Call the Market

Pasture and Range Conditions and Beef Cow Slaughter Trends

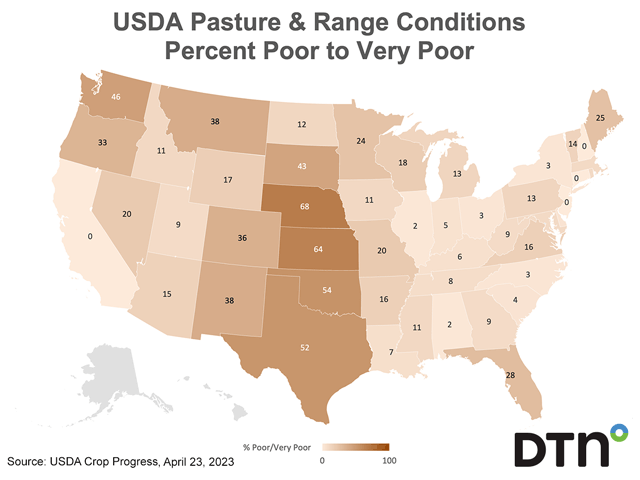

In recent weeks, we've spent a lot of time talking about market seasonality, the fat cattle market and what feeder cattle prices could do. For this week's column, I'd like to look at the data presented in the most recent USDA Crop Progress report as it pertains to pasture and range conditions, as well as look at recent trends in beef cow slaughter. Both factors will affect the live cattle and feeder cattle markets in the months ahead.

The Monday, May 8, Crop Progress report shared a grim outlook for pasture and range conditions across the United States. The National Agriculture Statistics Service (NASS) report can be accessed here to view it in its entirety: https://downloads.usda.library.cornell.edu/…. For this column, however, I elected to solely focus on the top 10 beef-producing states in the U.S.

In the chart below, I have the top 10 beef-producing states and the percentage of pasture and range land conditions that each state has for the five categories: very poor, poor, fair, good and excellent. When skimming through the chart, you'll notice a couple of undeniable realities.

First, Texas, Oklahoma, Nebraska and Kansas are all still in desperate need of moisture. It's alarming to me that not only are these states among those in the top 10 list for possessing the most beef cows, but they all are within the nation's top six states for possessing the most beef cows.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Secondly, it was powerful for me to note the percentage of states that had poor conditions and the percentage of states that had good conditions both totaled 242 marks. That means that while some states are reporting poor conditions and others are reporting good conditions, both categories could change dramatically in the weeks ahead.

Lastly, we know that there are two things vital to regrow and build back the U.S. beef cow herd: profitability and green grass. With increased interest rates, higher inputs and moisture still lacking in most states, I don't believe we will see a build-back as aggressive or as soon as the market did in 2014-15.

| State | % Very Poor | % Poor | % Fair | % Good | % Excellent |

| Texas | 26 | 26 | 22 | 21 | 5 |

| Oklahoma | 30 | 24 | 27 | 18 | 1 |

| Missouri | 2 | 18 | 38 | 39 | 3 |

| Nebraska | 25 | 43 | 30 | 2 | 0 |

| South Dakota | 5 | 38 | 43 | 13 | 1 |

| Kansas | 34 | 30 | 25 | 10 | 1 |

| Montana | 17 | 21 | 33 | 25 | 4 |

| Kentucky | 2 | 4 | 24 | 59 | 11 |

| Florida | 1 | 27 | 41 | 24 | 7 |

| North Dakota | 1 | 11 | 56 | 31 | 1 |

| Totals: | 143 | 242 | 339 | 242 | 34 |

To address the second topic of this column, we can't overlook the continued decline of the U.S. beef cow herd through aggressive beef cow slaughter. Thus far in 2023, there have been 1,067,880 head of beef cows slaughtered. Compared to 2022, beef cow slaughter has declined slightly, but the market is still processing more beef cows than compared to the industry's five-year average. As producers assess the market's outlook and pray that higher prices come to fruition, anyone who has grass or access to feed has been trying to keep more cows/heifers to capitalize on more feeder cattle sales. But while that may be the strategy for some, the pasture and range conditions listed above clearly indicate that there are plenty of producers still liquidating, as they simply don't possess the feed necessary to carry over more females.

To put the beef cow slaughter of 2023 into perspective even more, the industry's five-year weekly average beef cow slaughter was 57,865 head per week. In 2022, the market was aggressively slaughtering 74,038 head per week, and thus far in 2023, the market has on average processed 66,743 head of beef cows per week.

Again, this data tells us that the industry is processing fewer beef cows per week than what the market did in 2022. But liquidation hasn't ceased yet, as 2023's weekly average slaughter is still far more aggressive than the five-year average.

All in all, what does this mean for the market?

For starters, it's obvious that pasture and range lands still need moisture. It also leads me to believe that the cow herd build back is going to be much slower than it was the last time severe liquidation took place in 2014.

If supplies remain depleted for a longer, extended period and demand remains strong, shouldn't prices remain higher too?

Time will tell.

ShayLe Stewart can be reached at ShayLe.Stewart@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.