Kub's Den

Swift Soybean Disappearance: How Long Can It Last?

Back in the fall, there were 4.66 billion bushels (bb) of soybeans in this country: 525 million bushels (mb) left over from the previous year and 4.135 bb of newly grown beans. There was no single moment in time when all the new beans were harvested out of the fields before some of the rest were being gobbled up by processing plants, but if there had been such a moment in time, those 4.66 bb would have been enough to fill the volume of 64 NFL stadiums up to the brim (or to fill all 31 actual stadiums twice -- and then some).

Now (as of Dec. 1, 2020), there were only 2.93 bb of soybeans. Twenty-four stadiums' worth of soybeans have disappeared. Where did they all go?

They went through processing facilities, then down the gullets of the nation's 230 million turkeys, 390 million egg-laying hens and approximately 800 million broilers being fed to maturity on any given day. Or the meal went down some of the throats of our 9.38 million milk cows or 77.5 million hogs (no longer a record-large swine herd, but still within 1% of the record high). Or the whole, unprocessed soybeans left the country on trains bound for Mexico or on massive ships bound for China, Egypt, and elsewhere in Asia and South America.

USDA now expects soybean exports for the 2020-21 marketing year to total 2.230 bb, but 2.019 bb of that quantity have already been spoken for via export sales contracts. Actual, physical movement of the soybeans has also been impressive -- the volume of U.S. grain inspected for export has exceeded the 3-year average pace every week since the end of August. China has already shipped 83% of its soybean purchases.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

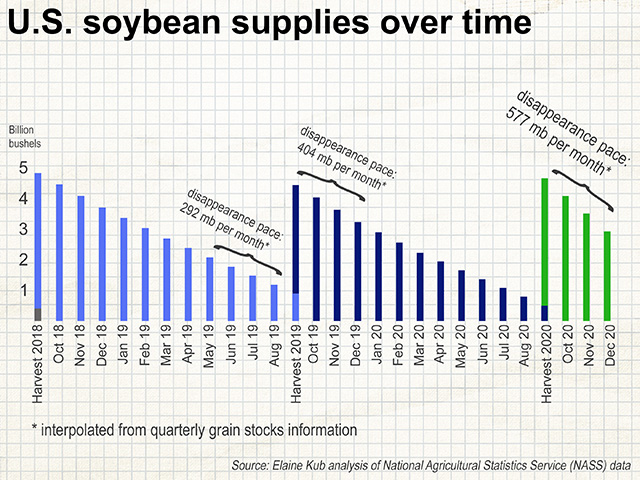

This should make us wonder how much of the bullishness can be sustained in the coming weeks and months. Soybean disappearance tends to happen according to a recognizable seasonal pattern, with fall disappearance typically faster than winter disappearance, which is typically faster than spring disappearance, which is typically faster than summer disappearance, which tends to be the slowest season. So, in the fall of 2018, for instance, the U.S. soybean supply went from 4.9 bb at its peak down to 3.7 bb on Dec. 1, implying that 375 mb per month were getting used up one way or another. That following winter, the monthly disappearance pace dropped slightly to 340 mb, followed by 310 mb in the spring, and a low of 292 mb in the summer from June 1 to Sept. 1, 2019.

During the last marketing year (the 2019-20 crop), a similar pattern was noted, with soybean disappearance at its fastest during the fall -- 404 mb used up per month -- then dropping to 333 mb per winter month, then 287 mb per spring month (during the COVID-19 recession) and 289 mb per summer month.

So, this marketing year has had a rollicking start with soybean disappearance at a very swift pace -- 577 mb per fall month -- going from 4.66 bb of total supply down to 2.93 bb on the Dec, 1 Quarterly Grain Stocks report. From history, however, we know this pace can't last.

Of course, there isn't a pattern of fewer dairy cows in January than there are in November, or fewer egg-layers in July than in October. So, the seasonal changes in soybean disappearance aren't driven by the livestock feeding and domestic processing part of the market. Instead, it's the traditional export shipping season that drives the pace. This tends to be fastest in the fall when the newly harvested U.S. soybeans are demanded by the world and slower in the spring and summer when the newly harvested South American soybeans compete for global business.

Lately, Brazil has effectively run out of soybeans and Argentina's wheat shippers have been stymied by port strikes. An end to the strike has now been negotiated and a fresh 2021 South American soybean harvest is within sight, with the very first few fields already harvested in Brazil and the bulk of them likely to be ready in mid-February.

Therefore, the real question for the soybean market is the availability of those South American soybeans -- the size of the crop and the timing of its arrival at export facilities. A huge, cheap serving of South American soybeans available on the global market next month would pretty much close the door on $14 soybeans leaving the U.S. Gulf of Mexico.

As it happens, however, the South American crop may not be huge, may not be cheap, and may not be quickly available next month. In the latest World Agricultural Supply and Demand Estimates (WASDE) released Jan. 12, USDA left its projection for Brazil's 2021 soybean supply unchanged at 133 million metric tons (mmt), but private estimators in Brazil who have noted the effects of spotty precipitation through the growing season have been quicker to drop their projections as low as 127 mmt. Meanwhile, even the notoriously conservative USDA has noted the less-than-ideal growing conditions in Argentina and dropped its projection for that country's 2021 soybean production from 50 mmt to only 48 mmt in the latest WASDE report. The USDA's estimate for world ending stocks of soybeans in the 2020-21 marketing year dropped to 84.31 mmt, but analysts polled ahead of the WASDE report were expecting to see a more bullish cut than that.

At this point, the rain forecast for Brazil and Argentina's soybean-growing regions remains "scattered," and for some of the fields already drying down, it's probably too late anyway. There are fewer mature fields than usual at this time of year after the dry weather delayed the seed getting into the ground by a couple of weeks. Therefore, availability of serious volumes at the ports is also likely to be delayed by a couple of weeks, deeper into the last half of February.

Elaine Kub is the author of "Mastering the Grain Markets: How Profits Are Really Made" and can be reached at masteringthegrainmarkets@gmail.com or on Twitter @elainekub.

(c) Copyright 2021 DTN, LLC. All rights reserved.