Technically Speaking

Weekly Analysis: Energy Markets

Brent Crude Oil: The spot-month contract closed $0.38 higher at $47.24. The market posted what looks to be a Gravestone Doji on its weekly chart, with last week's open of $46.92, low of $46.85, and close nearly equal. This would indicate that the market's minor (short-term) uptrend has come to an end and the spot-month contract is set to rejoin its secondary (intermediate-term) downtrend. Initial support is at $43.56, then $40.41. Weekly stochastics remain bearish above the oversold level of 20%.

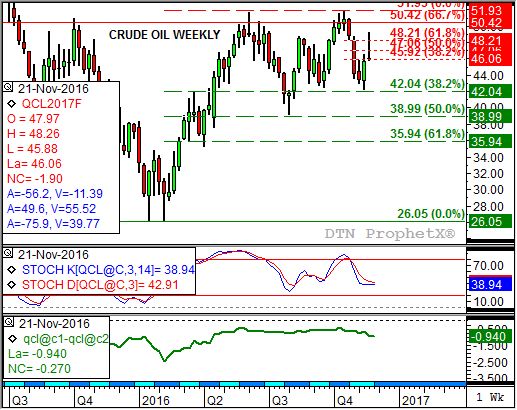

Crude Oil: The spot-month contract closed $0.37 higher at $46.06. The market posted what looks to be a Gravestone Doji on its weekly chart, with last week's open of $45.83, low of $45.77, and close nearly equal. This would indicate that the market's minor (short-term) uptrend has come to an end and the spot-month contract is set to rejoin its secondary (intermediate-term) downtrend. Initial support is at $42.04, then $38.99. Weekly stochastics remain bearish above the oversold level of 20%.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Distillates: The spot-month contract closed 1.23cts higher at $1.4700. Similar to both crude oil markets, the minor (short-term) uptrend for distillates looks to have come to an end meaning the market could now rejoin its secondary (intermediate-term) downtrend. If so, initial support is at $1.3674, then $1.2376. Weekly stochastics remain bearish above thee oversold level of 20%.

Gasoline: The spot-month contract closed 3.36cts higher at $1.3727. The spot-month contract looks to be in position to rejoin its secondary (intermediate-term) downtrend. If so, initial support is at $1.2820, then $1.1535. Weekly stochastics remain bearish above the oversold level of 20%.

Ethanol: The spot-month contract closed 4.0cts higher at $1.606. The market remains in a secondary (intermediate-term) uptrend, leaving a bullish gap between last week's low of $1.581 and the previous week's high of $1.573. Weekly stochastics remain bullish below the overbought level of 80%, indicating the spot-month contract could test its recent high of $1.671.

Natural Gas: The spot-month contract closed 24.2cts higher at $3.085. While weekly stochastics indicate the secondary (intermediate-term) trend is now sideways, the minor (short-term) trend remains up. Minor resistance is at $3.169, a price that marks the 76.4% retracement level of the downtrend from $3.362 through the low of $2.546. Daily stochastics continue to indicate the market is overbought and nearing a short-term downturn.

Propane (Conway cash price): Conway propane closed 2.25cts higher at $0.5100. While the secondary (intermediate-term) trend remains down, the minor (short-term) trend has turned up. Minor resistance is pegged at $0.5232, then $0.5417. These prices mark thee 50% and 67% retracement levels of the previous downtrend from $0.5788 through the low of $0.4675.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .