Sort and Cull

Live Cattle Take on Another On-Feed Report

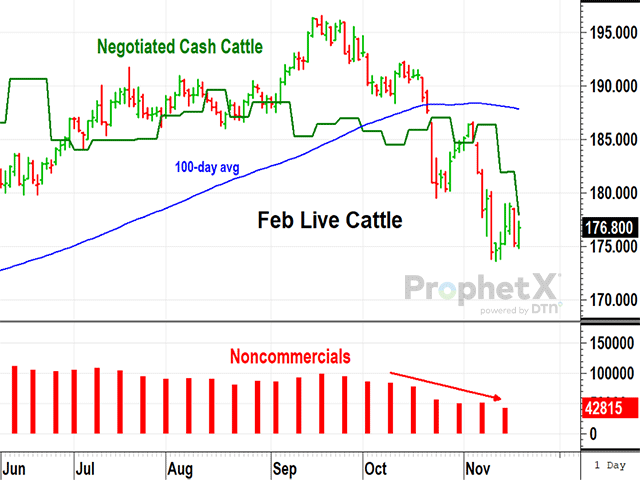

February live cattle closed up $2.15 at $176.80 in the week ending Nov. 17, showing some nervous support after reaching its lowest prices in six months. The recent sell-off was triggered by higher-than-expected placements in USDA's Cattle On-Feed report on Oct. 20, and it's fair to say traders were a little jumpy about what USDA would say in the next On-Feed report on Nov. 17 as the week saw a $4 rally the first three days of the week was corrected by a $3.45 drop on Friday, Nov. 17. Friday's CFTC data also showed specs shed another 8,412 net longs, ending with 42,815 on Nov. 14.

When the report was released Friday afternoon, it wasn't as bearish as feared and we may see a little relief from traders' worries Monday. USDA said there were 11.931 million head of cattle on feed on Nov. 1, up 1.7% from a year ago and slightly less than expected. There were 2.164 million head of cattle placed in October, up 3.8% from a year ago, not as heavy as the 6% to 7% gain that was expected in pre-report surveys.

The number of cattle in feedlots with capacity of 1,000 head or more has increased 901 million head since the Aug. 1 low and, even though some traders were shook, it's not unusual to see higher numbers this time of year. It was interesting that the bulk of higher October placements came from cattle under 700 pounds, while the heavier placements couldn't match the September totals.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Among the top three cattle states, the number on feed since Oct. 1 was up 50,000 in Texas, up 120,000 in Nebraska and up 20,000 in Kansas. It is also important to remember the Oct. 1 report showed 4.635 million head of heifers and heifer calves on feed, 60,000 more than the previous year and a sign that herd expansion will have to wait. USDA expects the beef cow herd to decline, from 28.92 million head in 2023 to 28.22 million in 2024.

Technically speaking, February cattle prices remain out of sync with the market's more bullish situation and it is up to the cash market to reconcile the difference.

It all comes down to packers' ability to secure the amount of cattle they need each week and the seasonal increase in on-feed supplies won't last forever. In the latest week, packers found their buying efforts easier as DTN reported southern trade mostly $2 to $3 lower and northern trade roughly $4 lower, awaiting Monday's report of weighted averages. Based on a previous low in May, February cattle should be able to find support in the $172 to $174 area.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on X, formerly known as Twitter, @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.