Fundamentally Speaking

Seasonality of November Soybean Price Movement

This past week I did an oilseeds presentation at a large agricultural economics conference and for the soybean complex, record world soybean stocks and the highest U.S. stock and stocks-to-use ratios in ten years have pressured markets along with fund liquidation and ever increasing South American crop estimates.

Values could get even cheaper this fall based on record U.S. soybean planting intentions of 89.5 million acres that could be even higher if a continuation of a wet weather pattern in the Midwest results in some intended corn acreage being switched to soybeans.

Hopes for general commodity appreciation in wake of the new administration's pro-growth policies including tax cuts, regulatory reform and infrastructure spending have fizzled as prospects for all of these is now uncertain in wake of failed ACA repeal.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Finally, with the fate of oilseed price direction depending heavily on China, possible trade frictions with U.S. and indications that they will increase their own oilseed plantings are possible bearish factors needing to be monitored.

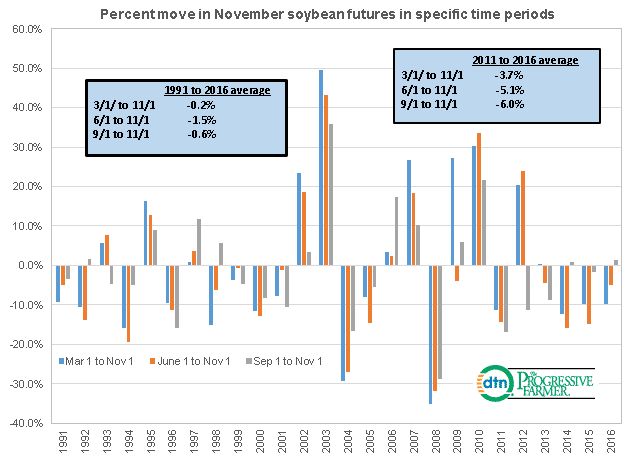

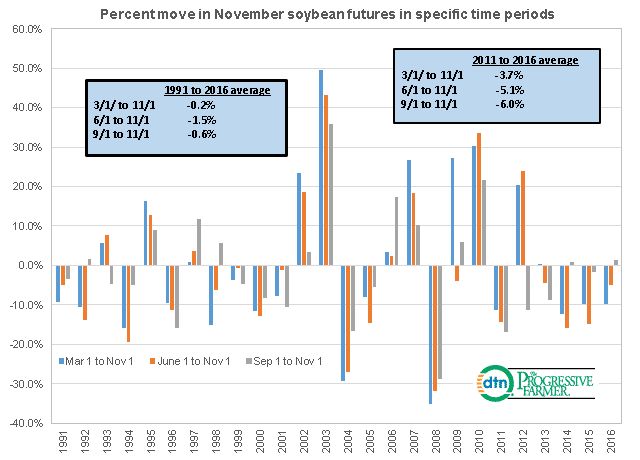

Given ideas that this downward trend will continue for a while this piece looks at the seasonality of November soybean futures from March 1st, June 1st and September 1st through November 1st for all three from 1991 to 2016.

In most years weather is at least decent, production is good and prices usually retreat and one can see that over the whole time period, values have retreated 0.2% from March 1 to November 1, off 1.5% from June 1 to November 1 and decline by an average of 0.6% from September 1 to November 1.

There are years however when price action is more bullish based on either better than expected demand, poor weather leading to a crop shortfall or perhaps some other factor.

Note that very good crops over the past few years including three years in a row of record yields has resulted in more significant price pressure since 2011.

Applying these percentages to the current November price projects values down to $8.97 to $9.06 though a 2008 type collapse would send November soybeans down to $6.77 per bushel.

(KA)

Comments

To comment, please Log In or Join our Community .