Todd's Take

When Is the Best Time to Sell New-Crop Corn?

USDA's annual Ag Outlook Forum got the public conversation for 2023-24 started on Thursday, Feb. 23, releasing USDA's new-crop estimates for corn, soybeans and a host of other ag commodities. For corn, USDA estimated 91 million acres will be planted, producing a 15.085-billion-bushel (bb) crop, just shy of the record 15.148 bb produced in 2016. USDA's 181.5 bushel per acre (bpa) yield assumes normal weather in the growing season.

If all goes as planned -- and that is a big "if" this early in the season -- 2023-24 will end with 1.887 bb of U.S. ending corn stocks, a 620 million bushel (mb) increase from the current season and 13% of USDA's estimated annual use. With the larger supplies, USDA expects the average farm price to drop from $6.70 per bushel in 2022-23 to $5.60 per bushel in 2023-24.

With help from DTN's weather team and Meteorologist John Baranick, I have a slightly different view of new-crop estimates than USDA that I'll be sharing in DTN's Ag Summit presentation on Tuesday, Feb. 28. Until then, we can say that Thursday's corn estimates from USDA largely confirmed suspicions that 2023-24 could very well be a year of higher supplies and lower prices in the fall, a scenario that begs the question: when should a person make forward sales?

To help answer that question, I looked at previous years when the corn market transitioned from a tighter supply situation to a more plentiful situation, and I found 10 examples over the past 30 years. Four of the 10 examples peaked around early March, suggesting now is a good time to sell. The other six peaks were scattered from early April to early July. Clearly, the context of each year is different, but by and large, selling before May tended to be better than waiting longer.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

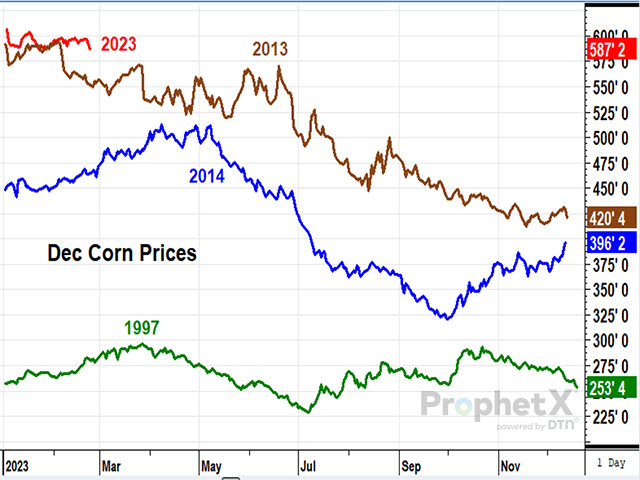

Getting even more selective, I looked closer for an analog year to compare to and came up with three examples when corn ending stocks increased by 40% to 50% from one season to the next, similar to USDA's estimate of a 49% increase in 2023-24. The 2013-14 season intrigued me the most as it followed the famous drought crop of 2012. In that year, December corn prices actually peaked in early February, but chopped roughly sideways until late June when prices finally let go and slid lower to harvest.

The following season of 2014-15 was also interesting as prices held firm until early May, offering very good hedge opportunities before descending to harvest lows. The earliest analog year was 1997-98 and it may offer the most important lesson. December corn prices held firm and even moved higher the first three months of 1997 before falling to new lows by early July. From there, prices rallied back to near their previous high by October, an unexpected move for a season when ending corn stocks increased by 48%. The lesson of 1997 still applies to 2023 -- prices don't always behave accordingly.

One of the catches this year is that Brazil is quickly becoming a bigger exporter in the corn market and, according to USDA's latest estimates, will be the world's largest corn exporter in 2022-23 for the first time, taking the long-held title away from the United States. Brazil's large safrinha corn crop is roughly 40% planted, about a week slower than its normal pace, and may be susceptible to drier weather over the next few months, depending on when the rainy season ends. Brazil's weather will have a big say in where December corn prices go from here.

From what we know and expect, there is good reason to consider making forward sales of corn in 2023. After USDA's estimates, December corn fell 6 1/2 cents to $5.85 1/2 Thursday, still a favorable price for most producers. The gamble of whether to wait or not largely depends on Brazil's weather, a tough call to make for a crop just going in the ground.

**

Come hear what DTN Meteorologist John Baranick and DTN Lead Analyst Todd Hultman have to say about the year ahead for weather and markets, including comments about diesel prices from DTN Energy Analyst Brian Milne. Sign up now for the virtual DTN Ag Summit on Tuesday, Feb. 28, at https://dtn.link/…. Recorded links will be provided for later viewing if you can't make the live broadcast.

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at todd.hultman@dtn.com

Follow Todd Hultman on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.