Todd's Take

An Awkward Time for New-Crop Corn, Soybean Prices

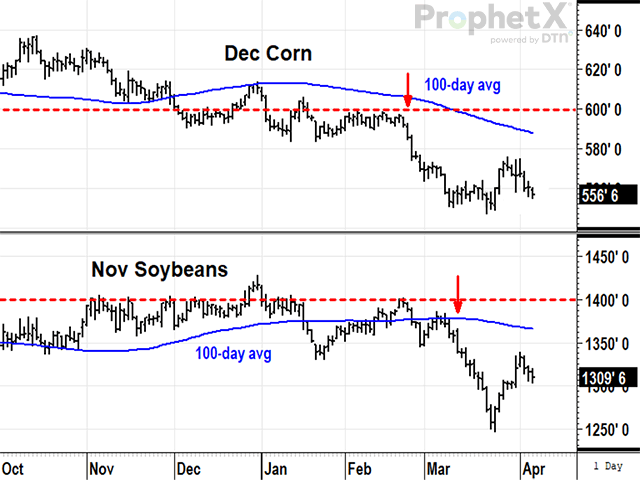

Isn't this great? Thanks to USDA's Ag Outlook Forum on Feb. 23 and Prospective Plantings report on March 31, many will assume the U.S. will grow 15.25 billion bushels (bb) of corn this year and have 2.1 bb of ending stocks in 2023-24. Plug into previous years when USDA estimated an ending stocks-to-use ratio of 15%, and we come up with a new-crop corn price of roughly $4.50 per bushel. Ipso facto, December corn prices are falling.

A similar exercise for 87.5 million planted acres of new-crop soybeans pegs production at 4.51 bb and ending stocks at 290 million bushels (mb), just as USDA outlined at its Ag Forum. The 6.5% ending stocks-to-use ratio suggests a new-crop price target of $14.30 per bushel, a higher price than Thursday's close of $13.09 3/4 a bushel in the November contract.

Hmm, have traders not done their homework?

I hope you're sensing the sarcasm. Even though some form of the above conversations probably took place hundreds or thousands of times in the days following USDA's Prospective Plantings report, the obvious flaw in all this is that estimates this early in the season don't mean a lot. Other than some weather developments, we don't know any more about new-crop markets now than we did before the February and March reports.

What's more, outside market influences in 2023 have already made their bearish presence felt in grain prices. There is plenty of uncertainty about how the economy will hold up as the one-armed Federal Reserve tries to fight inflation with rate hikes, while the U.S. lacks an answer for inadequate fuel production.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

We have already seen traders scared by three U.S. bank failures. Given the vulnerable network of modern banking without the protection of Glass Steagall, we can't say there won't be more. OPEC+ made the Federal Reserve's job tougher on Monday, April 3, announcing a 1.16-million-barrel-per-day cut in oil production, starting in May. Oddly, it is difficult to tell if traders remember there is a war in Ukraine or realize more lethal weapons are expected to be employed this spring. The potential for uncertainty in 2023 remains as high as ever.

Regarding new-crop corn and soybean prices, how do we navigate all the possibilities that lie ahead? For starters, crop insurance remains a farmer's best friend for risk management and, hopefully, Congress will maintain those essential protections in the next farm bill. This year's February averages were high enough for 85% coverage to protect December corn near $5 per bushel and November soybeans near $11.70 per bushel, assuming average yields.

In addition, DTN's Six Factors Market Strategies recommended early new-crop sales in February and March, totaling 50% of expected 2023 production. The sales not only took advantage of the favorable prices the market offered at the time, but also reduced the price risk to farm revenue moving forward.

For the rest of the year ahead, DTN's Six Factors will be relying on the market's best clues to guide the remaining marketing decisions, knowing the market's list of influences is always changing and the risk of uncertainty never goes away.

The current read of new-crop corn is bearish as prices sag lower with early expectations for larger crops in both Brazil and the U.S. For November soybeans, the current outlook is also bearish with prices pressured by Brazil's record soybean crop and the threat it offers to U.S. export sales in the fall. DTN also has a favorable early forecast for crop conditions in 2023, one of those factors that doesn't come with a guarantee but adds to bearish expectations.

As I tried to point out at the top of the column, estimates and expectations are not money in the bank, and we are always prone to being surprised. That is what makes this time of year especially awkward when considering new-crop prices. As the season progresses, we will incrementally learn more along the way and will also keep an eye on outside events. The market is no more perfect than the participants that make it up, but for digesting all the possibilities that may lie ahead, this fallible voting machine is the best we have.

Best wishes for a prosperous growing season.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at todd.hultman@dtn.com

Follow Todd Hultman on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.