Kub's Den

2022: The Most Momentous Year of Markets Doing Not Much

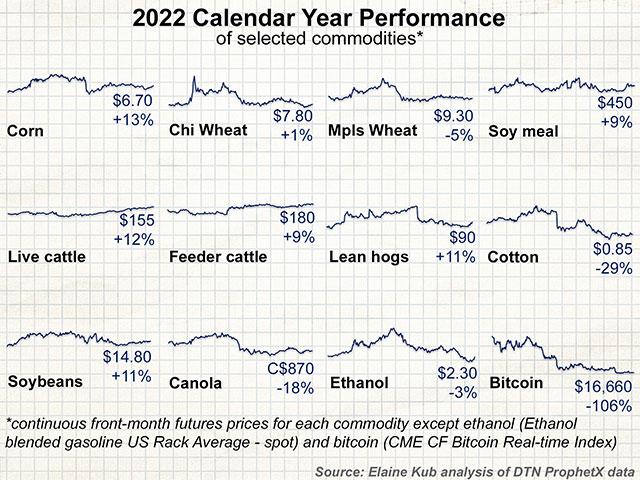

On any given Friday, we might see an agricultural commodity price collapse by double digits -- enough to make a producer despair that an overwhelmingly bearish mood has taken over the market. And yet, a look at the overall performance for that full week might still show a gain. Short-term fluctuations and flailing can disguise the bigger picture and the more important long-term movement. This same phenomenon can occur over an even longer period -- say a full calendar year, when a grain market might move down a dollar, then up $3.50, then ultimately end up 12 months later almost exactly where it began.

Consider the extreme situation for wheat prices in 2022: Chicago futures were $7.70 per bushel on Dec. 31, 2021, then $11.60 per bushel in mid-March when Black Sea supplies were thrown into question by the Russian war in Ukraine, and they're now right back to $7.74 at the time of this writing in the last week of the year. If all you ever did was look at one performance number describing the annual gain or loss, you would think not much happened at all in 2022.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Simple annual performance numbers also fail to convey the frisson of exhilaration experienced each time an agricultural producer looked at the markets during 2022 and saw corn above $6 per bushel or live cattle above $140 per hundredweight. The prices themselves are exciting, even if they haven't really moved very much. The live cattle chart, in particular, has been on one long, rather boring, steady climb higher and higher without a lot of up-and-down drama. Going from $139 for the December 2021 contract to $157 for the December 2022 live cattle contract today, this "boring" market has gained 12% over the calendar year. On one hand, a 12% gain isn't an overwhelmingly huge financial performance by some standards, but on the other hand -- live cattle futures are now worth $157! Feeder cattle futures are now worth over $180! These are wild times in the cattle market, with prices higher than anything we've seen since 2014, and even if the chart doesn't look too exciting over the past year, market participants feel the high stakes historical moment every time they see a chart or hear a market report.

Overall, most commodity price charts covering the 2022 calendar year look more boring than they felt during the actual experience of trading them. Most of the exciting bits happened in the middle of the year and were ultimately counteracted or erased by later corrections. Perhaps the biggest reason why they look more boring than they felt during 2022, however, is that some significant portion of the movement that brought prices to their present lofty levels already took place during 2021. We started 2022 with corn at $5.93 per bushel, soybean meal at $411 per ton, and ethanol at $2.36 per gallon. Even if big movements didn't last long through the calendar year, simply by staying near these price levels, the agricultural commodity markets have sustained an exciting narrative.

What will happen when the calendar flips over to 2023? So many of the bullish influences that brought these markets to these high levels -- war, inflation, drought, scarcity -- remain as true today as they were at any point during the calendar year 2022. But as this past year's day-to-day and week-to-week volatility has demonstrated, big markets are sometimes capable of big moves.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Elaine Kub, CFA is the author of "Mastering the Grain Markets: How Profits Are Really Made" and can be reached at masteringthegrainmarkets@gmail.com or on Twitter @elainekub.

(c) Copyright 2022 DTN, LLC. All rights reserved.