Blogger Katie Pratt says caretaking is what farmers do. Caring for houseplants seems a natural progression of those farm duties during the winter months.

Blogger Katie Pratt says caretaking is what farmers do. Caring for houseplants seems a natural progression of those farm duties during the winter months.

Blogger Tiffany Dowell Lashmet says first horses leave lasting impressions on their owner companions.

Blogger Jennifer Campbell says giving and donations can take many forms beyond financial contributions. Donating time, energy, space or highlighting the value of genuine generosity and being present for others can be incalculable gifts.

Blogger Meredith Bernard suggests instead of giving physical presents, gift a trip or simply share time with someone you love.

Blogger Katie Pratt says the annual harvest dinner is a celebration of the farm and the people who make it possible. It brings together everyone, from part-time help to landowners and friends, to enjoy food, share stories and laugh together.

Blogger Jennifer Campbell says the rhythm of farm life has farmers considering both last year's harvest results and the future promise of what's still growing.

Blogger Katie Pratt says plans and opportunities after high school or at any time in life can take new and exciting directions.

Blogger Tiffany Dowell Lashmet says if you can only get 18 summers to spend with your kids, make the memories count.

Blogger Katie Pratt says strawberries can be the basis of summer traditions that span generations.

Blogger Tiffany Dowell Lashmet encourages you to enjoy the gift of being around people who are different than you. Learn from the differences and find common points of interest.

Blogger Katie Pratt says after years of volunteering for school functions and taking kids to after-school activities, a massive change takes place for a parent once all the children graduate.

Blogger Meredith Bernard encourages people to enjoy the usually mild weather of May and take joy where you can find it.

Blogger Jennifer Campbell encourages mothers to stop, enjoy, reflect and appreciate Mother's Day.

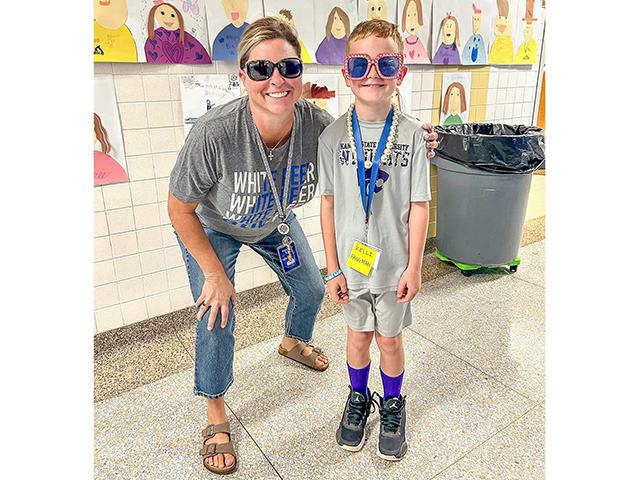

Blogger Katie Pratt spent an afternoon sharing the lifelong gift of food preparation with junior high students.

There is a cathartic beauty in cleaning out household items that bog down our lives.

Blogger Tiffany Dowell Lashmet says if you are struggling to get absolutely everything done, just remember that it's fine not to do it all because actually no one can do it all.

Blogger Jennifer Campbell says we could all learn something from a dog's ability to wind down and nap the non-productive, winter days away.

After Hurricane Helene devastated parts of North Carolina, blogger Meredith Bernard and her community raised money and donations to help those affected by the storm.

Blogger Tiffany Dowell Lashmet says how we talk about ourselves and others matters. Be strong in consideration of yourself.

Progressive Farmer Contributor Katie Pratt said she prepares for when Asian lady beetles lay siege to the Midwest every spring and fall, including being armed with a vacuum and duct tape.

DIM[2x3] LBL[columns-by-the-numbers-list] SEL[[data-native-ad-target=articleList]] IDX[1] TMPL[news] T[]