Todd's Take

The Bearish Dominoes Fall on Soybean Prices in Early 2023

One of the market factors we pay attention to in DTN Six Factors Market Strategies is the seasonal influence. Especially for corn and soybean markets, there are certain times of the year when certain market behavior is expected. Low prices at harvest time is an obvious example that also makes fundamental sense. Another seasonal expectation is for corn and soybean prices to tend to trade quietly through winter. For many years, I would talk about looking at inexpensive put options in March or April and then warn folks to buckle up when May arrived, a time when nerves would soon by tested in the volatility of a new crop season ahead.

During DTN's Ag Summit in December, I was hoping for a quiet winter to give us time to make both old-crop and new-crop sales of corn and soybeans; but that's not how things worked out. In the case of soybeans, the month of March has been in like a lamb, quickly eaten by a bearish lion.

For nearly three months in 2023, U.S. soybean demand looked bulletproof. Even after USDA raised its estimate of the soybean export estimate from 1.990 billion bushels (bb) to 2.015 bb in the March World Agricultural Supply and Demand Estimates (WASDE) report, the new estimate still looks achievable with only 160 million bushels (mb) of sales needed by the end of August. China's purchases of U.S. soybeans are up 11% in 2022-23 from a year ago, countering the negative economic headlines the market heard about China in the latter half of 2022.

Soybean crush incentives had been setting records for over a year and gave ADM some of its best earnings reports on record. As it became obvious that Argentina's soybean crops were succumbing to drought, the case for domestic soy product demand turned even stronger. March soybean meal prices flirted with $500 per short ton and cash prices for meal in the Midwest were even higher than the futures board, strong signs of legitimate demand for physical meal.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Then, the bearish clues started to appear. On Feb. 28, May soybeans fell to a new one-month low and DTN advised selling the final 25% of 2022 soybean production, as well as the first 25% of 2023 production. A second sale suggestion of 25% of new-crop production followed March 15 as prices fell to a new seven-month low.

At the time of the Feb. 28 recommendation, it was not clear what was happening, other than prices were breaking one-month support and weekly stochastics were showing bearish changes in momentum. At that point, prices in China were holding sideways, the soybean crush premium -- based on May futures -- was near its most profitable level of the year and we had not yet heard a thing about bank failures. In fact, some were suggesting the Fed might only have one or two rate hikes left.

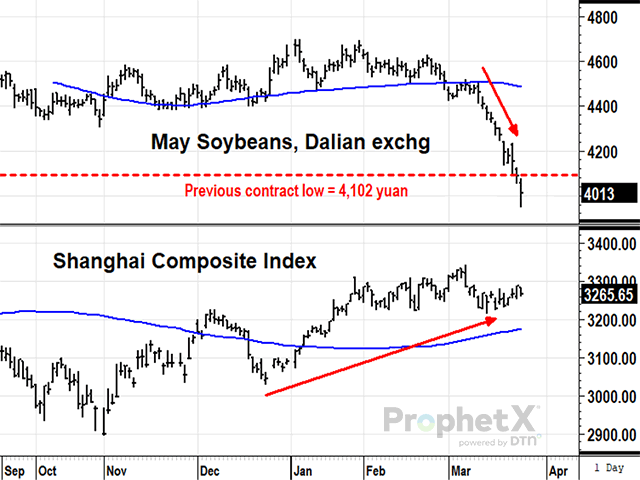

Quickly, the bullish arguments for soybean prices shrank. May soybean prices on the Dalian exchange that had been sitting near a new two-month low in early March proceeded to post 11 consecutive lower closes, ending March 24 at its lowest spot close in over a year, the U.S. equivalent of $15.90 per bushel. The sudden drop in China's soy prices remains a bit of a mystery, but likely resulted from a combination of new supplies from Brazil and concerns about African swine fever spreading in northern China, threatening this year's pork production. It is ironic that China's soybean demand held firm through all the negative press about COVID-19 and has now collapsed at a time when China's economy is picking up and the stock market is trending higher.

News of the seriousness of three U.S. bank failures hit markets Monday, March 13, and added to traders' fears. Both soybeans and meal futures had large contingents of specs net long in both contracts that soon would be looking for an exit door. May meal prices that hit a peak of $498 on March 7 hit a new one-month low on March 20 and ended March 23 at $438.30, the lowest close in 2023.

Even soybean oil, the bullish darling of the investment boom in renewable diesel production, could not withstand the sudden bearish derecho of trader selling. After trying to hold support near 55 cents in mid-March, May soybean oil fell 2.47 cents Thursday (March 23) to 52.17 cents, its lowest close in over a year. Based on May futures prices, the premium of crushed soybeans over the cost of May soybeans fell from $3.31 on March 6 to $2.15 on March 23, the lowest incentive for soybean processors since July.

An unexpected collapse of demand from the world's largest buyer of soybeans, an eruption of U.S. bank failures on top of pre-existing fears of higher interest rates, and a sudden collapse of demand for soy products at a time when Argentina's crops are drought-stricken have all the makings for a Hollywood horror movie, designed to scare the popcorn out of emotional traders. I could not have written this script a month ago and it's going to take a while to untangle the knots. As usual, we'll keep looking for market clues, one day at a time.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at todd.hultman@dtn.com

Follow Todd Hultman on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.