Todd's Take

Talk of Global Rice Shortage Deserves a Second Look

Recently, I've seen several articles on the internet saying the world is set to have its largest rice shortage in 20 years. Of course, I was interested to find out more, especially since I hadn't heard about this dire situation. One example is posted on CNBC.com (see the April 18 article by Lee Ying Shan at https://www.cnbc.com/…). According to CNBC.com, the claim for an impending shortage was based on a report from FitchSolutions.com, dated April 4, which said, "The global shortfall for (rice in) 2022-23 would come in at 8.7 million metric tons." Fitch analyst Charles Hart also added, "That would mark the largest global rice deficit since 2003-04, when the global rice markets generated a deficit of 18.6 million metric tons."

The numbers Mr. Hart cited are reasonable as USDA estimates a 9.25 million metric ton (mmt) deficit for 2022-23. However, a one-year production deficit is not the same as a shortage of rice. Anyone familiar with ag markets knows you can have a one-year production deficit and still have plenty of surplus rice from prior years.

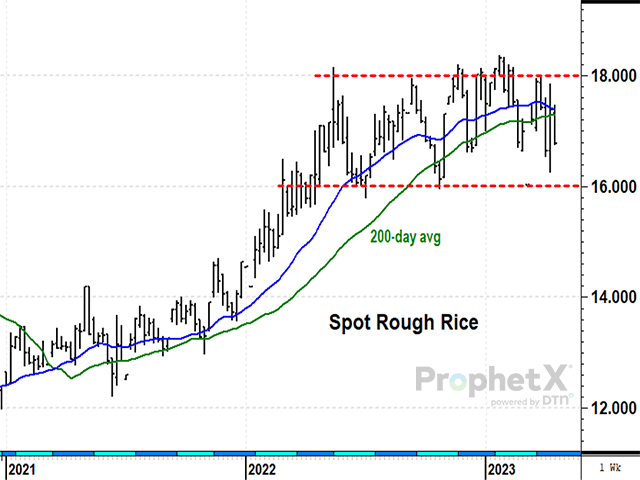

The notion of a global rice production deficit in 2022-23 is nothing new. In USDA's September 2022 World Agricultural Supply and Demand Estimates (WASDE) report, USDA estimated the deficit at 11.3 mmt and, in January 2023, it was estimated at 13.1 mmt. Spot prices of rough rice here in the U.S. have traded between roughly $16 and $18 per hundredweight for a year. The price range is at its highest level in three years, but prices are not showing any sign of a drastic shortage yet.

A closer look shows USDA's ending-stocks estimate for world rice in 2022-23 is currently 171.4 mmt, or 33% of annual use. Taken at face value, USDA's estimate of world ending rice stocks is the lowest in five years. That is a far cry from the biggest shortage in 20 years. When we check the estimates from the International Grain Council (IGC), we see a similar ending-stocks estimate of 172 mmt.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Here is where the story gets accidentally interesting. If you happen to remember November 2018, when USDA increased China's ending corn stocks estimate from 58.50 mmt to 207.49 mmt, or 8.17 billion bushels (bb), followed by the 2020-21 season when China bought a record amount of corn from the U.S., you understand how untrustworthy ending-stocks estimates for China can be. The West simply has no good way of verifying supplies in China.

If we look at USDA's estimate of world ending rice stocks, excluding China and India, we see USDA estimating available world ending stocks slightly below 32.0 mmt, the lowest in three years, which also coincides with U.S. rice prices trading at their highest level in three years. In fact, the global rice surplus has been this low or lower in four of the past seven years -- not as catchy of a headline, is it?

The possible bullish story for rice that may or may not be lurking beneath the surface has to do with the mystery of China's supplies. It is possible one of these days China's rice surplus could turn out to be just as bogus as their corn surplus was in 2020 and still is today (please USDA, buy an eraser!). If so, any hint of China starting to import rice in higher-than-normal amounts would be extremely interesting and potentially bullish, far more than any bullish reason we see in the market today. I admit, there is no evidence of overestimated supplies yet.

USDA's estimate of world rice production in 2023-24 won't be out until May 12, but IGC has put out an early production estimate of 521 mmt in 2023-24, up 12 mmt from 509 mmt in the current season and 2 mmt higher than world demand. Global ending stocks of rice are expected at 174 mmt in 2023-24, 2 mmt higher than the current estimate in 2022-23.

There is plenty of time between now and fall, when China and many northern producers harvest the next crop and weather will have a lot to say about whether the new season ends with a larger or smaller surplus. I did not find that rice is set to have its worst global shortage in 20 years, but I will say that rice's lower-than-normal supplies make this an interesting market to watch in 2023 with ramifications for wheat prices, the other human staple that has limited supplies. Be careful what you read.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at todd.hultman@dtn.com

Follow Todd Hultman on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.