Todd's Take

No Basis to Be Bearish for Corn, Soybean Prices

When I speak about markets at farm shows or other engagements, I try to explain up front that markets are human, and humans are emotional, fearful creatures. We come in all shapes and sizes; and when it comes to markets, some are more knowledgeable than others.

I say that because many seem to believe there is some kind of magic intelligence behind market prices, but I disagree. As I see it, futures prices are a mix of many influences, some ill-informed and some well-informed. It is important to know which is which.

Many in the market -- typically the noncommercial crowd -- buy and sell futures contracts without knowing much about markets other than what they read in the news and see prices doing. This summer's sell-off in corn and soybeans were good examples of why we should stay skeptical of what prices sometimes do.

The more knowledgeable group, in my view, are the commercial firms that make a living in the grain trade. Bunge has been in the grain business since 1818, Cargill dates back to 1865 and Archer Daniels Midland is the rookie of the group, starting in 1902. These firms aren't perfect, but they know more about actual supply and demand than most. You won't find any managed futures funds or other spec accounts as experienced as these firms.

I'll admit, looking at commercial positions in CFTC's weekly Commitments of Traders report can be confusing. Just because commercials are net short doesn't necessarily mean they're bearish. They're often just hedging cash positions. However, show me a commodity with a cheap price and commercials turning net long, and I'll show you a good buying opportunity.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

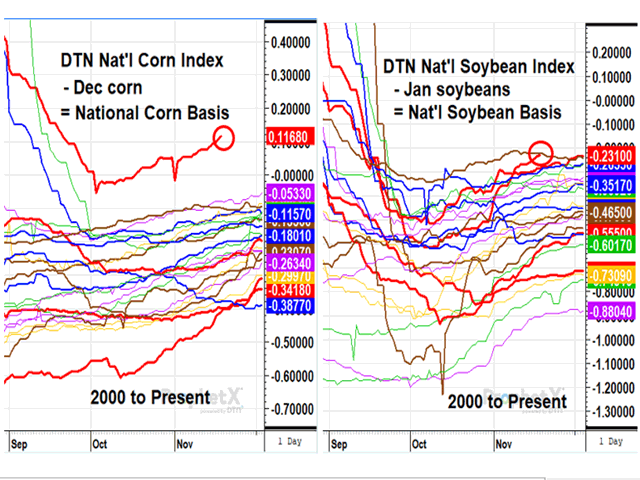

The more important market information commercials provide are the cash bids that determine basis. Many understand basis to be your local cash corn price minus the active futures price in Chicago. To calculate the national corn basis, I use DTN's national index of cash corn prices minus the active futures contract. The national corn basis on Friday evening, Nov. 18, was 12 cents above the December futures, figured as $6.79 and a fraction minus the December corn price of $6.67 and a fraction.

Why put so much importance on national basis? In short, because it is the most practical expression of action in the markets, coming from the segment of the market that knows actual supplies and demand best. Talk and market opinions are cheap and often unreliable. Actual cash bids around the country by companies that have years of experience in the grain trade are genuine insights to current market conditions.

Specs, or noncommercials, as CFTC calls them, have a history of loading up positions at the wrong time and zigging when they should have zagged. Specs aren't always wrong, but in general, they are the less-informed market segment and tend to distort prices. Specs are the reason we shouldn't trust all futures price moves. Cash bids from commercials, relative to futures prices, are the more reliable clue. When cash bids are high, relative to the board, demand for the crop is active and supplies are difficult to obtain.

DTN's current national basis for corn of 12 cents over the December contract is the strongest we have seen for this time of year in at least 20 years. While specs look at the news and are afraid of higher interest rates, slow export sales and barge restrictions on the Mississippi River, the more knowledgeable segment of the market is raising cash bids, indicating a need for more corn.

Similarly, specs in soybeans are holding close to their smallest net-long positions -- worried about the economy, COVID-19 in China, a new crop in Brazil and falling crude oil prices. Cash soybean bids, however, are near their highest prices relative to the futures board in 20 years and harvest is nearly over. The argument isn't close in my book. Commercial bids carry more weight than spec opinions.

As I mentioned earlier, no market clue is perfect as surprises happen and conditions can change, but national bases are about as good as market clues get. Looking at the past 22 years of corn prices and picking out the nine years with the strongest national bases in November, six of the nine were higher by the end of May with an average gain of 97 cents. Three of the nine years ended lower in May with an average loss of 42 cents each.

The American writer, Alfred Damon Runyon, once said, "The race is not always to the swift, nor the battle to the strong, but that's the way to bet." In this case, because commercial bids are bullish, I continue to suspect higher prices of corn and soybeans ahead.

**

This year's DTN Ag Summit will be held virtually on December 12 and 13, but you need to register. You can watch this premiere ag event in the comfort of your favorite chair, at a time convenient for you. Check out the topics and speaking lineups at www.dtn.com/agsummit . We'd love to have you join us!

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com.

Follow him on Twitter @ToddHultman1

(c) Copyright 2022 DTN, LLC. All rights reserved.