Fundamentally Speaking

Corn Likely to See Cut in Exports

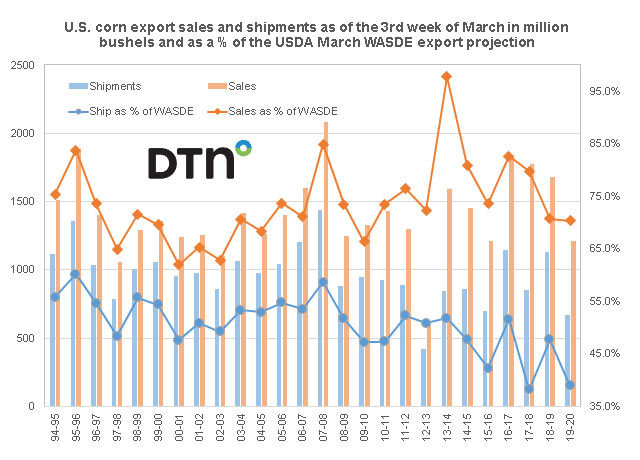

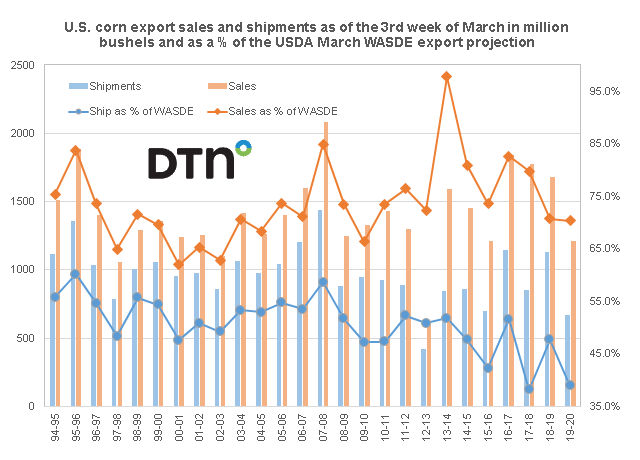

Similar to what we did with soybeans, this graphic shows U.S. corn export sales and shipments as of the third week of March in million bushels (mb) on the left hand axis and as a percent of the USDA March WASDE corn export projection on the right hand axis.

Last week's total sales for the marketing year starting September 1 was 1.214 billion bushels (bb) which is the lowest amount for this point in the year since the 2012/13 season and prior to that the 2002/03 marketing year.

Meanwhile the amount shipped at 671 mb is also the slowest since the 2012/13 season and is also the second lowest since the 1994/95 season.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

As a percent of the March WASDE projection of 1.725 bb, shipments are only 38.9% of this target; other than two years ago, this is the lowest going back to 1995.

Sales are just 70.4%, the lowest since at least the 2009/10 season.

U.S. corn export sales have picked up over the past two months with decent volumes to a number of Asian destinations with even China making their first purchase of U.S. corn since 2016.

However with the South American corn crop shaping up to be a decent one, headwinds created by a high valued U.S. dollar in the foreign exchange markets and reduced global corn demand (linked to a struggling feed and renewable fuels industry in the wake of the global COVID-19 pandemic), it is likely that the USDA will pare its corn export projection in subsequent WASDE reports.

This has happened a number of times already this marketing year; if you recall, the initial USDA export projection was 2.225 bb last May.

(KLM)

© Copyright 2020 DTN/The Progressive Farmer. All rights reserved.

Comments

To comment, please Log In or Join our Community .