Kub's Den

Three Idioms to Summarize Spring Planting Plans

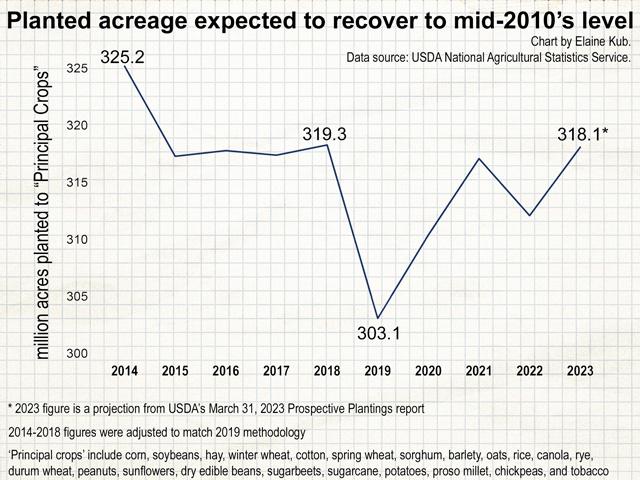

Last week, USDA released survey results showing U.S. farmers' intentions to plant more crops in 2023 than they have for the past four years: more corn, more soybeans, more wheat, more rice, more oats. If the fates allow, farmers will plant more of just about everything they can, and they'll harvest more hay too. In the days since the annual Prospective Plantings report was released, new-crop grain futures have generally dipped lower, making three cliched expressions come to mind:

1: The Cure for High Prices is High Prices.

If a downward trend in new-crop grain prices persists, it will relieve the stress and profitability challenges for many of the grain markets' end users -- livestock feeders, fuel customers and, ultimately, the world's grocery shoppers. The recent two-year spate of high prices will have been "cured." And what cured them? Ostensibly, the high prices themselves. Presumably, the farmers who provided these survey responses to USDA, indicating they will plant more of most crops in 2023, will be doing so because they're motivated by the high prices offered right now. The only way this will work out well for everyone is if producers lock in the forward high prices now and the end users ultimately receive the cure they're hoping for.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

2: The Spirit is Willing but the Flesh is Weak.

Farmers in North Dakota may want to plant 4% more corn in 2023, they may "intend" to do so, they may respond to USDA's survey with this optimistic plan, but if their fields are still covered in snow until mid-May or swamped by deep sloughs and potholes throughout the planting season, they will not be able to fulfill their intentions. As of April 5, snow continues to cover all of the Dakotas (in excess of 20 inches in some places), virtually all of Minnesota and half of Wisconsin. It's enough to make us think back to the bad ol' days of 2019, when nationwide planted acreage fell 3.89% despite the best of intentions. Of course, the moisture in that year was more widespread across the Corn Belt and extended later into the spring. It is only April 5, after all. Things could melt quickly.

3: Farmers are "Working for Peanuts."

Although they're not huge crops in acreage terms, it was striking to note which specialty crops won out in farmers' 2023 plans and which ones didn't. An international storyline can be seen for each case: Sunflower acreage is intended to fall 19.6% after a hot 2022 when North American farmers tried to pick up market share from a war-torn Ukraine. Cotton acreage is intended to fall 18.2% as the global economy wobbles precariously. Spring wheat (down 2.4%), sugarbeets (down 4.2%) and sorghum (down 5.5%) were other notable acreage losers. But the winners have an international storyline of their own -- rice acreage up 16.2% and peanuts up 6.7% are likely a direct response to a Chinese shortage of peanuts after a drought in its key peanut-growing region in 2022. More ominously for the future, Chinese government subsidies have pushed their farmers to raise more corn and soybeans, driving them away from crops like peanuts. In 2022, China's peanut acreage fell 19% and, in 2023, they are expected to be far and away the world's biggest importer of peanuts and peanut oil. So, there are opportunities out there for those who are able to match intention with action.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Elaine Kub, CFA is the author of "Mastering the Grain Markets: How Profits Are Really Made" and can be reached at masteringthegrainmarkets@gmail.com or on Twitter @elainekub.

(c) Copyright 2023 DTN, LLC. All rights reserved.