DTN Retail Fertilizer Trends

Prices Rise for Most Fertilizers, 10-34-0 Hits $800 Level

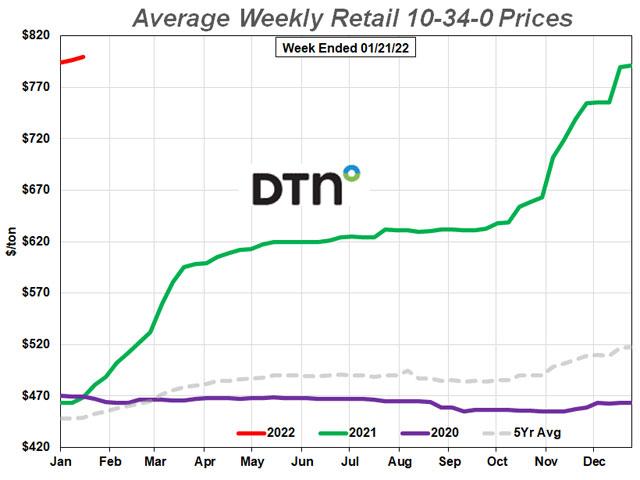

OMAHA (DTN) -- Most retail fertilizer prices were slightly higher the third week of January 2022. But as was the case last week, one fertilizer was lower in price looking back a month.

Seven of the eight major fertilizers were slightly higher, although none were up a considerable amount. DTN designates a significant move as anything 5% or more.

DAP had an average price of $863 per ton compared to last month, MAP $932/ton, urea $916/ton (all-time high), 10-34-0 $800/ton, anhydrous $1,433/ton (all-time high), UAN28 $585/ton (all-time high) and UAN32 $683/ton (all-time high).

10-34-0 hit the $800/ton level for the first time in this historic rise of retail fertilizer prices. The last time it was this high was the first week of March 2012 when starter fertilizer was $807/ton.

Like last week, one fertilizer was just slightly lower in price compared to a month ago. Potash was down just slightly and had an average price of $807/ton.

On a price per pound of nitrogen basis, the average urea price was at $1.00/lb.N, anhydrous $0.87/lb.N, UAN28 $1.04/lb.N and UAN32 $1.07/lb.N.

Crops such as corn and wheat probably jump to most peoples' minds when discussing fertilizer applications. However, other crops such as forages also need to be well fertilized to produce high yields.

In a post titled "Fertilizer Prices: How to Get Most of Your Application," Mississippi State University Extension Forage Specialist Rocky Lemus wrote that livestock producers also need to be conscious of how much fertilizer is applied. (See http://extension.msstate.edu/….)

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

In fact, forage crops export far more nutrients off the field than grain crops because most of the above-ground growth is removed as utilized forage, he wrote in the online Forage News newsletter.

Most of the time, forage producers are applying fertilizer without knowing the needs of existing forage crops and without knowing the soil nutrient reserves that are available. To have a better understanding of fertilizer needs and cost, producers should do soil samples, Lemus wrote.

"Producers should collect a representative soil sample in field sections no greater than 10 acres and to a minimum depth of 6 inches," Lemus wrote. "If legumes are present in the pasture, the percent of legumes and species in the stand should be included to obtain a more effective fertilizer recommendation."

Forage producers need to develop a well-managed and efficient fertilization plan, which can increase profitability depending on soil tests. Select a fertilizer mix that will give you the needed nutrients but at an economic advantage, he wrote.

Retail fertilizer prices compared to a year ago show all fertilizers have increased significantly, with several fertilizers having well-over 100% price increases.

MAP is now 69% more expensive, 10-34-0 is 71% higher, DAP is 78% more expensive, potash is 116% higher, urea is 146% more expensive, UAN32 is 176% higher, UAN28 179% is more expensive and anhydrous is 202% higher compared to last year.

DTN surveys more than 300 retailers, gathering roughly 1,700 fertilizer price bids, to compile the DTN Fertilizer Index each week. In addition to national averages, MyDTN subscribers can access the full DTN Fertilizer Index, which includes state averages, here: https://www.mydtn.com/….

The Federal Reserve Board is expecting the income of U.S. farmers to drop in 2022, according to Dow Jones. You can read it here: https://www.dtnpf.com/….

The DTN Global Fertilizer Outlook series in December focused attention on world expectations for 2022. This series examined the supply and demand of nutrients globally as well as what direction fertilizer prices could go this year.

Read the nitrogen outlook here: https://www.dtnpf.com/….

Read the phosphorus outlook here:

Read the potash outlook here:

| DRY | ||||

| Date Range | DAP | MAP | POTASH | UREA |

| Jan 18-22 2021 | 493 | 563 | 379 | 387 |

| Feb 15-19 2021 | 600 | 648 | 404 | 457 |

| Mar 15-19 2021 | 616 | 693 | 424 | 496 |

| Apr 12-16 2021 | 624 | 702 | 432 | 509 |

| May 10-14 2021 | 631 | 702 | 437 | 515 |

| Jun 7-11 2021 | 656 | 717 | 450 | 527 |

| Jul 5-9 2021 | 690 | 729 | 491 | 549 |

| Aug 2-6 2021 | 695 | 755 | 557 | 556 |

| Aug 30-Sep 3 2021 | 697 | 756 | 571 | 557 |

| Sep 27-Oct 1 2021 | 722 | 800 | 647 | 620 |

| Oct 25-29 2021 | 812 | 873 | 731 | 751 |

| Nov 22-26 2021 | 830 | 915 | 775 | 868 |

| Dec 20-24 2021 | 862 | 932 | 807 | 910 |

| Jan 17-21 2022 | 863 | 932 | 807 | 916 |

| LIQUID | ||||

| Date Range | 10-34-0 | ANHYD | UAN28 | UAN32 |

| Jan 18-22 2021 | 481 | 482 | 215 | 251 |

| Feb 15-19 2021 | 522 | 530 | 245 | 288 |

| Mar 15-19 2021 | 596 | 671 | 331 | 373 |

| Apr 12-16 2021 | 609 | 700 | 345 | 387 |

| May 10-14 2021 | 620 | 713 | 361 | 406 |

| Jun 7-11 2021 | 620 | 718 | 363 | 414 |

| Jul 5-9 2021 | 624 | 732 | 371 | 421 |

| Aug 2-6 2021 | 631 | 738 | 367 | 418 |

| Aug 30-Sep 3 2021 | 632 | 749 | 371 | 420 |

| Sep 27-Oct 1 2021 | 638 | 782 | 388 | 444 |

| Oct 25-29 2021 | 663 | 982 | 458 | 522 |

| Nov 22-26 2021 | 755 | 1308 | 574 | 660 |

| Dec 20-24 2021 | 791 | 1424 | 583 | 679 |

| Jan 17-21 2022 | 800 | 1433 | 585 | 683 |

Russ Quinn can be reached at russ.quinn@dtn.com

Follow him on Twitter @RussQuinnDTN

(c) Copyright 2022 DTN, LLC. All rights reserved.