An Urban's Rural View

The Long Wait for Lower Interest Rates

Attention farmers and other business borrowers: Interest rates are going to stay higher longer than expected just a few months ago.

Back in late 2023, financial markets were betting the Federal Reserve would lower interest rates six or seven times this year. Fed policymakers were more cautious but even they were projecting they'd lower their benchmark interest rate to 4.6% by the end of 2024 from 5.4% at the end of 2023.

Despite inflation reports in January and February that came in hotter than expected, markets were still betting the first cuts would come in June. In March, a majority of Fed officials thought there would be three cuts this year.

Suddenly, dark clouds have obscured that sunny rate outlook. Markets are now betting on one or two cuts this year, and a year-end benchmark rate of 5%. Some investors suspect this year won't see any cuts. In a recent interview one Fed official said "it's much too soon to think about cutting interest rates."

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

To understand the delay, a little history is helpful. When inflation took off in 2021, the Fed undermined its own credibility by being slow to react.

When it finally got with the program, it made up for its tardiness with a vengeance, raising its benchmark interest rate in 11 consecutive bimonthly meetings, from near zero to a range of 5.25 to 5.5%. That was the fastest rate of increase in 40 years and brought rates to a 40-year high.

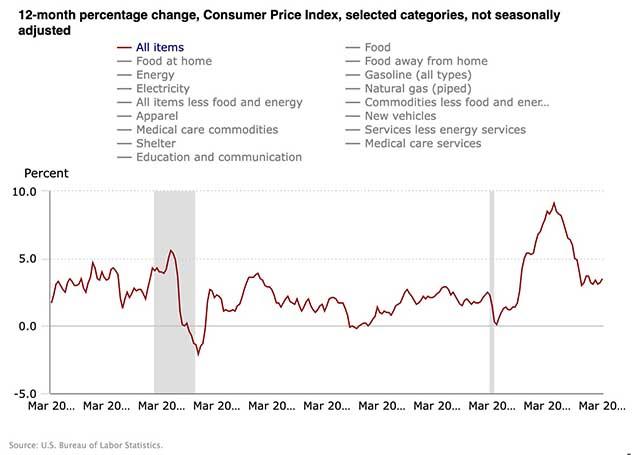

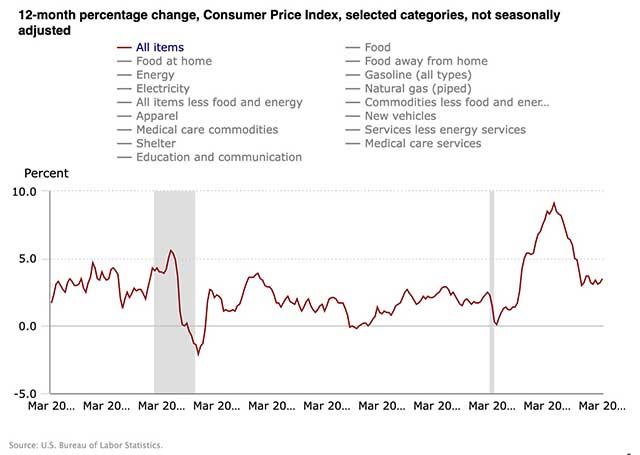

Last year, inflation finally started to recede, with the rate of price increase dropping from just over 9% in the summer of 2022 to just over 3% in the summer of 2023. (https://www.bls.gov/…) By the end of the year, the Fed's preferred inflation measure was rising at well under 3%.

At their December meeting, Fed officials sounded optimistic about rate cuts but repeated what has become their mantra: Cuts will depend on the Fed having greater confidence that inflation is on a sustainable path to the Fed's 2%-a-year target.

What's happened, then, is that the ensuing economic reports have not added to their confidence. They appear to have shaken it. The consumer price index has shown annual increases above 3% for three straight months. The March increase was 3.5%, up from February's 3.2%.

Meanwhile, the labor market has been far more robust than expected. In March the economy added 303,000 jobs, the unemployment rate remained unchanged at only 3.8% and average hourly earnings rose 0.3% month on month.

Had inflation continued to ease, the Fed could have ignored the strong labor market. Low inflation and low unemployment are, in a way, the very definition of what the Fed wants to achieve, the proverbial economic "soft landing."

But with inflation remaining stubbornly above target while the labor market is healthy, the Fed will hold rates where they are and await further economic developments. There almost certainly won't be a rate cut in June. Another couple months of prices rising faster than the previous month and the Fed could even be talking about another rate increase.

There's still a chance of one or two rate reductions this year -- the job market could weaken, inflationary pressures could ease -- but it's only a chance. Fed officials always say their decisions are "data dependent," so if you're trying to figure out when rates will start to come down, keep an eye on the data.

Urban Lehner can be reached at urbanize@gmail.com

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .