Inside the Market

Planted Acres May Increase, But Not Surpluses

As we approach the month of March, there's a certain anticipation that comes with climbing out from under another U.S. winter. Just a year ago, things didn't look so good as new-crop corn prices were starting to crack under pressure from a spreading coronavirus.

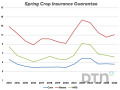

Unfortunately, coronavirus is still with us, but its bearish influence on crop prices has been replaced by bullish pressure thanks to remarkably large and unexpected purchases of corn and soybeans by China. As we approach a new planting season, December corn and November soybean prices are both trading at their highest levels for this time of year since 2014, strong incentives for producers to increase planted acres of both in 2021.

Seven years ago, December 2014 corn was priced at $4.76 1/2 a bushel, and November 2014 soybeans were at $11.71 1/2, 20 to 30 cents higher than the prices of those two contracts at the time of this writing. The soy/corn ratio of 2.46 to 1 in March 2014 was a little less than today's 2.57 to 1, but as year-to-year comparisons go, the two situations are roughly similar.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

If we look at the three-crop totals of corn, soybeans and wheat acres the past several years, 2014 stands out as the highest planting total since 1982, with 230.7 million acres. Last year's three-crop total of 218.2 million acres was suppressed by low prices and 8.9 million acres of prevented plantings. In 2021, prevented acres are apt to be lower thanks to the combination of drier fall and winter weather, and this year's higher prices.

In the new scenario, 92 million acres of corn and soybeans each look like reasonable early guesses. 45 million acres of wheat, most of which is already planted, puts the three crops at 229 million acres, near the 2014 total.

There is plenty of uncertainty in making early guesses as there is much about the new season we can't yet know. Applying light pencil and assuming a normal weather scenario, the higher plantings suggested above would only increase the U.S. corn supply a slight amount and add possibly 100 million bushels to the U.S. soybean supply.

As USDA estimates current U.S. corn and soybeans supplies at their lowest levels in seven years, higher plantings in 2021 probably won't be enough to restore corn and soybean markets to more comfortable surpluses for end users.

As usual, weather will be a key factor for 2021 prices, and the current blotches of abnormally dry conditions on the U.S. Drought Monitor represent early threats. For now, corn and soybeans are apt to maintain their higher-than-normal prices and show plenty of potential to go even higher should weather problems arise.

> Read Todd's blog at about.dtnpf.com/markets.

> You may email Todd at todd.hultman@dtn.com, or call

402-255-8489.

[PF_0321]

(c) Copyright 2021 DTN, LLC. All rights reserved.