Call the Market

Tighter Beef Supplies Affecting Production

One of the biggest problems we face as market participants is that, to some degree, we expect the market to behave "normally" from one year to the next; but what is "normal?" Some individuals fall into the trap of believing that because X, Y and Z happened at such and such time last year, that the same can be expected for the year ahead. While some seasonality is normal in the market, we can't expect one year to trade identically to the next.

For example, because feeder cattle prices topped in August 2022, some producers could be led to believe that'll happen again this year. However, the problem with that type of logic is that you're expecting all the market's moving variables (demand, supply, interest rates, moisture/lack thereof, feed availability, fed cattle prices, slaughter speeds, exports, imports, the strength of the U.S. dollar, etc.) to all remain the same, which never happens.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

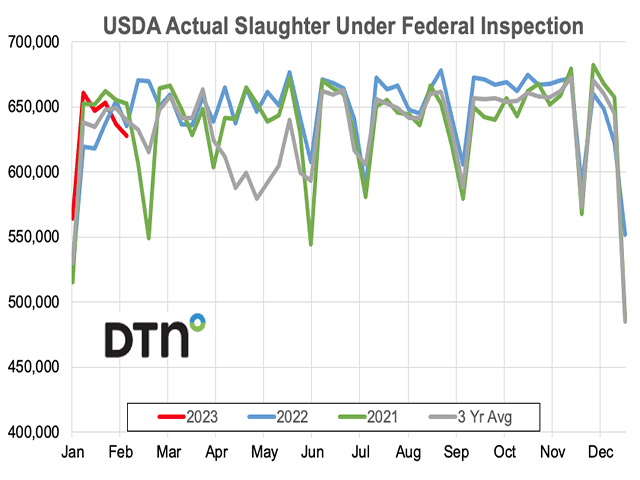

One dramatic change that's obvious thus far in 2023 is that beef production will be nothing like that of 2021 or 2022. Thus far this year the market has processed 3,790,792 head of cattle. For the first three weeks of 2023, the market surpassed expectations and processed more cattle than in 2022 or 2021, but as fed cattle supplies have diminished over the course of the last three weeks, 2023's slaughter speeds have fallen well below those of the last two years and have come close to falling below the market's five-year average.

The recent decline in processing speeds hasn't been because demand is null -- actually, quite the opposite is true. Typically, February is a month when beef demand is stagnant, but this year beef demand has been uncharacteristically strong, which is helping incentivize packers to keep speeds as elevated as they are.

The biggest reason beef slaughter speeds have regressed is supply. With the U.S. possessing the fewest beef cows in the last 51 years, there are simply less cattle in the supply chain to feed and slaughter.

This market scenario of incredibly strong beef demand amid tight supplies is helping drive fed cattle prices higher and consequently gives both cow calf producers and feedlots an opportunity to possess a larger share of the market's leverage. Consumers are who suffer the most in the supply-demand scenario, and while current prices are still far below the highs established in 2020 and 2021, keeping beef affordable for consumers is worrisome.

ShayLe Stewart can be reached at ShayLe.Stewart@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.