Todd's Take

How Bearish Will Brazil's Next Soybean Crop Be?

With this fall's U.S. soybean harvest set to wrap up in November, many are already facing the perennial sell or store question for soybeans, and the answer is not so clear. DTN's national cash average of soybean prices settled near $13.40 per bushel Thursday, Oct. 27, a tempting level as it's the highest price for this time of year since 2012.

The October average for November soybeans is running near $13.79 per bushel, which is just 4% below the $14.33 February average, two prices used for crop insurance purposes. That high of an October price would normally mean no payment for revenue coverage, but for many that suffered either hail or lower yields from summer and fall drought, some revenue protection may be available.

As some saw 30-bushel yields or less and some saw 70-bushel yields, it is difficult to give a one-size-fits-all recommendation for producers, but in general, if cash is not needed early, there is good reason to spread out soybean sales from January through June in 2023. Current futures prices peak in the July contract, indicating expectations for a normal seasonal tendency.

Looking ahead, there is no doubt soybeans have lost favor with the speculative crowd since June. Higher interest rates have been talked about for a long time and November soybean prices started falling back from their summer high in late June, about the time Federal Reserve Chairman Jerome Powell started warning about the possibility of recession. Having specs out of the market is not all bad, however, as that selling ammunition has been spent.

Four months later, the economy is doing pretty well, considering the prognosis. New jobs are still being added, and on Thursday, Oct. 27, the U.S. Commerce Department said real GDP was up 1.8% in the third quarter from a year ago. Interest rates aren't done going up and the economy will likely slow moving forward, but the meat we're buying at the stores still requires livestock to be fed soybean meal. Also, the diesel running combines and trucks this fall is depending on growing amounts of soybean oil to keep supplies available.

Earlier this week, Archer Daniels Midland (ADM) posted its best third quarter on record, earning $1.03 billion. Operating profits in the ag services and oilseeds segment were up 74% in the third quarter from a year ago. As the company explained, margins were driven by resilient global demand for both meal and oil, historically profitable conditions that DTN has written about frequently in daily market comments.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The bullish news for soybean prices is that those generous processing margins aren't expected to go away anytime soon. Based on January futures prices, the value of crushed soybeans was $3.76 above the cost of uncrushed soybeans on Thursday's close, Oct. 27. That is among the highest premiums on record for January contracts.

USDA's weekly crush margins report for the cash market indicate even more profits, showing a $6.04 margin in Illinois as of Oct. 21. USDA finds extra margin in cash prices of products that are higher than their corresponding futures quotes and also includes the value of soybean hulls. There is not a comparable time in history when demand has been this strong for both soybean meal and bean oil, relative to the cost of soybeans.

The export side of soybean demand is more difficult to assess. Of course, it does not help that U.S. soybean shipments are down 8% early in 2022-23 from a year ago and barge traffic has been restricted on the Mississippi River due to low water levels. Here at harvest, this is the active time of year to move soybeans and take advantage of Brazil's lower supplies before the next harvest arrives in February.

It also doesn't help soybean prices that Brazil is expanding plantings again and early conditions have been favorable. However, there is plenty of season ahead and on Thursday, DTN Ag Meteorologist John Baranick described challenges of colder weather and drier conditions on the way to southern Brazil and Argentina in November (see https://www.dtnpf.com/…).

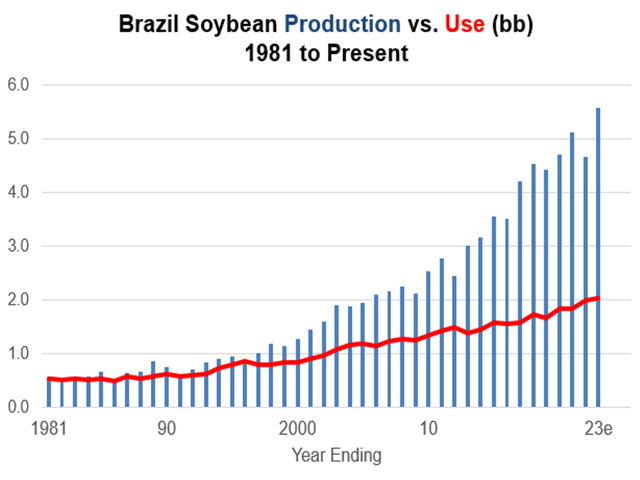

USDA's early estimates expect a record Brazilian soybean crop of 5.58 billion bushels (bb) or 152.0 million metric tons (mmt). Exports are estimated at 3.29 bb or 89.5 mmt, the second largest total for Brazil on record.

According to USDA, Brazil exported 3.39 bb, or 92.1 mmt, of soybeans in 2019-20, starting about the time the U.S. signed the phase-one agreement with China. July soybean prices dropped roughly $1.25 in the first four months of 2020, but that was largely due to the global pandemic. It is difficult to know how much prices suffered from Brazil's record exports. We do know Brazil's big export totals in early 2020 did not prevent the U.S. from achieving its own record of 2.266 bb of soybean exports in 2020-21. China's appetite is the wildcard that is difficult to predict.

Speaking of China, the economy has suffered numerous COVID-19 lockdowns this year, but there is still no sign of slower demand for soybeans. November soybeans on China's Dalian exchange are trading near their contract highs at the U.S. equivalent of $20.83 per bushel. USDA estimates China's soybean production will fall short of demand by 3.61 bb in 2022-23. Brazil is China's first choice for soybeans, but Brazil can't supply all of China's needs.

As usual, I can't guarantee how Brazil's crop will turn out or where prices will trade next year. Given the impressive strength of crush demand in the U.S., there is good reason to believe that, even with a large Brazilian crop, demand for U.S. soybeans will remain active enough in early 2023 to keep U.S. soybean supplies on an increasingly tight path toward summer. From my view, U.S. soybeans are currently undervalued, at least until January. After that, stay tuned to see how this potentially bullish situation unfolds in 2023.

This year's DTN Ag Summit will be held virtually on December 12 and 13, meaning you can watch this premiere ag event in the comfort of your favorite chair, at a time that is convenient for you. Check out the topics and speaking lineups at www.dtn.com/agsummit. We'd love to have you join us!

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on Twitter @ToddHultman1

(c) Copyright 2022 DTN, LLC. All rights reserved.