Technically Speaking

Soy Complex Maintains Bullish Potential Amid Economic Concerns

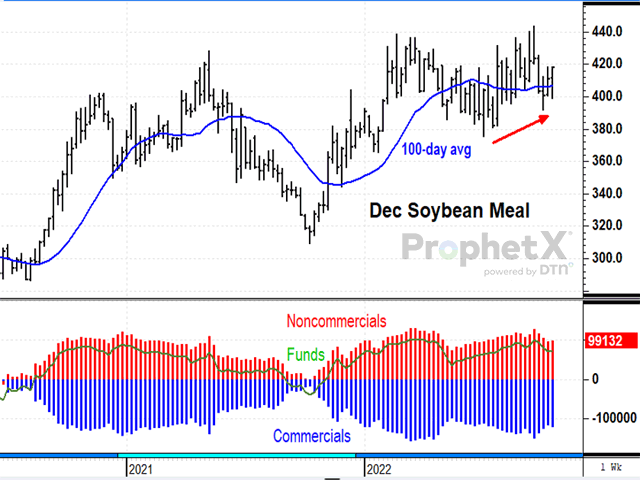

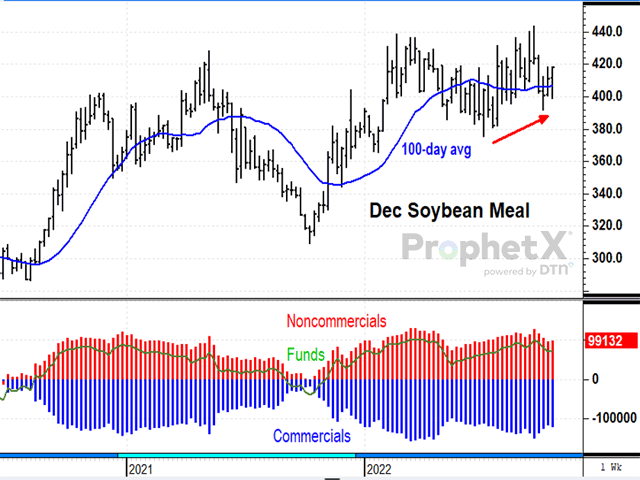

December soybean meal closed up $6.80 at $417.90 in the week ended Oct. 21, the highest close in October and an impressive turnaround from earlier this month when prices fell to a new two-month low, following the Federal Reserve's interest rate hike on Sept. 21 and all the bearish trading response that went with it. In spite of the bearish fears of noncommercial traders, physical demand for soybean meal has remained impressive with cash prices in Illinois staying within $1 of the futures board. The December contract has also tipped off bullish commercial interest, trading above the March contract all summer and expanding to a $6.30 premium Friday. Technically speaking, December soybean meal is trading within a sideways range, but has shown a higher high in late September and a higher recent low in early October, two possible hints of a bullish price move ahead.

SOYBEAN OIL:December soybean oil closed up 6.20 cents at 71.50 in the week ended Oct. 21. Not only was Friday's close a new-four month high, it was the largest percentage gain of the week for grain-related contracts. With this week's surge higher, the trend turned up Tuesday and there is little reason to doubt the credentials of this bullish market. Soybean oil prices received support from OPEC's announcement of a 2 million barrel per day (bpd) production cut earlier this month and from Wednesday's reported 5.3 million barrel drop in U.S. crude oil supplies. Not only has soybean oil demand been supported by tight supplies of oil and diesel fuel this year, it also received support last week from higher prices of canola and palm oil. Like soybean meal, December soybean oil has carried a bullish premium over the March contract nearly all summer and the premium widened to 4.98 cents Friday, a bullish sign of support from commercial buyers wanting access to physical bean oil. Technically, the trend remains up, a large move that originally came out of the initial pandemic in 2020.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

January soybeans closed up 11 3/4 cents at $14.04 1/2 in the week ended Friday, Oct. 21, holding within a narrow, sideways trading range in October, while the U.S. soybean harvest moves into the final third. In addition to noncommercial traders being spooked by rising interest rates and outside market concerns, traders are also troubled by low water levels on the Mississippi River restricting barge traffic and by the possibility of Brazil growing a record soybean crop in early 2023, estimated by USDA at 5.58 billion bushels (bb), if weather cooperates. Despite the bearish concerns, January soybean prices survived a test of its lowest prices in two months last week and held steady. Technically, January soybeans remain in a sideways, trading range with support from strong demand for soy products and the highly profitable crush values that go with it.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com .

Follow him on Twitter @ToddHultman1

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .