Call the Market

Cattle Market Regains Bullish Outlook

The last three weeks have been agonizing for both the live and feeder cattle markets. But Monday's (March 27) trade reawakened the bullish nature of the cattle complex. Until three weeks ago, the cash cattle market was easily adding $2.00 to $3.00 week in and week out, and traders were steadily supporting both the live cattle and feeder cattle contracts. But once news broke of the Silicon Valley Bank collapse, traders withdrew from the market hastily and the bullish fundamentals of the cattle market didn't seem to matter.

However, Monday's market reminded the cattle complex about its fundamental strength. However, will the cattle complex be able to keep its regained momentum?

Let's break the market down, piece by piece, and discuss whether or not its momentum is here to stay.

LIVE CATTLE

The live cattle market possesses the ability to trade higher, but so much of its fate will depend on feedlots and their ability (or inability) to market cash cattle at higher prices. This past week, we've seen boxed beef prices start to bottom seasonally and gain more support, which should embolden feedlots to price their cattle higher as market-ready supplies of front-end cattle are extremely thin. But doing so is going to take extreme discipline. Over the last three weeks, packers have outplayed feedlot managers and have been able to get cattle bought early in the week.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

But why in the world would you sell cattle early in the week when market-ready supplies are thin?

Even if you have to roll your showlist over into the next week, waiting for higher prices would be more advantageous. I understand that there's a psychological component to the market and it's hard to remain true to your market plan when the board is trending lower and banks are closing. However, now that traders have decided to look beyond the banking concerns here in the United States, feedlots need to be prepared to drive the cash cattle market higher.

FEEDER CATTLE

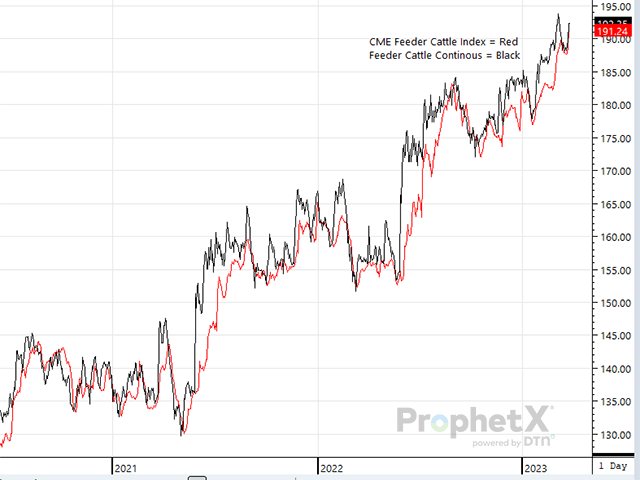

The feeder cattle market is nothing short of invigorating right now. On Monday, March 27, the CME Feeder Cattle Index closed at $191.24, which is the highest the market has seen the index close at since November 2015. I know there is some concern surrounding the feeder cattle market because breakevens on these calves/feeders aren't profitable right now, but as buyers continue to flock to sales across the countryside, there seems to be only one thing on their mind -- getting the feeders they need/want bought now before prices become even higher.

I continue to be amazed at the spread between the May and August 2023 feeder cattle contracts. Throughout the early parts of 2023, the price spread between those two contracts has varied anywhere between $10.00 to $25.00. As of Monday afternoon's close, the price spread sat at $15.63, again highlighting the fact that everyone (including traders) is keenly aware that feeder cattle supplies in the second half of 2023 are going to be inherently thinner. If the market didn't have the demand component it currently possesses, I'd be concerned about how sustainable these feeder cattle prices are, but given that demand has shown no signs of weakening, I don't see feeder cattle prices softening in the near future.

A couple weeks ago, when the mayhem about Silicon Valley Bank was storming through the markets, I encouraged you to cling to the market's positive fundamentals despite the chaos the futures complex was enduring. We will face more turmoil in the span of the next two to three years when the cattle market is expected to be hot, and it will continue to be vital that we cling to the market's fundamentals. I remain extremely optimistic about the market's outlook and believe that there are still higher prices ahead of us.

ShayLe Stewart can be reached at ShayLe.Stewart@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.