Call the Market

The US Cowherd Now Has the Fewest Beef Cows Ever

By now, there's a strong chance that you've already heard about Tuesday's Cattle Inventory report, as its findings stunned the market, but today we're going to do a deep dive in the report and how it could potentially affect the market in the months and years to come.

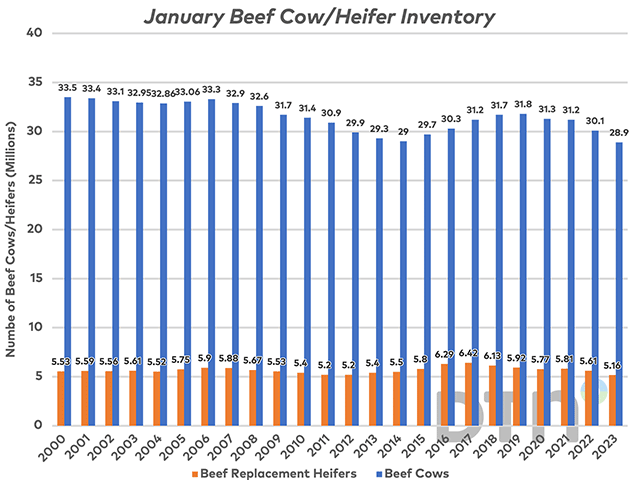

For those who haven't had the time to study the report, its big headline was that the total number of beef cows in the United States totaled 28.9 million head. Leading up to the report, everyone knew that there would be significantly fewer beef cows in the market than the January 2022 report and years past, but believing that there would actually be fewer beef cows in the market than in 2014 was a step that some weren't prepared to take.

What Tuesday's report clarified is that, not only do we have fewer beef cows in the industry than compared to years past, but we also have the fewest beef cows ever recorded (heavy emphasis on "ever recorded"). That's a staggering reality to stomach and a factor that should send the cattle market soaring.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The 10 states with the most beef cows are: Texas, Oklahoma, Missouri, Nebraska, South Dakota, Kansas, Montana, Kentucky, North Dakota and Florida. Only one of those states –- Missouri -- had the same number of beef cows as a year ago, and the other states saw decreases in their beef cow herds anywhere from 1% to 7%.

The sobering reality that we possess the fewest number of beef cows ever recorded has huge ramifications on the market in the near term and for the long term.

For the near term, this could push the market to test levels it otherwise wouldn't have felt confident enough to test. The thing about the market is we know previous highs and lows are only relative to time. Given a new cycle and a new market environment, new lows and new highs are never too far out of reach.

Less supplies amid strong demand beckons for higher prices. Whether it be for fat cattle or feeder cattle, the realization that we sit with dramatically fewer beef cows in the U.S. will have a ripple effect across the markets. Whether it's packers buying fat cattle, feedlots procuring more feeders or cattlemen buying up replacement females after destocking, the competition amongst buyers is going to drive prices higher in all sectors of the market -- for females, feeders and fats.

For the long term, it's highly likely that this will propel the cattle market into a strong bullish run for the next two to potentially three years, but from there I'm cautious. High prices and good times in the cattle market makes everyone want to be a cowman, but I'm not convinced that the build back after this cycle will be as fast or as aggressive as it was after 2014. Whether because interest rates are higher, that grass is harder to come by, the unsettled nature of our world or inflation -- building back this time will no doubt be different than it was in 2014.

Also see "Turning the Cattle Market Loose": https://www.dtnpf.com/…

ShayLe Stewart can be reached at ShayLe.Stewart@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.