Kub's Den

Soy-to-Corn Price Ratio on the Move Again

Most North American row-crop producers only need to think about the soybean-to-corn price ratio maybe once or twice per year, when they're buying seed or planning which fields to plant to which more profitable crop.

The rest of the industry -- the feeders of beef cattle, dairy cattle, hogs, poultry and fish; the processors who sell either ethanol and its byproducts or soybean oil and soybean meal; even South American farmers who plant multiple crops per year -- keeps an eye on this price relationship much more frequently. Maybe they're not frantically checking it daily, because nobody is likely to recalibrate their animals' diets daily, but certainly the price ratio itself is stochastic, a moving target that wobbles and shifts continuously through any trading session.

From an end-user perspective, it's not the "plant corn or plant soybeans" question that's most interesting -- instead, it's the "feed DDGS or feed soybean meal" question, alongside every other energy- and protein-providing feed alternative that's available: wheat, barley, milo, cottonseed meal, factory-reject Oreo cookies, sunflower meal from Ukraine, etc.

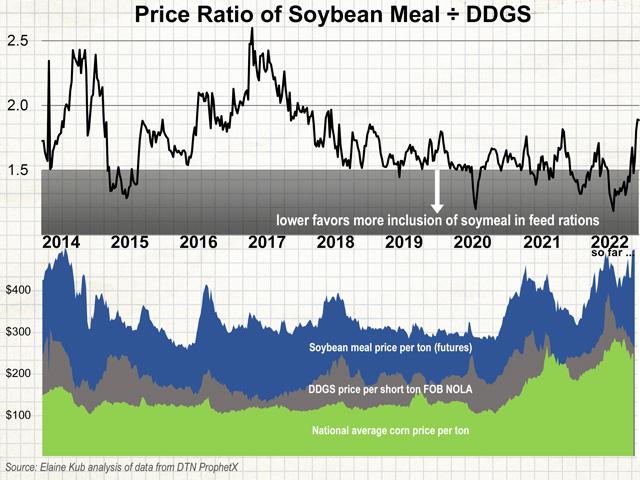

Starting around March 2022 until late June, although the value of soybean meal kept rising alongside the value of every other feedstuff, in relative terms, it wasn't rising "as fast" as the feed grains. The price ratio of soybean meal-to-DDGS slipped to less than 1.5-to-1 (i.e., the price spread for DDGS was 67% of the price of soybean meal, with DDGS at $313 per ton in the same week while soybean meal was $469 per ton). This is a crucial benchmark for these two feed ingredients. Although everyone's feed rations will calculate differently, depending on each sample's protein and energy contents, and especially depending on whether you can get local wet distillers grains much cheaper than the DDGS values used here (priced for export at New Orleans), it's still a good rule of thumb. If either distillers grains start being priced too hot or soybean meal suddenly goes on sale, there is some price ratio at which an animal feeding operation will start to save more money by substituting more of one for the other.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Playing around with the K-State DDGS calculator (available here: https://www.asi.k-state.edu/…) and keeping all other inputs equal and roughly realistic with today's prices, that's the level at which more soybean meal inclusion, compared to using more DDGS, started to save more money when growing pigs. DDGS are typically favored for being cheaper per ton and highly palatable to the animals. If DDGS are $264 per ton (as they are today at the export market), then let's say it's not until soybean meal falls below $400 per ton (1.5 times the value of DDGS) that the economics would motivate the livestock feeder to substitute in more than their usual amount of soybean meal.

However, soybean meal is no longer $400 per ton, it's $500 per ton. The brief moment of market weirdness seems to have passed for now.

Was the burp on the chart due to an unusually bullish feed grains environment (DDGS overpriced compared to soybean meal), or was it due to an unusually relaxed oilseeds price environment (soybean meal underpriced compared to DDGS)? I'd say maybe a little of both, although it's hard to characterize $17 soybeans as a "relaxed" price environment.

These days, it seems like any market movement can be explained by either weather or war. In the case of the soy-to-corn price ratio (and also the soybean meal-to-DDGS price ratio), it's probably both. Following USDA's March Prospective Plantings report, which surprised the market with a record-high intention of 91 million acres of soybeans, and a late, wet spring planting season that forced farmers to follow through with 88.3 million acres of soybeans planted, there was already some bias toward shading soybean values. On top of that, there's the whole "Russian invasion of Ukraine" thing, which continues to throw into question how much cereal grain will be able to reach the global market.

Today, feed grains are tentatively moving out of Ukraine's ports, and the panic in global feed grains prices has been allowed to subside ... at least for now. This alone could explain why the soy-to-corn price ratio has, since mid-July, suddenly surged back into its old "normal" range. Usually, we expect to see soybeans-to-corn at around 2.5-to-1, and today September soybean futures at $14.64 and September corn futures at $6.08 (2.41-to-1) are well within one standard deviation of the historical mean.

Another market force may also be at work: Finally, it may be the more value-added pieces of the supply chain that are starting to get the attention as global traders source their needs for the coming seasons. Last Wednesday, a huge daily export sales report showed 135,000 metric tons of soybean cake and meal for delivery to Poland during the 2022-23 marketing year. Poland isn't typically one of our top-five soybean meal buyers -- Philippines, Mexico, Canada, Colombia, Ecuador -- and even the entire European Union only bought about 500,000 metric tons of soybean meal from the United States last year. So, while I don't know the full story behind that single-day sale, it does make a person wonder about the availability of the processed feed ingredients that are more commonly in use from the Black Sea region and Europe, like sunflower meal and canola (rapeseed) meal -- commodities that still aren't on those corn ships headed out of Ukraine yet.

Someone somewhere will always value the protein and energy contained in a ton of soybean meal, distillers grain or dry rolled corn. The question is, which of these commodities may be hogging all the limelight (overpriced) or waiting in the wings (underpriced) to get their own big headlines?

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Elaine Kub, CFA is the author of "Mastering the Grain Markets: How Profits Are Really Made" and can be reached at masteringthegrainmarkets@gmail.com or on Twitter @elainekub.

(c) Copyright 2022 DTN, LLC. All rights reserved.