2023 USDA Farm Income Forecast

USDA Forecasts 2023 Net Farm Income to Fall 16% From 2022 But Remain Above 20-Year Average

MT. JULIET, Tenn. (DTN) -- USDA's Economic Research Service expects 2023 farm incomes to decline nearly 16% compared to 2022 due to lower cash receipts, smaller government payments and higher production expenses.

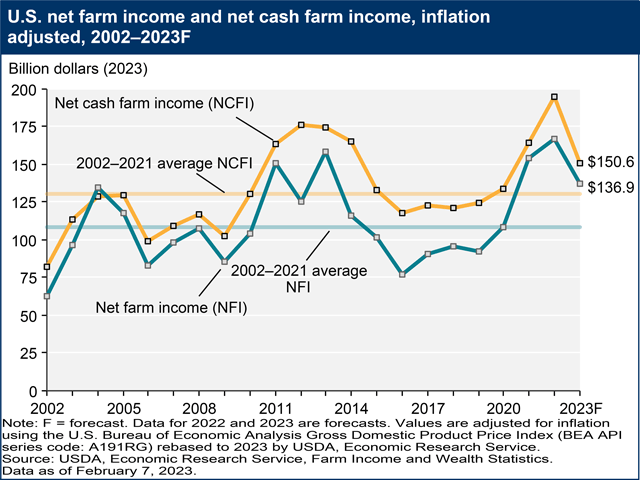

On Tuesday, the agency forecast total net farm income at $136.9 billion for the 2023 calendar year. After adjusting for inflation, it'd be the fifth-highest net farm income since 2002.

Net cash income, which doesn't include economic depreciation, changes in inventories and the cost of operator dwellings, is forecast to decline nearly 21% relative to 2022, to $150.6 billion.

Matt Bennett, an Illinois farmer and co-founder of brokerage and consulting firm AgMarket.Net, said he doesn't know what the market's going to do in 2023.

"What I do know is this is the most expensive corn crop the U.S. farmer will have ever put in the ground," he told DTN on the sidelines of AgMarket.Net's Farming for Profit, Not Price conference. "We run that risk that if the market ends up turning us out, we could be in a situation where we could be underwater even with phenomenal yields."

He shared similar projections from the University of Illinois Farmdoc team, which called for an average return of $72 per acre of corn grown on high-productivity Illinois soil. While that's significantly lower than the last two years' $300-plus-per-acre returns, it's significantly better than what farmers saw from 2017 to 2019.

For farmers, it's important to consider their crop insurance and marketing strategies carefully in 2023, adding that there are ways to lock in more than $72 per acre in profit right now using various strategies.

"A person needs to make sure they're not making marketing decisions about 2023 based on how much money they made in 2021 and '22," Bennett said. "Look at 2023 as a standalone year."

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

CASH RECEIPTS

Overall cash receipts are expected to decline by $23.6 billion, or 4.3%, from 2022. USDA said cash receipts for crops, particularly corn and soybeans, are expected to contribute $8.9 billion to the decline, while lower animal and animal product receipts are expected to account for $14.7 billion, following lower prices for milk, eggs, broilers and hogs.

USDA says there are two factors that influence the change in cash receipts from year to year: changes in prices and changes in quantities.

"In 2023, falling prices are expected to account for most of the decline in cash receipts," the agency states.

PRODUCTION EXPENSES

Farm sector production expenses, which include operator dwellings, are expected to increase by $18.2 billion from 2022 to $459.5 billion in 2023. While that sets a record in nominal dollars, it remains below 2014's record high when adjusted for inflation.

"Most of the production expense categories are projected to remain above their 2021 levels in 2023, in both nominal and inflation-adjusted dollars," USDA said.

Feed costs remain the biggest line item at $72.7 billion. Although that's $3.9 billion less than 2022, it comes on the heels of an $11.3 billion increase in the prior year.

Fertilizer, lime and soil conditioners are the second-largest expenses category at $42.2 billion, just shy of 2022's record high of $42.5 billion.

USDA notes considerable increases in farmers' interest expenses, up more than 22% from the year before, as well as labor costs, which are expected to grow 7% from 2022.

Fuel and rent expenses are expected to decline in 2023. Fuel expenses are projected to fall nearly 15% to $3 billion due to lower U.S. Energy Information Agency forecast diesel prices. USDA says net rent is expected to decline $1.6 billion, or 8.2%. "If realized, this decline would be the first reduction in net rent since 2018 and, in part, reflects the forecast decline in net income."

GOVERNMENT PAYMENTS

At $10.2 billion, government payments are anticipated to be 34.4% lower than 2022 due to lower supplemental ad hoc disaster assistance. These payments include farm program payments, such as the Agricultural Risk Coverage (ARC) program and Price Loss Coverage (PLC) program but exclude USDA loans and insurance indemnity payments made by the Federal Crop Insurance Corporation.

USDA noted that government payments hit a record high of $45.6 billion in calendar year 2020, before declining to $25.9 billion in 2021 and $15.6 billion in 2022. Much of this is due to lower payments from COVID-19-era programs, such as the Coronavirus Food Assistance Program (CFAP), the Paycheck Protection Program, the Emergency Relief Program and the Emergency Livestock Relief Program.

Conservation program payments are expected to total $4 billion in 2023, up nearly half a million dollars from the previous year.

Farm bill commodity program payments under ARC and PLC are expected to decline more than 81% from 2022 to $303.4 million due to higher commodity prices.

Katie Dehlinger can be reached at katie.dehlinger@dtn.com

Follow her on Twitter at @KatieD_DTN

(c) Copyright 2023 DTN, LLC. All rights reserved.