Canada Markets

Select Commodity and Currency Moves in 2023

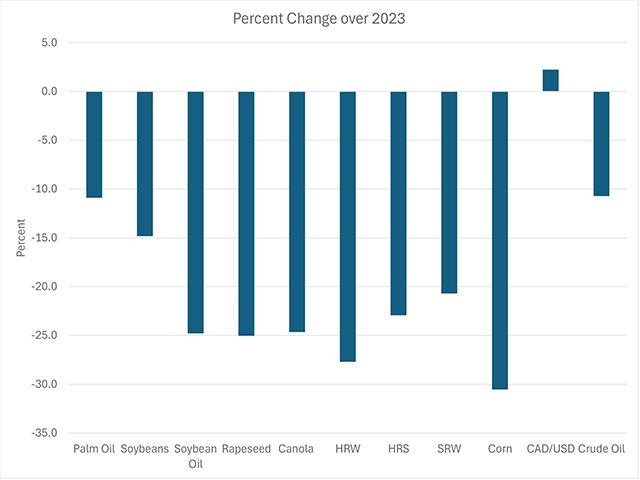

With 2023 coming to an end, the attached chart shows the percent change in price for select commodities. The figures are based on the continuous active futures chart in local currency terms and the Canadian dollar seen on the spot Canadian dollar chart.

The largest year-over-year change was seen for corn, ending 30.5% lower over the year due to the record U.S. production and swelling supplies. This drop is despite a 2.1% year-over-year drop in the U.S. dollar index (not shown).

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

It is interesting to note the drop in soybean oil futures at 24.8%, close to the drop faced in rapeseed at 25% and the drop in canola at 24.7%.

The Canadian dollar has gained 2.2% over the past year, adding to weakness in cash bids in Canada as well as canola futures.

The upcoming year of 2024 will see early focus on the potential for production in Brazil and Argentina, uncertainty in the Middle East, the Russia-Ukraine conflicts, and the need for drought relief for North America with the prairies in greatest need.

The potential for rate cuts ahead will be watched closely, which would be supportive of speculative activity in the futures market, while the debate over whether we are entering a recission or have narrowly avoided one continues.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .