Farmers and 45Z Tax Credit

45Z Tax Credit Offers a Market for Ag and Carbon Scores, Demands Data and Trust

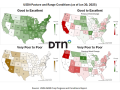

OMAHA (DTN) -- Farmers are still planting their 2024 spring crops, but their local biofuel plants are going to be increasingly focused on the carbon intensity score of those crops as well.

The initial Treasury Department guidance for the 40B Sustainable Aviation Fuel (SAF) tax credit released April 30 created some confusion over how it would work. But the guidance also laid the groundwork for what biofuel plants should do to get ready for the next tax credit, the 45Z Clean Fuel Production Credit.

Unlike the SAF credit, the 45Z credit isn't just focused on jet fuel but can provide as much as $1 a gallon for any biofuel with a carbon intensity score 50% lower than a petroleum-based fuel.

With the 45Z starting in 2025:

-- At least some ethanol plants will want to quickly qualify for 45Z based on their in-house efforts to lower emissions. The plant operators will want to know more about the farming practices surrounding the 2024-25 crops used for feedstocks.

-- Farmers should expect biofuel plants to offer a premium for reducing carbon intensity through no-till practices or nutrient management plans that lower fertilizer inputs.

-- Farmers will have to share more data about their farming practices. In return, companies signing contracts with farmers based on practices or carbon scores also need to respect their relationships with farmers.

INCENTIVES TO PARTICIPATE

The 45Z could eliminate the demands of "additionality" -- additional climate-smart practices -- but reward farmers for the practices they are already doing to sequester carbon.

"There's no better time to be a no-till, cover-crop farmer," said Roger Wolf, director of conservation for the Iowa Soybean Association. "And the investments being made, it's kind of a coming of age."

For farmers who have not reduced tillage or considered cover crops, opting into an ethanol program adds to the financial incentives that are starting to stack up climate-smart practices, which includes a mix of USDA pilot climate-smart projects, conservation programs and state cover-crop incentives.

All of this is ramping up as farm inputs remain high and the average price of corn next year is $4.40 a bushel.

The bet is that the lower farm-gate price could give more farmers more reasons to adopt new practices and a willingness to share some data in the process. The 45Z has a chance to kickstart a more nationwide low-carbon biofuels market.

"It's one of the most exciting stories in environmentalism today," said Steele Lorenz, head of sustainability for Farmers Business Network. "I just want to make sure whatever happens with 45Z is forward-thinking enough to really incentivize farmers to participate en masse."

Mitchell Hora, an Iowa farmer and founder of the company Continuum Ag, had been consulting with some companies around carbon metrics, but now sees an opportunity to help farmers score the carbon intensity of their operations and earn premiums selling their grain to ethanol plants.

"Until now, it hasn't been clear what the opportunity was going to be," Hora said. "But now, because of the tax credits like 45Z, there's a real opportunity for farmers to get involved."

Hora leads one of a growing number of businesses that will market a carbon-scoring platform.

ETHANOL AND CI SCORES

Biofuel plants now are looking for ways to reduce their carbon footprints with renewable power, carbon sequestration or changes such as using different enzymes in their processes. USDA already has indicated that farming practices also will count towards the carbon intensity scores 45Z tax credit.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

For the first time, a big chunk of the agricultural supply chain has a government incentive to develop relationships with farmers who are already engaged in these kinds of practices. Farmers who have the history and data to show their conservation practices can plug that information into an ethanol plant's carbon-intensity score.

Depending on climate and soil, no-till production alone in most parts of the country can result in seven to 10 points in a carbon intensity (CI) score. Stacking practices on that baseline can push some producers to lower CI scores.

To receive a 45Z tax credit, a biofuel plant must show its fuels have a CI score at least 50% lower than petroleum. Beyond that, every point of CI reduction is worth 2 cents a gallon. A 60% reduction compared to petroleum is worth 20 cents a gallon.

A group of farmers that provide feedstock for an ethanol plant and score a 10% reduction or better with their farming practices can help push that facility over the goal line to qualify and boost the 45Z tax credit.

PILOT PROJECTS AND PARTNERSHIPS

At least some ethanol plants are already testing carbon intensity of farm practices in different ways. The American Coalition for Ethanol (ACE) is working with 14 ethanol plants across a 10-state region to generate more data on measuring the carbon intensity of corn production using climate-smart practices. The ethanol facilities were chosen to help take a broad measure of data by looking at a range of practices, soil types and climates.

"It's our hope the ethanol plants do become the hub of activity at some point because of the value of the 45Z," said Brian Jennings, CEO of the ACE. "It's more substantial than what a farmer can get in these voluntary markets. So, we're hoping that value is translated through the rulemaking for 45Z so it isn't so cumbersome that it discourages participation by farmers."

In another example, Southwest Iowa Renewable Energy (SIRE) is participating in USDA's climate-smart commodities project with Gevo, which is looking to produce jet fuel. SIRE and Gevo are investing in a model to help airlines trace back lower emissions, or "carbon inset" emissions, of that jet fuel supply chain.

"The ability to track that carbon reduction from the field where the farm practices come in with the corn, to the ethanol plant, and then you have the SAF facility and ultimately to the fuel tank, it really presents a very interesting opportunity to provide a carbon inset, this idea of tracking all the way through and to the final user," said Mike Jerke, SIRE general manager.

SIRE and Gevo are now talking more with farmers about the practices and participation. Their program will pay farmers for annual sign-ups and it doesn't have a "look back" to see if producers were already using those practices. Payments can be tiered based on acres and farming practices or they can use a CI score of the corn and be paid on a per-bushel basis.

"The USDA funding opportunity presented an attractive mode to dip our toe in the water," Jerke said. "As we sit here today, there isn't a sort of this robust, transparent CI market that would allow us to match up the various points. By doing this, we can get the farmers engaged to see what the opportunity might be.

Partnerships are developing in other ways. Continuum Ag is working with Siouxland Energy in Sioux Center, Iowa, on a CI project. Red Trail Energy in Richardton, North Dakota, has partnered in a similar project with Indigo Ag. Those are just a few of the carbon-biofuel relationships developing.

Going beyond farming practices, the 40B and 45Z tax credits also will stir the pot when it comes to carbon capture and sequestration. The Iowa Sierra Club, which has been battling the development of carbon pipelines in the state, said corn ethanol can only hit a 19% CI reduction. The organization maintains carbon capture pipelines also won't help corn-ethanol plants hit the 50-point target.

PROGRAMS PAYING FOR CLIMATE PRACTICES

The table for farmers is being set with an increasing list of options to be paid for practices such as reduced tillage and growing cover crops.

Farmers who have not already converted to no-till, dabbled in cover crops or focused on reducing fertilizer application have a suite of options to consider. There are 135 grant recipients that have split $3.1 billion under USDA's Partnership for Climate-Smart Commodities pilot projects, which includes 75 projects nationally that in some way focus on reduced tillage. Another 92 projects -- with a lot of overlap -- are paying for farmers to plant cover crops.

The climate-smart pilot projects were meant to offer the first widespread incentives for farmers to lower greenhouse gas emissions or sequester carbon. USDA's goal is to sign up at least 60,000 farmers and enroll 25 million acres, which could sequester or reduce more than 60 million metric tons of carbon dioxide in the process.

Along with the pilot projects, USDA also received $19 billion from the Inflation Reduction Act to further push carbon sequestration and reduce greenhouse gas emissions through the Natural Resources Conservation Service (NRCS) programs.

States have cover crop programs for producers as well, such as Iowa's first-time incentive of $30 an acre. USDA's Risk Management Agency also offers crop insurance discounts of $5 an acre for planting fall cover crops in some states.

DTN'S ROLE

DTN is a partner in a climate-smart commodity grant led by Farmers for Soil Health, which looks to enroll 1.3 million acres in cover crops over five years. Farmers for Soil Health is a collaboration of the National Corn Growers Association, the National Pork Board and the United Soybean Board. The group offers up to $50 an acre as incentives to grow cover crops. As part of that program, DTN manages the enrollment platform, which provides farmers with an "eco-score" for practices such as cover crops and conservation tillage. DTN also is developing a "Sustainability Marketplace" platform where farmers can sell commodities grown with climate-smart practices to buyers looking for those qualities.

DATA DEMANDS AND PRIVACY

Much of the work on the 45Z will rely on plugging increasingly more data into computer modeling built around the Department of Energy's Greenhouse Gases, Regulated Emissions, and Energy Use in Technologies (GREET) model.

Wolf is the Iowa coordinator for Farmers for Soil Health. The program asks for a limited amount of data, but some is required.

"Even (with) that program, farmers have to supply some data, similar to numbers they might provide the Farm Service Agency," Wolf said. "You are using government money and there has to be some credibility behind it."

Data demand has caused a lot of problems for producers. Aimee Bissell, a director for the Iowa Soybean Association, sought to enroll her family's farm near Bedford, Iowa, in a program that would pay $5 an acre for planting no-till.

"We didn't sign up that we use cover crops. We just said, 'Let's get our feet wet' for an established practice that we no-till on our farm." Bissell said.

Bissell soon found herself dealing with two additional companies. One wanted her to log on and register an account with them. The third company -- that she didn't know then -- wanted 10 years of farm data uploaded so the company could have access to edit it. Bissell pushed back.

"Agriculture is all about relationships and building trust. My trust was with Company A, not with B or C. So as each new company becomes involved -- and hearing other people's stories about how this hasn't gone well for them -- you're losing trust and credibility. Each time you are introducing me to a new, unknown company."

As biofuel producers and agribusinesses are going around the country wanting CI scores, Bissell said they need to be more inclusive about how they think about their relationships with farmers.

"If you want us to buy into this, then probably let us be involved in how it is created and you will probably have a better outcome," she said.

See, "Groups Criticize Cover Crop Requirement for Sustainable Aviation Fuel Modeling,"

Also see, "Do Corn and Soybeans Have a Chance in the SAF Market? " https://www.dtnpf.com/…

A Missouri farmer planting directly into a cover crop: https://www.dtnpf.com/…

Chris Clayton can be reached at Chris.Clayton@dtn.com

Follow him on social platform X @ChrisClaytonDTN

(c) Copyright 2024 DTN, LLC. All rights reserved.