Technically Speaking

Weekly Analysis: Grain Markets

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $2.97 1/2, up 2 1/4 cent for the week. Weekly stochastics continue to indicate the secondary (intermediate-term) trend is up. However, the NCI.X needs to see a weekly settlement above the recent high weekly close of $2.98 (week of September 6) to confirm.

Corn (Futures): The December contract closed 3.00cts higher at $3.39 3/4. Weekly stochastics continue to indicate a secondary (intermediate-term) uptrend. Dec corn posted a high above initial resistance at $3.46 1/2, a price that marks the 23.6% retracement level of the previous downtrend from $4.49 through contract low of $3.14 3/4. The next target remains the 38.2% retracement level of $3.66.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

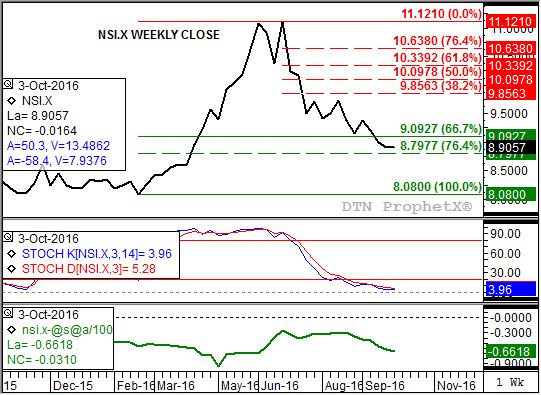

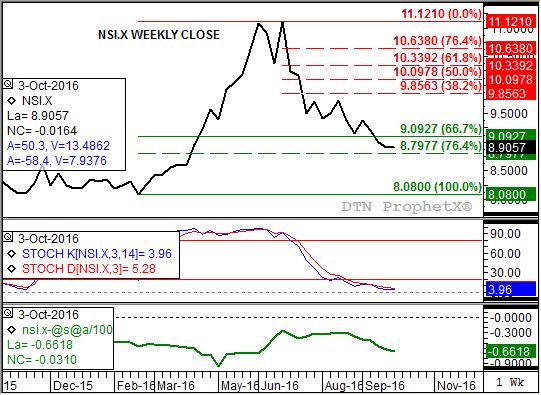

Soybeans (Cash): The DTN National Soybean Index (NSI.X, national average cash price) closed at $8.90 1/2, down 1/2 cent for the week. The weekly close chart for the NSI.X continues to show a sideways trend, with the NSI.X holding between support levels at $9.09 1/4 and $8.79 3/4. These prices mark the 67% and 76.5% retracement levels of the previous uptrend from $8.08 through the high of $11.12. Weekly stochastics are in single digits reflecting a sharply oversold situation. This would imply that cash soybeans are in position to establish a secondary (intermediate-term) uptrend over the coming weeks. However, national average basis continues to weaken putting pressure on the market.

Soybeans (Futures): The November contract closed at $9.56 3/4, up 2 3/4 cents for the week. The weekly candlestick chart for Nov beans continues to reflect indecision with the previous week's doji followed by last week's spinning top. Nov beans continue to hold above support near $9.29 1/4, a price that marks the 76.4% retracement level of the previous uptrend from $8.50 through the high of $11.86 1/4, while weekly stochastics remain well below the oversold level of 20%. While this would imply the market should nest establish a secondary (intermediate-term) uptrend, no turn signal has been established yet.

SRW Wheat (Futures): The December Chicago contract closed at $3.94 3/4, down 7 1/4 cents for the week. The secondary (intermediate-term) trend remains sideways with resistance at the 4-week high of $4.11 3/4 and support the contract low of $3.86 3/4. Weekly stochastics continue to hold well below the oversold level of 20%. However, a break below its contract low would imply a renewed downtrend taking Dec Chicago wheat to a target of $3.71 3/4.

HRW Wheat (Futures): The December Kansas City contract closed at $4.03, down 12 1/2 cents for the week. The secondary (intermediate-term) trend is sideways with resistance at the 4-week high of $4.25 3/4 and support the contract low of $3.95. Weekly stochastics continue to hold below the oversold level of 20%. However, a break below its contract low would imply a renewed downtrend taking Dec Kansas City wheat to a target of $3.64 1/4.

HRS Wheat (Futures): The December Minneapolis contract closed at $5.22, up 7 1/2 cents for the week. While the secondary (intermediate-term) trend remains up, the minor (short-term) trend has turned down. Initial minor support is at $5.15 1/2, a price that marks the 33% retracement level of the previous minor uptrend from $4.80 1/4 through last week's high of $5.33 1/2. The 50% level is down at $5.06 3/4. Given the strong uptrend in the December-to-March futures spread, Dec Minneapolis shouldn't see more than a 50% minor retracement.

To track my thoughts on the markets throughout the day, follow me on Twitter:www.twitter.com\Darin Newsom

Comments

To comment, please Log In or Join our Community .