Kub's Den

Looming Renewable Diesel Revolution Set to Change Rail Traffic

If the projections turn into reality, then the soybean market is about to undergo a renewable diesel transformation just as dramatic as the corn market's ethanol boom in the mid-2000s ... and with just as many growing pains and complexities too. Be prepared for the "food-versus-fuel" debate to heat up again and for your local truck, train and barge markets to scramble in preparation of higher volumes of commodities moving in new directions.

As far as the pure arithmetic goes, if all of the processing plants that are currently able to produce renewable diesel plus the 12 new plants under construction or conversion from "old" biodiesel production plus nine more proposed plants, were to operate at full capacity, then nationwide production will reach 7.5 billion gallons per year. Biodiesel Magazine keeps a list of these plants (https://biodieselmagazine.com/…).

But it would take 63.7 billion pounds of feedstock -- for example, soybean oil -- to make that much renewable diesel (using 8.5 lbs. of edible oil to produce each gallon of renewable diesel), and that's more soybean oil than we currently produce in this country in a year. It's certainly more soybean oil than we have kicking around to spare. In fact, if we get 11 lbs. of soybean oil from each bushel of soybeans, then it would take 5.8 billion bushels (bb) of soybeans to produce that much soybean oil, and that's more soybeans than we've ever grown in a year. It's about 30% more soybeans than we're projected to grow in 2023.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Of course, many of these plants won't come online for a few years, and they likely won't all be operating at 100% capacity 100% of the time, and there are other oils that can be used as feedstock for renewable diesel, like canola oil or animal fats or even soybean oil imported from South America -- if it comes to that. Commodity markets will always find a way to arrive at some sort of equilibrium.

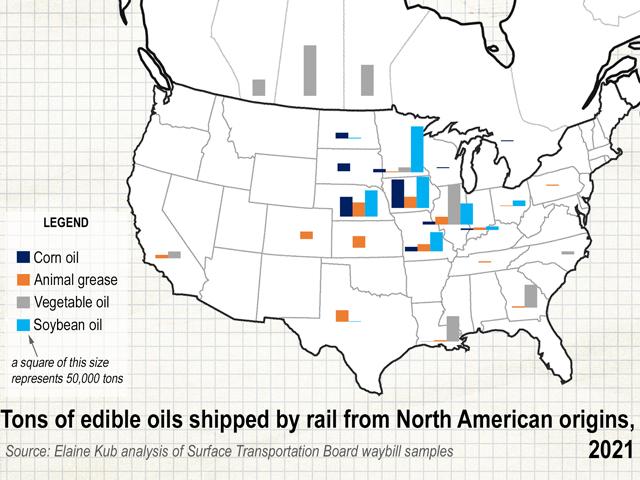

The overall shift in demand is one thing, but I am also wary of some of the secondary effects. Currently, only about 10% of this nation's soybean oil production gets shipped by rail on tanker cars to any destination. A typical rail shipment of soybean oil might be from a soy processor in Iowa down to New Orleans, Louisiana, ultimately to be exported. But if all these planned renewable diesel plants come online, the draw might instead be toward Texas or more likely California, where over half of the capacity currently under construction will be located.

Meanwhile, new oilseed processing plants are being proposed and constructed in various locations, which will motivate new crop mixes in those draw areas. Frankly, as we start to source more of our diesel from green growing things instead of black mineral things, the entire ag commodity landscape will change -- from where and how much is grown, to where the raw oilseeds get processed, to how much of that final product will be competing for freight service alongside other ag commodities. If the collective new processing goals are achieved, then the looming renewable diesel revolution will raise the demand for ag commodity transportation almost everywhere.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Elaine Kub, CFA is the author of "Mastering the Grain Markets: How Profits Are Really Made" and can be reached at masteringthegrainmarkets@gmail.com or on Twitter @elainekub.

(c) Copyright 2023 DTN, LLC. All rights reserved.