Inside the Market

Confusion About Current Inflation

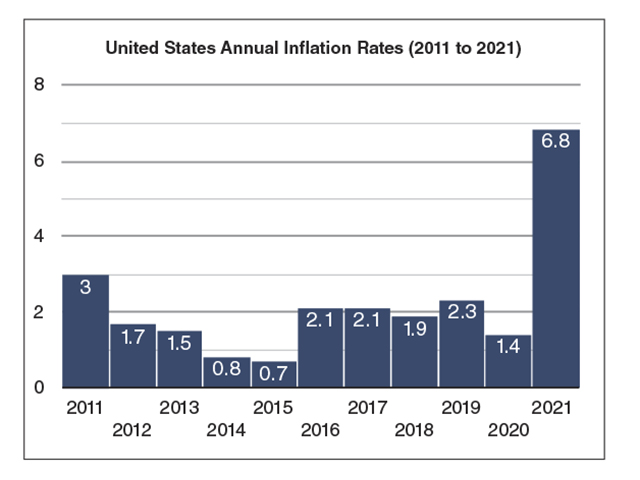

In early November, the U.S. Department of Labor reported consumer prices were up 6.2% in October from a year ago, the largest annual increase in 31 years. Concerns about rising inflation have increased in late 2021, and it's important for all of us to understand what this means for the U.S. economy.

Traditionally, the task of keeping prices stable falls at the feet of the Federal Reserve chairman, charged with pursuing the twin goals of full employment and price stability. Recently, Fed Chairman Jerome Powell took a lot of criticism for describing the inflation threat as transitory.

I'm not interested in defending the Federal Reserve chairman per se, but I would like to point out there seems to be a lot of confusion about the causes of the higher prices we are experiencing.

The worst kind of inflation no one wants to see is a widespread lack of confidence in the U.S. dollar, as the U.S. experienced in the 1970s. That fever finally broke when President Jimmy Carter installed Paul Volcker as head of the Fed, and he promptly allowed the federal funds rate to rise to 20%. Investor confidence returned to the dollar, and inflation has rarely been a significant threat since. That is, until recently, highlighted by the October report mentioned previously.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

In the October report, the largest price increases were seen in the energy sector. Gasoline prices were up 49.6%, and utility gas services increased 28.1% from a year ago.

Shortly before the pandemic hit in early 2020, the U.S. produced 13 million barrels per day of oil and 117 billion cubic feet per day of natural gas. After COVID-19 erupted, oil production promptly fell 25%, and natural gas production dropped 9%. Saudi Arabia did not help matters and actually increased production, driving world oil prices sharply lower.

Here in the U.S., there was concern about where all the excess crude oil would go. This was an extremely tough time for oil companies, and many of us remember the day in April when May crude oil fell to negative $40 per barrel. According to the Houston Chronicle, more than 100 North American oil and gas companies filed for bankruptcy in 2020.

After that much devastation, it is not easy to get production back. As I write this, U.S. oil production is 1.4 million barrels per day below its pre-COVID peak, and natural gas production is 3.0 billion cubic feet per day below its earlier peak. Economic demand has rebounded much quicker than our ability to produce and distribute goods again.

The good news is that the world's investors have not lost confidence in the U.S. dollar. The U.S. Dollar Index is currently trading near its highest prices in more than a year. Holders of 10-year T-Notes are also not panicking, as yields are less than 1.50%. Today's inflation, even though uncomfortable, is not the scary monetary problem that none of us want to see.

The real solution is not in the Federal Reserve's hands. Higher interest rates will become appropriate as the economy improves, but rate increases won't restore oil production or any other good or service entangled in this post-pandemic mess. The best hope lies in continuing to make progress in overcoming viral threats and getting back to work -- something I am confident this country can do.

**

-- Read Todd's blog at about.dtnpf.com/markets

-- You may email Todd at todd.hultman@dtn.com, or call 402-255-8489.

[PF_0122]

(c) Copyright 2022 DTN, LLC. All rights reserved.