Farmland Fans Keep Market Afloat

Land Market Shakes Off Commodity Crash

ST. LOUIS (DTN) -- Sure, Illinois farmer Alan Madison has economized to make ends meet during this farm recession. He told an audience of ag journalists recently that he has slowed his combine trades to every four years instead of three; split applied nitrogen to shave fertilizer rates; and follows a seed company's data management service to fine-tune his hybrid choices and in-season chemical applications. But when the right farm came up for sale close to his Walnut, Illinois, home base in March, he and his wife Jan splurged, buying farm real estate for the first time in 15 years.

"In our area, we've had a correction of 10% to 15% off the highs of $15,000 to $16,000 Class A land," said Alan, who began farming part-time in 1979. "We've only seen [setbacks like] that happen a couple of times in my lifetime."

Madison knows he can expect further declines in the short term, but believes there will be no repeat of the 50% free fall in land values that occurred in the 1980s. Purchases don't look overly risky to him today: Lenders now require large down payments and record-low interest rates make fixed rates mortgages more affordable. In fact, he had to talk Jan out of buying a second parcel, just five miles away, arguing it would take too much working capital to subsidize the purchase if corn hovers below $4 too long.

While the Madisons' daughters don't plan to farm, their parents believe the recent investment will offer stable rents for their inheritance. Plus, the 2016 purchase provides a land base should their eight-year-old grandson choose to farm someday.

"We should have been buying all along since the 1980s," said Jan, the real estate enthusiast. Past results are no guarantee of future performance, but between 1987 and 2014, Illinois land values increased an average of 7.3% annually. Off-farm investors also got the benefit of rental returns on top of that.

Fans like the Madisons are keeping farm real estate values surprisingly strong, despite farm incomes that are expected to plunge for the third year in a row in 2016 and possibly further in 2017. Such immunity won't last forever, but farmland buyers and owners with long horizons seem to view the agriculture's current income problem as a temporary phenomenon.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

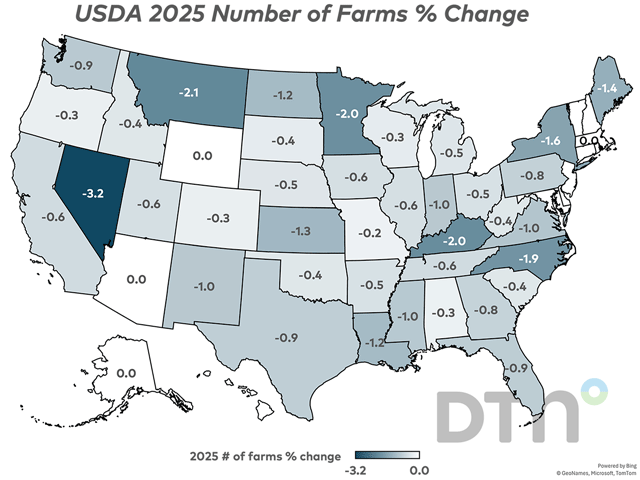

In early August, USDA's National Agricultural Statistics Service reported that U.S. cropland values had slipped about 1% in the last year. Illinois averaged the steepest drop in the Corn Belt, down 2.6%. USDA found the state's "average" land running $7,450 per acre, down modestly from its $7,700 per acre average in 2014.

In contrast, real estate trends in other regions ranged all over the map, with the Northern Plains (Kansas, Nebraska and the Dakotas) plunging 5.4%, but the Southeast up 4%, Delta up 3.1%, Pacific Northwest up 2.8%, and Mountain and Northeast states up 1.1%.

Such single-digit stability jibes with preliminary data on land sales across a 15-state Corn Belt area monitored by AgriBank, the Farm Credit System bank. "We're seeing low single-digit declines on average, something consistent with what USDA reported," said Jerry Lehnertz, AgriBank's senior vice president of credit. Longer term, however, he expects more adjustments as farm revenue wanes.

Likewise, Bill Davis, senior vice president and credit officer for Omaha-based Farm Credit of America, expects a gradual realignment of land values but no abrupt crash. "We'll see more declines in land values, but I wouldn't use the term 'sharp.' We've had a long-term view of commodity markets and profit margins on land ever since we knew we had entered a toppy period of corn prices. Our projections were we could see as much as 25% to 30% drop from peak, and we haven't changed our view. If we've had a 20% drop in Iowa so far, for example, we might be due for another 5% or 10%. That wouldn't be a sharp drop. And it's been gradual."

Some sales continue to surprise Davis to the upside, even though averages are trending down. "You can still find some sales in highly competitive areas where values may not [be] off at all. That tells us investors and producers are in the market at price levels we have today. And that is going to mitigate the amount of any drop. There's just buyers out there," Davis said.

At the moment, record low interest rates on bonds and CDs give investors few safe options to earn comparable returns elsewhere, Davis added. If they already own land that's appreciated, many investors are holding.

A New Jersey retiree who owns a farm in southeast Iowa told DTN he recently turned down an unsolicited offer of more than $6 million for the property. It's appreciated multiple-fold since he bought it, so he doesn't want to trigger capital gains. It also pays about $200 per acre cash rent, providing a steady $60,000 retirement income, not counting his rent from the Conservation Reserve Program. Deer hunting is a bonus.

"Even my financial planner says he wishes he had invested in farmland rather than stocks over the past 10 years," the investor chuckled.

Another factor moderating a correction in cropland values until now is that cash rents have remained relatively strong. Illinois cash renters were willing to dig into their cash reserves to subsidize operating losses that exceeded $100 per acre in 2015 and will likely take another loss in 2016, the University of Illinois estimates. With working capital drained by back-to-back losses, they may not be available to avoid uncomfortable cash rent negotiations this fall.

Reductions in fertilizer costs and fuel helped lower input costs somewhat in 2016, but bigger savings will need to be found to get many growers to breakeven next year. "At this stage we're forecasting $3.50 to $3.60 corn and $9.50 soybeans for 2017, with no Agricultural Risk Coverage payments for either one," University of Illinois economist Gary Schnitkey said. "That means we're looking at lower revenue in the year ahead and it will keep the pressure on to reduce cash rents. We'll see a lot of operations with high rent, low working capital who will simply have no choice but to make those cuts next year."

Such news doesn't discourage producers like Johnny Hunter from Essex, Missouri, who purchased 152 acres this winter, across the road from land his family already farmed. His investment horizon isn't just for his own career, but for generations of Hunters that may come after him. "We're bullish on our industry," he said. "Owning land puts us in the drivers' seat to control our destiny."

To see USDA's annual farmland value report, go to http://usda.mannlib.cornell.edu/…

Marcia Zarley Taylor can be reached at Marcia.taylor@dtn.com

Follow Marcia Taylor on Twitter @MarciaZTaylor

(CZ/BAS)

Copyright 2016 DTN/The Progressive Farmer. All rights reserved.