Agriculture Confidence Index Results

Farmer Optimism Increases, Agribusinesses Show Worry, as 2022 Came to Close

COLUMBIA, Mo. (DTN) -- Farmer optimism continues on a slight upswing, while agribusiness owners reveal concerns about the future. Those were major takeaways from the most recent DTN/The Progressive Farmer Agriculture Confidence Index and the companion DTN/The Progressive Farmer Agribusiness Confidence Index.

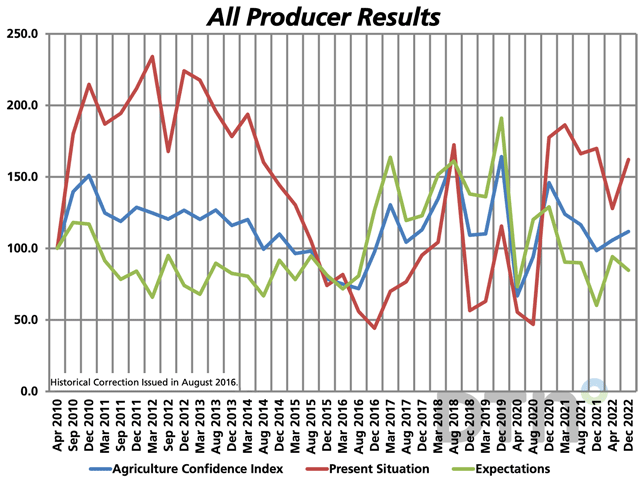

The current farmer-focused Agriculture Confidence Index is a slightly optimistic 111.8, up from 105.8 in spring and from 98.5 in December 2021.

To see a video about the latest results, go to: https://www.dtnpf.com/….

The Agriculture Confidence Index survey is conducted via telephone interviews with approximately 500 farmers and ranchers. Respondents who identify as being the major decision-makers on their operations are asked questions about how they feel current economic and financial conditions are compared to a year ago, and how they estimate conditions will be a year from current. Those questions create "present condition" and "future expectations" scores, respectively, which are combined to create the overall Index.

The latest survey, conducted in late November and early December, showed a highly optimistic present condition score of 162.1, up significantly from spring, yet down slightly from the 169.8 of a year ago.

Scores are based on a neutral baseline of 100. Numbers above 100 indicate optimism compared to the baseline, while scores falling below 100 indicate pessimism.

While farmers feel positive about the present, they are concerned about the future. Survey responses put the future expectations level at 84.8, the lowest since December 2021, when it was an all-time record low of 60.1.

The last time there was an 80-point-or-more difference between how farmers felt about the current situation and the future was December 2021. The 109-point swing between how farmers rated their current plight (169.8) versus the future (60.1), similar to the difference this year, is likely driven by continued strong commodity prices with the worry of when grain and oilseed production might break the back of those prices, while the costs of growing those crops stay high due to high fertilizer, fuel, seed and other input costs.

Survey answers are examined along income level, region, and whether the chief income of the operation comes from crops or livestock. There were no significant differences by income category from this most recent survey. This is not surprising, as surveys that showed more pessimism in one income demographic versus others were typically during periods of significant pessimism, such in the early COVID lockdown days of 2020. During such times, lower income categories (annual income below $499,000) tended to have lower (more pessimistic) scores than did the upper income groups.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The latest survey of 500 farmers was conducted in late November and early December, after the November midterm elections.

MIDWEST MOST OPTIMISTIC

Producers in Midwest states were slightly more optimistic overall than the general population; they reported an overall Index of 124.5, with a present situation score of 169.5 and a less pessimistic future expectations score of 93.

Southeastern producers had the lowest overall Index of 86, a score pulled down by concerns about the future. Those farmers reported a present situation score of 147.4, with a strongly pessimistic future expectations score of 63.5.

Scores for producers in the Southwest were an overall Index of 96.4, created from a present score of 128.6 and future expectations of 82.2. The area did turn in a higher future expectations score than in December 2021, when drought was at its highest point.

As has been the case recently, crop farmers had a slightly more optimistic outlook than livestock producers. The crop group's overall Index was 119.6, with an optimistic 172.1 present situation and an 89.3 for future expectations. That is more optimistic than the 101.8, 168.8 and 62.9 ratings in December 2021.

Comparatively, the Index for those who identified as livestock producers was 95.4, created from a present situation score of 140 and a future expectations level of 75.6. Those numbers are only slightly higher than December 2021.

INPUT COST CONCERNS LOOM

Input costs remain a downward pressure on farm optimism, though that pressure appears to be easing. In companion questions asked during the survey, 32% of farmers said they would likely have the fertilizers and other inputs they would need for 2023, but likely would be at a higher cost that may hurt profits. A similar amount (32.2%) said they would have needed supplies at normal prices. Only 19% feared input costs would significantly hurt profits, while 17% said they feared they would not have all the inputs they needed for 2023.

Political issues also bring down optimism. Less than 20% of farmers surveyed felt good about the midterm elections. More than 80% of farmers had political concerns, with 35% saying they had "some" concerns about the political environment in 2023; 45.4% replied they had "great" concerns about the coming year.

Farmers were also asked about other topics, from the economy to political divisiveness. The U.S. economy was most on farmers' minds, with 38.6% of farmers saying it was the thing they were most concerned about. Some 27% of farmers said agriculture profitability topped their concern list, while only 13% put political conflict and divisiveness as their chief worry in the year ahead.

For several years, DTN has asked about broadband access on the farm. This winter, 61% of farmers surveyed said they had acceptable access on a regular basis, with more than a third saying broadband access was regularly less than what's needed to run their farms.

AGRIBUSINESSES SURPRISE WITH PESSIMISM

The most recent DTN/The Progressive Farmer Agribusiness Confidence Index broke from typical winter results. The overall Index for agribusiness is a significantly pessimistic 67.7, well below the 97.8 of December 2021 and below the multiyear average, which was typically near the neutral line of 100 or above. Business owners scored their present situation at 88.7, with their future expectations score, 52.8, truly bringing down the overall index. That is an all-time low for the Index, showing significant pessimism of how they expect their businesses to perform a year from now.

Some 100 agribusiness owners from across the country are surveyed. This latest round was also conducted from late November through early December.

The results show agribusiness owners are the most pessimistic about the future since the 70.9 of March 2016. At that time, overall commodity prices were well off the 2012-13 highs, and the uncertainty of a presidential election year was beginning to take hold.

When responding to the current survey, some 84% of agribusiness owners expected profitability to be the same or worse a year from now compared to current conditions.

Greg D. Horstmeier can be reached at greg.horstmeier@dtn.com

Follow him on Twitter @greghorstmeier

(c) Copyright 2023 DTN, LLC. All rights reserved.