Call the Market

What's Brewing in the December Live Cattle Contract?

During the week of the nation's midterm elections, it only seems fitting that the December live cattle contract is teetering, as it's been shown bullish clues, but bearish stumbling blocks still linger in the market's nearby future. The fourth quarter is always an anxious time for the live cattle market, as beef demand usually performs exceptionally well, and so long as showlists are in check, the cash cattle sector can rely on some sort of a rally. However, given that our nation's dollar is as strong as it is -- combined with high inflation and rising interest rates -- this isn't the type of market where you can rest your hat on historical habits.

Let's discuss both the bullish and bearish characteristics weighing on the market today.

BULLISH CHARACTERISTICS

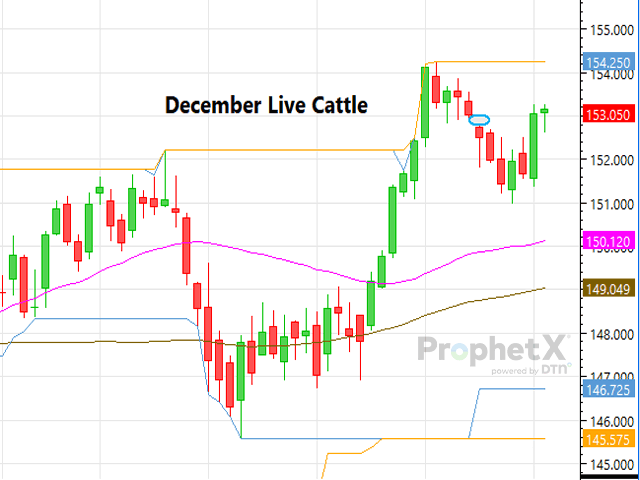

It's hard to look at the December live cattle contract and the moves it's made over the last two days and not be somewhat excited with how well the market has performed, at least technically speaking. Last Monday, Oct. 31, the market gapped lower and consequently formed a new resistance plane at $152.77. Throughout last week's market, traders were unwilling to rival the newfound resistance, but come early this week, traders reappraised the market and blew through the $152.77 threshold with little to no effort. Then, come Tuesday, the market again supported traders' advancement as Tuesday's market honored the move and closed slightly higher at $153.05. This higher move in the December contract comes at a pivotal time as last week some feedlots were willing to let cattle trade steady when one could argue they should have advanced the market by no less than $1.00. Last week the Southern Plains traded cattle for $150, which was fully steady with the previous week's weighted average, but Northern dressed cattle traded for $242, which was $2.00 higher than the previous week's weighted average.

So, in order for feedlots to comfortably price cattle higher this week and be willing to wait until Thursday to see bids develop from packers, the added confidence from the technical side of the market is more than helpful.

The fact that boxed beef prices are performing as well as they are helps both packers and feedlots in this season. As feedlots continue to yearn for a stronger and higher cash cattle market, packers have been innately monitoring their margins. But with the added support of higher boxed beef prices, packers see even more profitability, allowing them to continue to chase after the cash cattle sector.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Last, but certainly not least, we cannot forget to highlight this year's outstanding throughput that has helped the cash cattle market, as it kept showlists current. As of last Friday, in the 2022 calendar year there have been 28,708,000 head of cattle processed, which is 1.6% greater than what had been processed at this time a year ago.

In conclusion, it's hard not to be bullish about the cattle market, especially the spot December contract, given the recent advancements that have been made technically, combined with the market's inarguably strong fundamentals (throughput, strong cash cattle trade, boxed beef demand).

BEARISH CHARACTERISTICS

As I mentioned earlier, this market is laced with too much volatility (thanks to the Russia-Ukraine war and our depressed economic state) to rest on its laurels. The two immediate bearish factors I believe need all our attention are Wednesday's (Nov. 9) World Agricultural Supply and Demand Estimates (WASDE) report, and how it forecasts demand, and packers' foothold on the cash market through deferred deliveries.

First, Wednesday's WASDE report could be important as beef exports could be scaled back thanks to the dollar's advancement. If that happens, it shouldn't come as a big surprise to the market, as the last three weekly export reports have all been significantly lower, but it still will dampen the market's excitement.

**AUTHOR'S POST WASDE NOTE:

Wednesday's WASDE report increased beef production for 2022 by 211 million pounds as aggressive throughput on fed cattle combined with heavier carcass weights to contribute more beef to the market. But adversely, 2023 beef production was decreased by 90 million pounds as the market expects few cows to be slaughtered and there to be tighter fed cattle supplies.

Steer prices for 2022's fourth quarter jumped by $4.00 from last month to average $152.00. And for 2023's first quarter, steer prices are anticipated to average $153 (up $2.00 from last month) while second quarter prices in 2023 are anticipated to average $154 (up $2.00 from last month as well).

Beef imports for 2022 fell by 13 million pounds, but exports also fell by 29 million pounds as the Asia markets aren't expected to buy as aggressively through the end of the year. Beef imports for 2023 remained steady at 3,350 million pounds, and exports held steady at 3,070 million pounds. At this point the spot December contract is trading lower, indicating traders aren't enthused with the decrease in exports, but also have to appreciate what else the report shared with cash cattle prices expected to trend higher and production scaled higher as well.

**

Lastly, today's showlists are current and manageable, but as the year end nears, there will be more market-ready supplies of fat cattle available, which could pressure the cash market if not properly managed by feedlots. Unfortunately, packers were able to commit 19,725 head of cattle last week to the deferred market, which gives them a foothold to use against the spot cash market.

In conclusion, the market is never without roadblocks lingering, it's just a matter of whether or not the market gets hung up on them.

ShayLe Stewart can be reached at ShayLe.Stewart@dtn.com

**

Cattlemen are eager for supply and demand mechanics to swing their way, but the market isn't completely free of hurdles as bearish concerns about the U.S. and global economies loom. Hear DTN Livestock Analyst ShayLe Stewart's thoughts on the 2023 cattle market at the all-virtual DTN Ag Summit on Dec. 12-13. Full details available at www.dtn.com/agsummit

(c) Copyright 2022 DTN, LLC. All rights reserved.