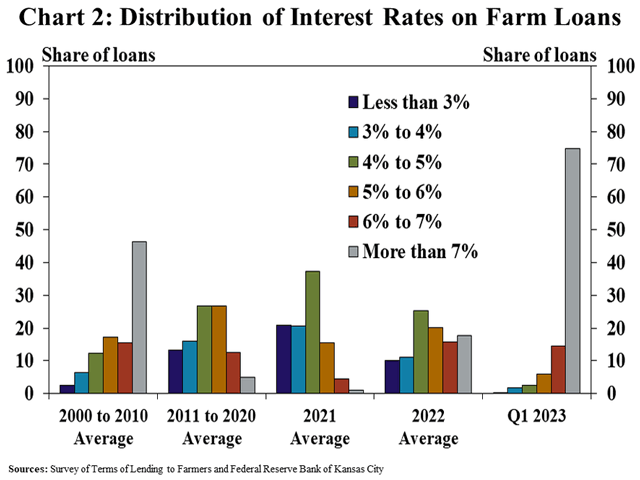

The average interest rate charged on all types of farm loans increased for the fifth consecutive quarter, reaching the highest level since 2007. The average interest rate on real estate loans climbed 3.5 percentage points since 2021 and are now just shy of 7%. Interest rates on non-real estate loans are up 4.5% in the same period to near 7.5%.

Rates remain lower for Farm Service Agency borrowers right now. FSA on Monday released interest rates showing 5% rates for both direct operating and farm-ownership loans for the month of May. FSA loan rates are adjusted monthly based on average Treasury yields.

LOWER FERTILIZER, FUEL PRICES

For farmers, another counterweight to the interest-rate hike is falling input prices. DTN Retail Fertilizer Trends reported this week urea fertilizer is below $600 a ton for the first time since September 2021. The average anhydrous price last week was $928 a ton, the lowest since October 2021, according to DTN data.

Diesel prices are also declining. AAA reports the average diesel price at $4.11 a gallon, down from $5.37 a year ago. Some farm states in the middle of planting season are seeing better prices. AAA reports the average diesel price in Iowa at $3.86 while in Nebraska is $3.92 a gallon.

"That's a big deal in the middle of planting season," Hultman said.

Also, see:

"Farmers Borrow Less as Average Interest Rate on Operating Loans Exceed 7.5%," https://www.dtnpf.com/…

"Urea Fertilizer Price Drops Below $600 Per Ton for First Time Since September 2021," https://www.dtnpf.com/…

Chris Clayton can be reached at Chris.Clayton@dtn.com

Follow him on Twitter @ChrisClaytonDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.