DTN Retail Fertilizer Trends

Anhydrous Leads Fertilizer Prices Lower in Mid-January 2023

OMAHA (DTN) -- Most retail fertilizer prices continue to decline, according to prices tracked by DTN for the second week of January 2023. Seven of the eight major fertilizers are lower compared to last month.

Of these seven, five were noticeably lower compared to last month. DTN designates a significant move as anything 5% or more.

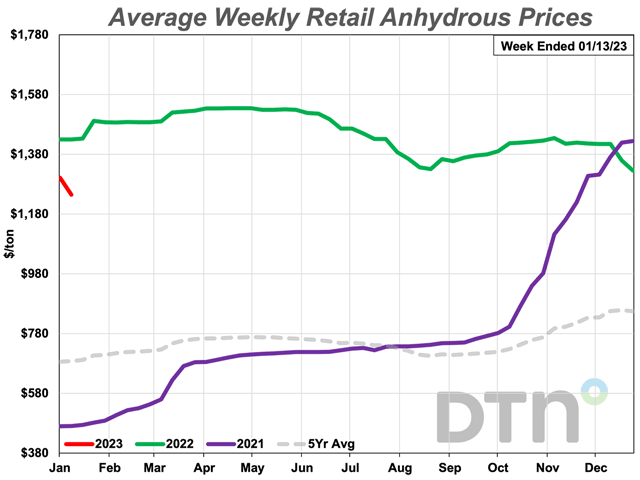

Anhydrous was down 12% from last month. The nitrogen fertilizer had an average price of $1,245/ton. It's the first time the anhydrous price dropped below $1,300/ton since the second week of November 2021. That week the price was $1,220/ton.

Potash was 8% less expensive compared to last month with an average price of $742/ton.

MAP was 7% lower in price compared to a year ago with an average price of $875/ton.

Urea was 6% lower compared to last month with an average price of $732/ton.

UAN32 was 5% less expensive than in mid-December with an average price of $650/ton.

Two fertilizers are only slightly lower compared to a month earlier. DAP has an average price of $868/ton while UAN28 is at $563/ton.

One fertilizer is slightly higher in price looking back to last month. 10-34-0 had an average price of $754/ton.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

On a price per pound of nitrogen basis, the average urea price was at $0.80/lb.N, anhydrous $0.76/lb.N, UAN28 $1.01/lb.N and UAN32 $1.02/lb.N.

Natural gas prices have dropped across the world, but the price is still considerably higher in California, Dow Jones newswires report. The spot natural gas price in southern California this month has averaged $19.40 per million British thermal units, which is roughly five times the U.S. benchmark of $3.75.

The premium was even greater last month when natural gas in California at times exceeded $40. Meanwhile, the rest of the country's prices dropped from around $7 to less than $4.

California prices usually don't move much from the U.S. benchmark and regional prices spikes tend to only last just days, Dow Jones said. The sustained surge is due to uncertainty over when a key pipeline in the state will reopen.

Natural gas, a key ingredient for fertilizer, in southern California has faced the highest price increases, but its costs have also risen sharply across the entire state. Average prices in December quintupled from a year earlier at five California trading hubs, according to Dow Jones.

Most fertilizers are now lower compared to one year ago. This week, seven fertilizers are lower while only one is slightly higher.

Both UAN28 and UAN32 are 4% lower, 10-34-0 is 5% less expensive, MAP is 6% lower, potash is 8% less expensive, anhydrous is 13% lower and urea is 20% less expensive looking back to a year prior.

One fertilizer is still more expensive compared to last year. DAP is 1% higher compared to last year.

DTN gathers fertilizer price bids from agriculture retailers each week to compile the DTN Fertilizer Index. DTN first began reporting data in November 2008.

The supply of fertilizer is readily available, and farmers should communicate their needs to their fertilizer retailers, according to a fertilizer executive. You can read it here: https://www.dtnpf.com/….

DTN recently published a series titled "Global Fertilizer Outlook." Here are those articles:

To see Global Fertilizer Outlook - 1, go to:

To see Global Fertilizer Outlook - 2, go to:

To see Global Fertilizer Outlook - 3, go to:

| DRY | ||||

| Date Range | DAP | MAP | POTASH | UREA |

Jan 10-14 2022 | 863 | 932 | 807 | 913 |

Feb 7-11 2022 | 876 | 935 | 815 | 905 |

Mar 7-11 2022 | 919 | 955 | 822 | 901 |

Apr 4-8 2022 | 1040 | 1056 | 875 | 1031 |

May 2-6 2022 | 1057 | 1081 | 881 | 1001 |

May 30-Jun 3 2022 | 1056 | 1079 | 880 | 979 |

Jun 27-Jul 1 2022 | 1039 | 1053 | 885 | 867 |

Jul 25-20 2022 | 1005 | 1041 | 887 | 836 |

Aug 22-26 2022 | 972 | 1026 | 880 | 804 |

Sep 19-23 2022 | 950 | 1005 | 875 | 811 |

Oct 17-21 2022 | 930 | 986 | 863 | 826 |

Nov 14-18 2022 | 930 | 978 | 848 | 812 |

Dec 12-Dec 16 2022 | 902 | 939 | 807 | 779 |

Jan 9-Jan 13 2023 | 868 | 875 | 742 | 732 |

| LIQUID | ||||

| Date Range | 10-34-0 | ANHYD | UAN28 | UAN32 |

Jan 10-14 2022 | 796 | 1430 | 584 | 679 |

Feb 7-11 2022 | 827 | 1487 | 600 | 699 |

Mar 7-11 2022 | 866 | 1490 | 603 | 704 |

Apr 4-8 2022 | 901 | 1534 | 629 | 729 |

May 2-6 2022 | 906 | 1534 | 631 | 730 |

May 30-Jun 3 2022 | 905 | 1529 | 633 | 731 |

Jun 27-Jul 1 2022 | 904 | 1466 | 611 | 702 |

Jul 25-20 2022 | 894 | 1431 | 596 | 693 |

Aug 22-26 2022 | 869 | 1331 | 575 | 676 |

Sep 19-23 2022 | 860 | 1376 | 578 | 670 |

Oct 17-21 2022 | 759 | 1419 | 576 | 678 |

Nov 14-18 2022 | 753 | 1415 | 584 | 681 |

Dec 12-Dec 16 2022 | 750 | 1415 | 579 | 682 |

Jan 9-Jan 13 2023 | 754 | 1245 | 563 | 650 |

Russ Quinn can be reached at Russ.Quinn@dtn.com

Follow him on Twitter @RussQuinnDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.