Todd's Take

Corn Prices Turn South to Start 2023

On New Year's Day, Kristalina Georgieva, the managing director of the International Monetary Fund (IMF), said in an interview with CBS News that she expects one-third of the global economy to enter recession in 2023, including half of the European Union. She cited familiar factors such as the war in Ukraine, rapidly rising COVID infections in China and rising interest rates as the main factors likely to make 2023 a tougher year than what we've seen so far. (https://www.cbsnews.com/…)

Ms. Georgieva's comments were no surprise to anyone paying attention to the news the past year, but they did seem to galvanize the fears of many at the start of 2023. On Tuesday, Jan. 3, nearly the entire commodity board was red at the close, including an 8-cent drop in March corn and a 31 3/4-cent drop in March soybeans. As of Thursday's close, losses for the week had grown to 25 3/4 cents for March corn and 53 1/4 cents for March soybeans.

Throughout December, corn's national basis stayed strong at 12 cents over the March contract and helped take DTN's national index of cash corn prices to a new one-month high of $6.95 on Dec. 28. As of Thursday evening, Jan. 5, the index had fallen 34 cents from the peak to $6.61, and the basis weakened to just 9 cents over the March contract, a sign that farmer selling has likely been part of this week's selling mix.

Had this week's selling been largely based on outside market worries about the possibilities of recession, the way it unfolded this summer, I would be more confident about the resiliency of corn prices to bounce back. However, the steady erosion of demand since early November is concerning. Not only do corn export commitments remain in a deep hole, down 47% from a year ago at this time, but FOB corn prices for January also continue to favor more export business going to Brazil. There is a good chance USDA will lower its corn export estimate in the Jan. 12 WASDE report.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Demand for ethanol is corn's other bearish concern in early 2022-23 and is a bit of a puzzle. As of Dec. 30, the pace of ethanol production is holding steady from a year ago, but gasoline demand since Sept. 1 is down 7% from a year ago. Thursday's report from the Department of Energy (DOE) also showed last week's ethanol production fell to 844,000 barrels per day, the lowest performance since a week in February 2021 that was similarly affected by a polar vortex. Overall, demand prospects seem bearish, and the price of Chicago ethanol remains near its lowest level in 10 months, ending Thursday at $2.295 a gallon.

The curious thing about ethanol is U.S. gasoline supplies are down 4% from a year ago and are at their lowest level in 14 years for this time of year. U.S. crude oil supplies are available to produce more gasoline, but only because the White House released 221 million barrels of oil from the Strategic Petroleum Reserve in 2022. Despite ethanol's seasonal sluggishness, it is quite possible more ethanol will be needed to extend gasoline supplies in 2023.

I'll admit up front, it is too early to be confident about weather forecasts for the U.S. growing season in 2023. As DTN Ag Meteorologist John Baranick explained at DTN's Ag Summit in December, the early expectation for the summer of 2023 is that, without La Nina, the Corn Belt is apt to see a more normal summer in terms of both temperatures and precipitation. I suspect similar forecasts are giving the market early optimism for U.S. corn yields in 2023, but there is no hurry to price the 2023 crop yet. Brazil's safrinha corn crop has yet to be planted, and with somewhat dry conditions in southern Brazil and drought concerns in Argentina, there is still much to consider in early 2023.

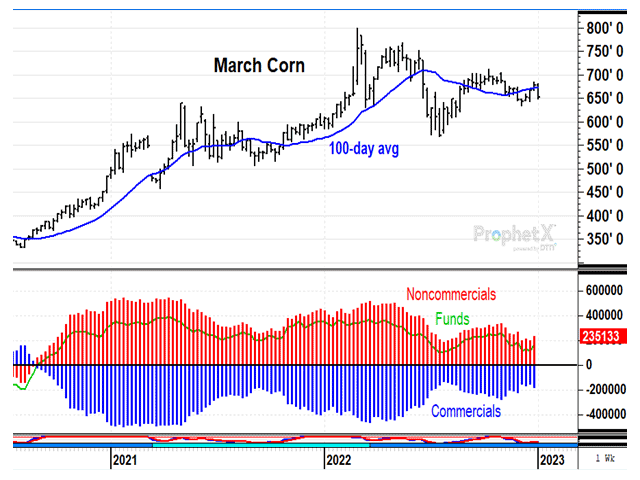

From a practical perspective, this week's sell-off in corn rejected a late-December bid to trade above the 100-day average and left behind a lower high. With specs last seen holding 235,133 contracts of corn net long, many worried about the economic climate and specific concerns about corn demand not going away, corn prices are facing an unexpected bearish start in 2023. The past two years, producers have been rewarded for closing their eyes and hanging on until May. I make no guarantees, but I don't think that will be a good plan for corn this year.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.