Kub's Den

Corn Belt's Drought-Hit Regions Underinsured in 2023

We're finally getting to that point in the growing season when farmers can inspect the ears of their corn fields and pods of their soybean fields to get a clear indication of how badly the 2023 drought may have affected the plants' yields. The markets may not know it yet, in the sense that new-crop prices keep sliding lower, but individual farmers looking at individual fields know it -- in all the places across the Corn Belt where severe drought has stretched its fingers, grabbed hold and sucked the verdant green joy out of summer.

For producers who purchased crop insurance earlier this year, their financial losses from lost yield or lost revenue may be mitigated eventually -- once the final bushels are known and compensation payments are made. This will help keep the farmers of those drought-hit regions in business for another year and help keep their retailers and service providers paid, and help keep the local economy ticking. But producers who didn't purchase crop insurance this year will have a longer wait for potential disaster payments from Farm Service Agency programs ... and less to wait for.

I vividly recall the shock I felt in 2012 when an Illinois farmer, suffering from drought-hit fields and poor crops, told me he hadn't bought crop insurance. "What do you mean you didn't buy crop insurance?" I remember thinking. "You must buy crop insurance!" To me, someone who farms in South Dakota, where it seems there is always some drought, freeze, wet spring or other disaster waiting to befall our fields, buying crop insurance seems as automatic as buying fertilizer. One does not simply farm here without crop insurance.

Apparently, however, there are portions of the world where they feel quite confident of receiving timely rains in most years. In those places, I guess rational people make the decision not to pay insurance premiums, when nine years out of 10 (or better), there would never be any need for it. I've heard that such places exist; I've even met farmers and crop insurance agents from all across the Corn Belt who have told me that crop insurance uptake varies regionally. Apparently, not everyone is as zealous about its use as we are in the Dakotas.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

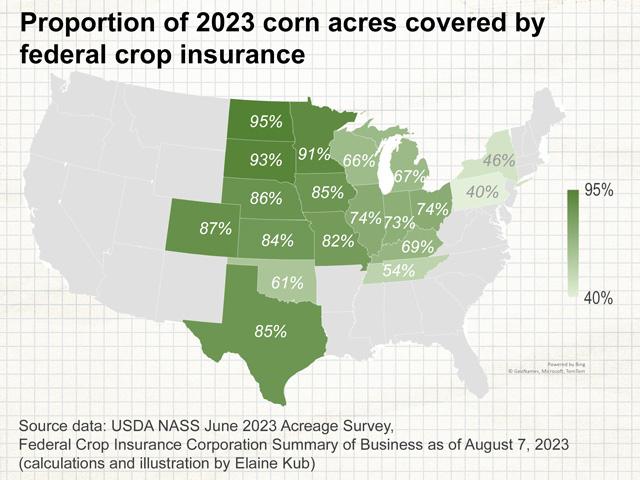

A look at the actual numbers this year for corn acres, state-by-state, illustrates this phenomenon. Note, however, many of the states where crop insurance coverage is relatively low in 2023 are also states where the drought's effects may be hitting crop yields the worst this summer.

| State | Corn Acres Planted | Corn acres enrolled in federal crop insurance | Percent insured | % in D0 or worse drought (8/1/23) |

| IOWA | 13,400,000 | 11,375,646 | 85% | 100% |

| ILLINOIS | 11,500,000 | 8,523,386 | 74% | 95% |

| NEBRASKA | 9,500,000 | 8,185,002 | 86% | 77% |

| MINNESOTA | 8,400,000 | 7,613,723 | 91% | 100% |

| SOUTH DAKOTA | 6,200,000 | 5,773,769 | 93% | 40% |

| INDIANA | 5,500,000 | 3,990,238 | 73% | 54% |

| KANSAS | 5,500,000 | 4,609,939 | 84% | 88% |

| WISCONSIN | 4,000,000 | 2,650,561 | 66% | 98% |

| NORTH DAKOTA | 3,900,000 | 3,693,187 | 95% | 67% |

| MISSOURI | 3,650,000 | 3,006,414 | 82% | 94% |

| OHIO | 3,500,000 | 2,577,749 | 74% | 18% |

| TEXAS | 2,500,000 | 2,112,639 | 85% | 79% |

| MICHIGAN | 2,400,000 | 1,607,084 | 67% | 62% |

| KENTUCKY | 1,550,000 | 1,073,759 | 69% | 4% |

| COLORADO | 1,250,000 | 1,092,048 | 87% | 27% |

| PENNSYLVANIA | 1,240,000 | 494,144 | 40% | 24% |

| NEW YORK | 1,130,000 | 522,220 | 46% | 17% |

| TENNESSEE | 1,000,000 | 541,999 | 54% | 14% |

| OKLAHOMA | 370,000 | 226,338 | 61% | 48% |

(Sources include: USDA NASS June 2023 Acreage report: https://downloads.usda.library.cornell.edu/…; Federal Crop Insurance Corporation, Summary of Business as of Aug. 7, 2023: https://www.rma.usda.gov/…; National Drought Mitigation Center, U.S. Drought Monitor dated Aug. 1, 2023: https://droughtmonitor.unl.edu/…)

Overall, in the United States this year, 74.3 million corn acres are enrolled in some sort of federal crop insurance, which is about 79% of the total 94.1 million acres planted. The vast majority of these acres (93%) are specifically enrolled in a "Revenue Protection" policy, which will reimburse producers for losses from any combination of both market price losses and yield losses. Therefore, many farmers in many of the drought-hit regions will have some indemnity coming their way eventually.

This is not meant to be a scolding for the other farmers who made a different management choice before the March 15 crop insurance sign-up date. Regional differences or even regional "traditions" about using crop insurance are a reflection of what it's really like to run a business in those regions and to rationally choose which inputs to buy. No one had any perfect long-term weather prediction at the start of this growing season.

Rather, it's meant to be an indication of how the cash flows of producers in certain regions may struggle or be delayed when the time comes to sell a drought-diminished 2023 crop. And it's a reminder of the importance of federally supported crop insurance in the next Farm Bill. It's the best program to keep grain producers in the business of providing food to the nation despite our unique dependence on unpredictable weather conditions.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Elaine Kub, CFA is the author of "Mastering the Grain Markets: How Profits Are Really Made" and can be reached at masteringthegrainmarkets@gmail.com or on Twitter @elainekub.

(c) Copyright 2023 DTN, LLC. All rights reserved.