USDA 2022 Income Forecast

Cattle Operations Seeing Stronger Net Cash Receipts for 2022

OMAHA (DTN) -- Despite a record rise in production costs, USDA paints an overall positive boost for farmer incomes in 2022 with net farm income forecast at $160.5 billion, a 13.8% increase from 2021, based on a new Farm Income Forecast released Thursday.

USDA's Farm Income Forecast looks at broad measures of cash receipts, government payments and input costs for calendar year 2022.

Looking at farm operations, producers who specialized more in corn, soybean, cattle, and dairy operations are seeing stronger net cash receipts for 2022. Farmers who focus more on hogs, wheat, cotton, and specialty crops didn't generate enough cash receipts to ward off higher expenses and smaller government payments.

Broiler income soared more than 46% due partly to avian influenza now impacting more than 50 million chickens and turkeys that have been lost to the bird flu.

On farm household incomes, commercial farm operations that rely more heavily on the farm operation for the family income report median incomes of $194,791, down 1.2% from 2021 when adjusted for inflation.

NET CASH INCOME VERSUS NET INCOME

Net cash farm income, which factors in the value of everything farmers sold or are still selling in 2022, is projected to hit a record high of $187.9 billion, a $39.4 billion increase or 26.5% than 2021. Even adjusted for inflation, net cash farm income is expected to rise $30.1 billion compared to 2021.

Net farm income, which factors in changes to depreciation and inventories, came in at $160.5. billion, up $19.5 billion from 2021. Just two years ago, net farm income came in at just $94.4 billion.

Asked about the $27.4 billion gap between the two indicators, USDA Economic Research Service Economist Carrie Litkowski explained in a webinar Thursday that the higher net cash value stemmed from farmers selling more of their older, on-hand inventory throughout the year.

CASH RECEIPTS

Cash receipts for the sale of agricultural commodities reached $541.5 billion, an increase of $105.7 billion, up 24.3% from 2021.

Crops' cash receipts are pegged at $285.5 billion, up $45.5 billion from 2021. By crop:

-- Corn cash receipts topped $90.7 billion, up $19.6 billion from 2021, due to higher expected prices.

-- Soybean cash receipts were $63.68 billion, a $14.5 billion increase from 2021 because of both prices and quantities sold.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

-- Wheat cash receipts came in at $14.7 billion, up $2.8 billion due to large gains in prices.

-- Cotton cash receipts were $8.49 billion, up $800 million from last year.

Livestock:

-- Cattle and calves sold in 2022 will value $86.8 billion, up $13.9 billion in value, due largely to higher prices. Cattle sales last topped $80 billion in sales in 2014.

-- Dairy products came in at $57.6 billion, up nearly $15.9 billion from 2021.

-- Broiler sales hit $48.9 billion, up $17.4 billion from 2021.

-- Hog sales are valued at $29.56 billion, up $1.5 billion in 2022.

LOWER GOVERNMENT PAYMENTS

After spikes in government aid going back to the trade war and then the pandemic, direct government payments to farmers will fall to $16.5 billion in 2022. Since 2021, government payments to farmers have fallen 63.8%.

Direct payments to farmers had reached a record high $45.6 billion in 2020 but dropped to $25.9 billion in 2021.

Pandemic aid payments reached $23.5 billion in 2020 but dialed back to $7.5 billion in 2021 and down to $1.2 billion for 2022.

Non-USDA pandemic assistance such as Paycheck Protection Program loans also went from $8.6 billion in 2021 to zero in 2022.

Ad-hoc disaster payments are expected to be $11.9 billion for 2022, down $7.1 billion from a year ago.

EXPENSES

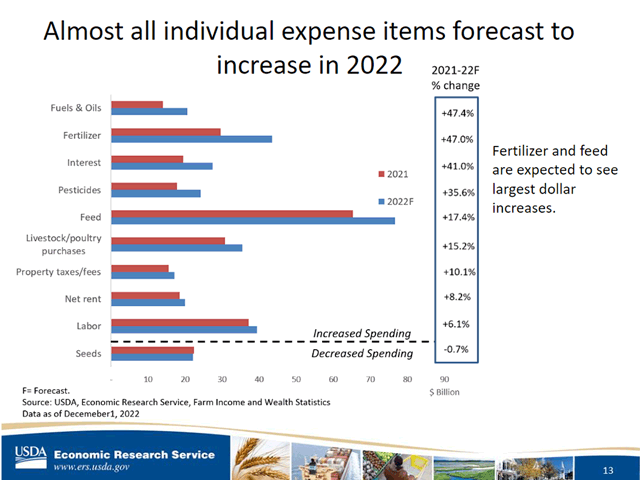

Expenses for farmers will rise a record $69.9 billion in 2022 to top $442 billion, about an 18.8% increase overall.

-- Fertilizer expenses are forecast up $13.9 billion -- 47% -- to $43.3 billion in costs to farmers.

-- Fuel and oil expenses also are up this year 47.4% or $6.6 billion to hit $20.5 billion.

-- Interest payments are up 41%, or $8 billion to $27.4 billion.

Feed expenses, the largest expense for livestock producers, are up $11.3 billion, or 17.4%, to $76.6 billion.

OTHER INCOME MEASURES

Farm equity is projected at $3.3 trillion, up 10.6% from last year -- 12% higher since 2019.

Debt was valued at about $500 billion, down about .4%, or relatively unchanged.

The average farmer debt-to-asset ratio is 13.1% The ratio is coming down, but still slightly above the 10-year average.

Bankruptcy rates for farmers are at the lowest level since 2004. The rate right now is less than 1 farm per 10,000 farms.

For more, see USDA Farm Income Forecast:

Chris Clayton can be reached at Chris.Clayton@dtn.com

Follow him on Twitter @ChrisClaytonDTN

(c) Copyright 2022 DTN, LLC. All rights reserved.