Todd's Take

At Last, the Outlook for Interest Rates Shows Signs of Easing

Sometimes in the day-to-day garble of news, it's easy to lose sight of how today's market challenges began. For growers of corn, soybeans and other crops, we can look back and see the dramatic rise of fertilizer prices in 2021 and 2022 began at a time when a heightened response to the spread of COVID-19 resulted in logistical nightmares at the world's busiest ports. In the U.S., 25.5 million jobs were lost in a matter of months, energy prices plunged as transportation screeched to a halt, the oil and gas industry was hit with a surge of bankruptcies in 2020 and then overall demand picked up.

The situation was further complicated by western sanctions on fertilizer from Belarus and China's move to protect domestic supplies of phosphates in 2021. In August 2021, Hurricane Ida damaged fertilizer facilities and disrupted U.S. natural gas production in the Gulf, an important component for making anhydrous ammonia. We also can't leave out Russia's attack on Ukraine in February 2022. As a good family friend used to say, it was a "mell of a hess" situation.

The good news for producers today is that fertilizer prices have come down dramatically since the spring of 2022. DTN's national index of anhydrous prices is currently at $830 per ton, not as low as during the early stages of COVID, but nearly half the cost of last year's peak. The logistics problems have unraveled, people are back to work in record numbers, plentiful supplies of natural gas have returned and gas prices are cheap. The war in Ukraine goes on and the dry Mississippi River is a concern, but by and large, the problem of expensive fertilizers in 2021 and 2022 has greatly eased.

The new challenge facing producers in 2023 is high interest rates. New cost of production estimates from USDA for corn on Nov. 15 show total operating costs fell $72.87 an acre in 2023, primarily the result of cheaper prices for fertilizer, chemicals and seed. Overhead costs, however, increased $34.26 an acre, largely related to higher interest rates. Different farms employ different levels of debt, and some will be hit harder than others, but even debt-free farms with strong balance sheets will notice a tendency for crop prices to be lower, partly due to the impact of higher interest rates. High interest rates add to costs at every step of the supply chain and make commercials more reluctant to take possession of grain that becomes expensive to store.

When COVID-19 first appeared in the U.S. and jobs were rapidly being lost, the Federal Reserve initially responded by taking the federal funds rate to a near-zero target with an upper limit of 0.25%. In April 2020, consumer prices were falling and inflation was not a concern. As people started getting active again, demand returned to the economy faster than cash-strapped businesses could adjust, and it wasn't long before consumer prices began perking up. One year later, in April 2021, the annual rate of inflation as measured by the Labor Department's consumer price index was up to 4.1%, higher than the Fed would normally allow. U.S. jobs, however, were still down 7.7 million from the pre-COVID peak and understandably, the Fed did not want to squelch a recovery.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Many will find it easy to blame the Fed for not being vigilant sooner, but whatever one's view, the Fed didn't start raising the federal funds target until March 2022 when the annual rate of inflation was about to hit 8.5%, the highest in over 40 years. Ten rate hikes later, the upper limit of the federal funds target is now at 5.50%, with the latest increase taking place on July 26, 2023. The current prime rate among major banks is up to 8.5%.

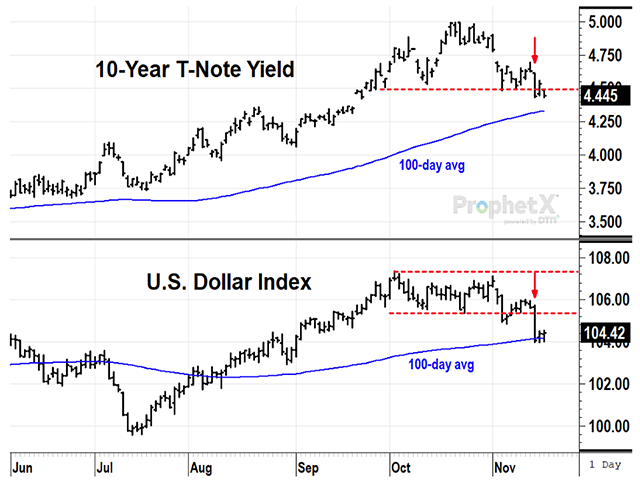

Just this week, markets received good news concerning the outlook for inflation. On Tuesday, Nov. 14, traders were encouraged to hear consumer prices were unchanged in October. The yield on 10-year T-Notes fell to a new one-month low of 4.44% and the U.S. Dollar Index fell to a new two-month low of 104.05. On Wednesday, October's producer price index was down a half-percent, suppressed by a 6.5% drop in energy prices.

As I tried to explain in late 2021 (see https://www.dtnpf.com/…), and just over a year ago (see https://www.dtnpf.com/…), the key to unraveling the inflationary pressures we have been experiencing was to find a way to increase domestic oil production. It was the contraction of the oil industry after COVID, and the reluctance to increase domestic energy production in an age of going green, that fueled many of the higher prices the Fed has been trying to fight.

Wednesday's Department of Energy report showed crude oil supplies at 439.4 million barrels as of Nov. 10, up over 25 million barrels since the end of September. Nearly four years after COVID-19 first arrived in the U.S., domestic oil production finally surpassed its pre-COVID peak of 13.0 million barrels per day and has been running near 13.2 million barrels per day since October. Not only did lower energy prices appear in Wednesday's Producer Price Index, but the price of December crude oil broke below support at $80 on Nov. 7 and closed at $72.90 on Thursday, Nov. 16.

For the first time since before the Fed started raising interest rates, the market now has a legitimate reason to expect lower price inflation and lower interest rates in the months ahead. Of course, circumstances for oil prices can change quickly with two active wars taking place, but the door to a lasting solution has cracked open. A productive country at work that now has more supplies of oil and gas available is a good start. This week's charts, showing drops in T-Note yields, the U.S. dollar and crude oil, are also encouraging signs. Fingers crossed, a year from now we may be talking about interest rates in 2024 the same way we're talking about fertilizer prices today.

Have a Happy Thanksgiving!

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com.

Follow him on X, formerly Twitter, @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.