Landwatch

June 2020 Recent Farmland Sales

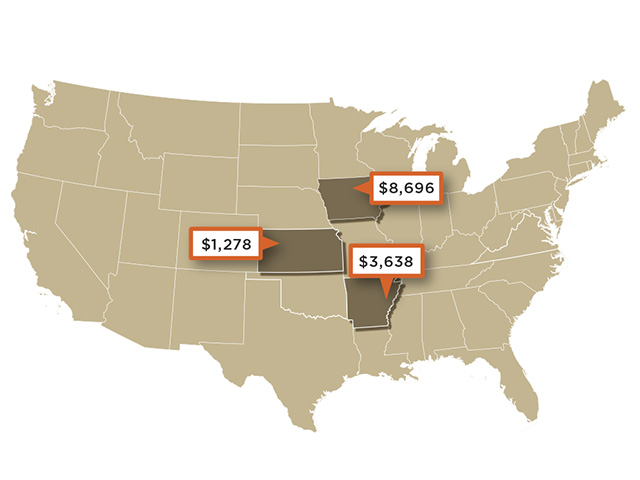

ARKANSAS, Cross County. A 180-acre farm with 151 tillable acres sold for $654,840, or $3,638 per acre. The majority of the property was precision-leveled, and all of the land was irrigated. Soil types were mixed, as is the crop history. An investor bought the property and rented it back to a local farmer. Contact: Cole Fields, BrokerSouth Ag; cole.fields@gmail.com; 318-512-5325; www.brokersouthag.com.

IOWA, Wright County. Land totaling 115 acres sold for about $1 million, or $8,696 per acre. Tillage portion of the property was 113.5 acres, with a CSR2 of 85.1. This was a leaseback sale, where investor-buyer allows previous operator to continue to farm the land. Contact: John Kirkpatrick, MWA Auctions and Real Estate; john@mwallc.com; 515-532-2878; www.murraywiseassociates.com.

KANSAS, Gove, Sheridan and Trego Counties. A 2,830-acre property with large tracts and excellent cropland sold at auction for $3.6 million, including bases in wheat, corn and grain sorghum. One-third of the 2020 wheat crop went to the buyer. Grasslands and roads made up 594 of the total acreage. The property sold in 13 tracts, with average per-acre tract prices ranging from $850 to $1,800. Average per-acre price across the entire property was $1,278. Contact: Neal Mann, Farm and Ranch Realty Inc.; info@frrmail.com; 800-247-7863; www.farmandranchrealty.com.

These sales figures are provided by the sources and may not be exact because of rounding.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

> Submit recent land sales to landwatch@dtn.com.

> Find current listings at about.dtnpf.com/landwatch.

Land Market Waits To Tally Impacts From Disruptions:

It will take time for the agricultural land market to feel the full impact of adverse economic conditions that came along with the COVID-19 pandemic. Things were off to a positive start in the first quarter; however, as some land values reports noted, the continued attractiveness of farmland was already bolstering prices.

REALTORS LAND INSTITUTE IOWA

The Iowa Chapter reported a small statewide increase in farmland values of 0.1%, based on a survey through the last quarter of 2019 and the first quarter of 2020. During that time, the state's southeast district saw the largest increase in value, at 1.8%. Factors supporting farmland values included low interest rates, a tight supply of quality farms on the market, above-average yields in many areas and MFP (Market Facilitation Program) payments. Potential negatives included trade uncertainty and low commodity prices.

SOCIETY OF PROFESSIONAL FARM MANAGERS AND RURAL APPRAISERS ILLINOIS

Farmland values in Illinois were holding stable ending the first quarter of 2020. David Klein, vice president of First Mid Ag Services, reported "little deviation from a year ago" in farmland values. While land considered "excellent" in terms of productivity was reported to show no change at an average per-acre price of $10,500, decreases ranged from 1% for good-quality land to 3% for average-quality land to 2% for fair-quality land. "Individual micromarkets of strength and weakness do exist, and this can create opportunities for sellers and buyers. You will notice variations within regions and different local markets for similar-quality land. Location continues to be an important variable," Klein says. Several trends were noted in the report: 58% of Illinois land was being sold to settle estates; 59% of buyers were farmers; more farms were being sold private treaty; net cash returns are in the 2 to 3% range, below traditional levels of 3.5 to 4%; sales of land for development are down; institutional investors were still demanding land.

NEBRASKA FARM REAL ESTATE MARKET SURVEY

Looking at year-over-year numbers, the University of Nebraska's (UNL) early survey showed a 3% increase in ag land values, taking average per-acre price statewide to $2,650. Grazing and hayland were up 2 to 5%, with major cow/calf areas up between 6 and 8%. Jim Jansen, agricultural economist with UNL, says a final report on this survey is scheduled for June release. At press time, he notes tighter margins on corn, soybeans and livestock were a concern moving into the second quarter. Even with the low cost of borrowing, he says market values could recede one to three years out based on what happens in the current economy and agricultural markets.

[PF_0620]

(c) Copyright 2020 DTN, LLC. All rights reserved.