DTN Retail Fertilizer Trends

All Major Retail Fertilizer Prices Lower Again

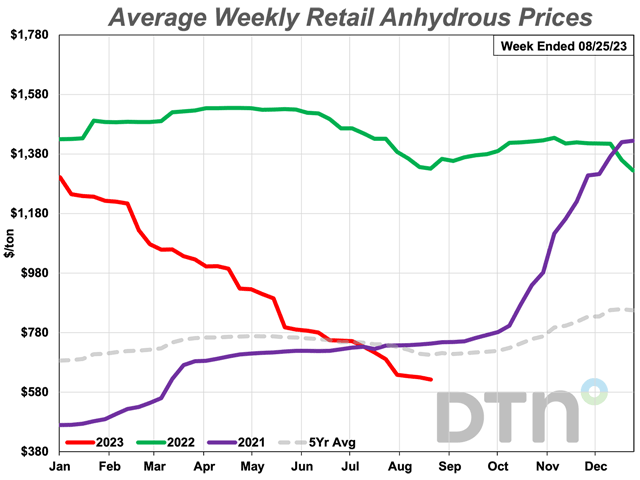

OMAHA (DTN) -- Retail fertilizer prices are once again moving lower, according to sellers tracked by DTN for the third full week of August 2023. As has been the case in recent weeks, all eight major fertilizers were again lower compared to a month ago.

Five of the eight major fertilizers had a substantial price decline from a month ago. DTN designates a significant move as anything 5% or more.

Leading the way lower were anhydrous and UAN32. Both were 10% lower compared to last month with anhydrous posting an average price of $622/ton while UAN32 had an average price of $399/ton.

DAP was 8% lower compared to last month and the phosphorus fertilizer had an average price of $735/ton. UAN28 was 7% less expensive than last month and had an average price of $355/ton.

Potash was also down a considerable amount from last month. The fertilizer was down 6% and had an average price of $557/ton.

Three fertilizers were just slightly lower compared to the prior month. MAP had an average price of $764/ton, urea $575/ton and 10-34-0 $698/ton.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

10-34-0 was sub-$700/ton for the first time since the fourth week of October 2021. That week the starter fertilizer's average price was $663/ton.

On a price per pound of nitrogen basis, the average urea price was at $0.62/lb.N, anhydrous $0.38/lb.N, UAN28 $0.63/lb.N and UAN32 $0.62/lb.N.

In a press release Tuesday, The Fertilizer Institute (TFI) and CEO Corey Rosenbusch expressed disappointment in the latest revised Waters of the United States (WOTUS) Rule from the Environmental Protection Agency (EPA). The EPA finalized changes to the WOTUS rules, removing the term "significant nexus" (https://www.dtnpf.com/…).

TFI is disappointed in the continued lack of clarity in EPA's newly released WOTUS rule, including the agency's disregard for both the procedural need to invite public input for consideration and for May's Supreme Court ruling determining which bodies of water fall under federal jurisdiction, according to the release.

"It is unclear how a half-baked rule will provide any amount of durability or certainty to the regulated community," the press release stated. "In this regard, the guidance and implementation tools that EPA says it plans to develop are critical to both the fertilizer industry and its farmer customers."

A recent survey of TFI members found the number one concern for companies in the fertilizer industry dealt with regulatory certainty, according to TFI. The organization wants clear rules that facilitate long-term planning and capital investments to continue to provide critical nutrients that feed the crops that feed our communities, the release stated.

All fertilizers are now lower by double digits compared to one year ago. 10-34-0 is 20% lower, DAP is 24% less expensive, MAP is 26% lower, urea is 29% less expensive, potash is 37% lower, UAN28 is 38% less expensive, UAN32 is 41% lower and anhydrous is 53% less expensive compared to a year prior.

Nutrien reported a 20% drop in sales for its second quarter and a profit of $3.6 billion, according to Down Jones. You can read about it here: https://www.dtnpf.com/….

DTN gathers fertilizer price bids from agriculture retailers each week to compile the DTN Fertilizer Index. DTN first began reporting data in November 2008.

In addition to national averages, MyDTN subscribers can access the full DTN Fertilizer Index, which includes state averages, here: https://www.mydtn.com/….

Retail fertilizer prices are significantly lower compared to a year earlier, according to an in-depth look at the DTN retail fertilizer price dataset. You can read about it here: https://www.dtnpf.com/….

| DRY | ||||

Aug 22-26 2022 | 972 | 1026 | 880 | 804 |

Sep 19-23 2022 | 950 | 1005 | 875 | 811 |

Oct 17-21 2022 | 930 | 986 | 863 | 826 |

Nov 14-18 2022 | 930 | 978 | 848 | 812 |

Dec 12-Dec 16 2022 | 902 | 939 | 807 | 779 |

Jan 9-Jan 13 2023 | 868 | 875 | 742 | 732 |

Feb 6-Feb 10 2023 | 840 | 857 | 694 | 693 |

Mar 6-Mar 10 2023 | 825 | 823 | 657 | 643 |

Apr 3-7 2023 | 818 | 809 | 642 | 625 |

May 1-5 2023 | 826 | 805 | 623 | 599 |

May 29-Jun 2 2023 | 824 | 832 | 620 | 622 |

June 26-30 2023 | 825 | 829 | 620 | 616 |

July 24-28 2023 | 795 | 791 | 594 | 581 |

Aug 21-25 2023 | 735 | 764 | 557 | 575 |

| LIQUID | ||||

| Date Range | 10-34-0 | ANHYD | UAN28 | UAN32 |

Aug 22-26 2022 | 869 | 1331 | 575 | 676 |

Sep 19-23 2022 | 860 | 1376 | 578 | 670 |

Oct 17-21 2022 | 759 | 1419 | 576 | 678 |

Nov 14-18 2022 | 753 | 1415 | 584 | 681 |

Dec 12-Dec 16 2022 | 750 | 1415 | 579 | 682 |

Jan 9-Jan 13 2023 | 754 | 1245 | 563 | 650 |

Feb 6-Feb 10 2023 | 755 | 1220 | 499 | 579 |

Mar 6-Mar 10 2023 | 740 | 1059 | 436 | 522 |

Apr 3-7 2023 | 740 | 1002 | 423 | 507 |

May 1-5 2023 | 739 | 926 | 424 | 507 |

May 29-Jun 2 2023 | 739 | 791 | 413 | 478 |

June 26-30 2023 | 731 | 753 | 396 | 468 |

July 24-28 2023 | 715 | 691 | 383 | 442 |

Aug 21-25 2023 | 698 | 622 | 355 | 399 |

Russ Quinn can be reached at Russ.Quinn@dtn.com

Follow him on X, formerly known as Twitter, @RussQuinnDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.